Grid trading leverages a systematic approach to place buy and sell orders at predetermined intervals, capitalizing on market volatility without predicting price direction, while swing trading focuses on capturing short- to medium-term price movements based on technical and fundamental analysis. Grid trading excels in ranging markets by automating profit-taking across fluctuating price levels, whereas swing trading requires identifying entry and exit points to maximize gains during trending phases. Explore the advantages and strategies behind grid and swing trading to determine the best fit for your investment goals.

Why it is important

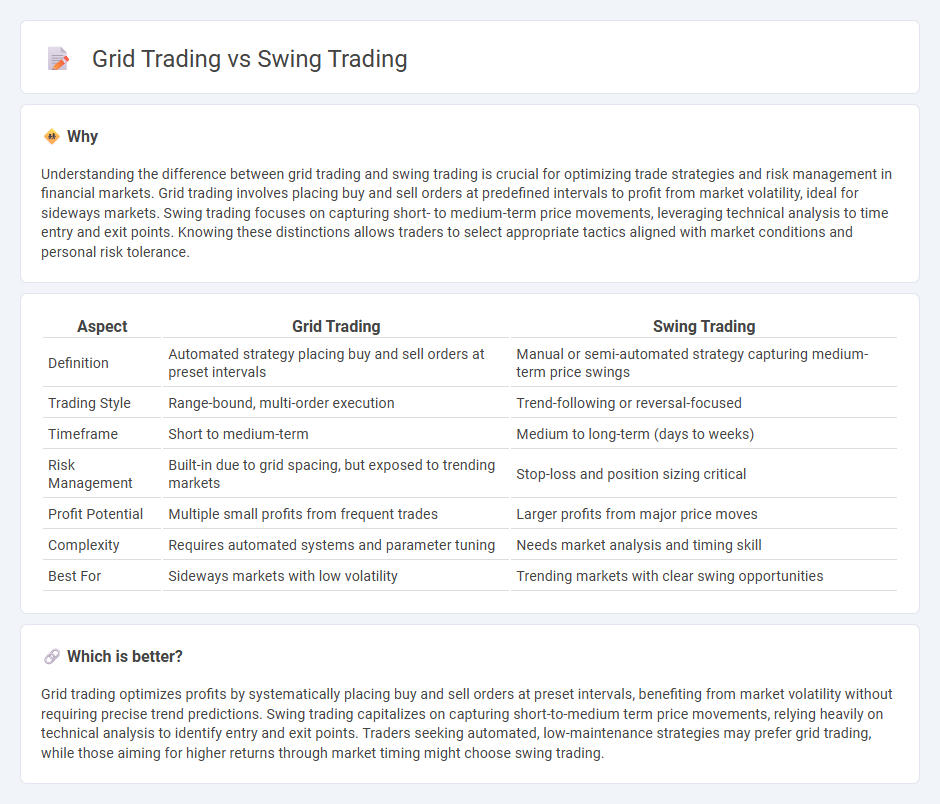

Understanding the difference between grid trading and swing trading is crucial for optimizing trade strategies and risk management in financial markets. Grid trading involves placing buy and sell orders at predefined intervals to profit from market volatility, ideal for sideways markets. Swing trading focuses on capturing short- to medium-term price movements, leveraging technical analysis to time entry and exit points. Knowing these distinctions allows traders to select appropriate tactics aligned with market conditions and personal risk tolerance.

Comparison Table

| Aspect | Grid Trading | Swing Trading |

|---|---|---|

| Definition | Automated strategy placing buy and sell orders at preset intervals | Manual or semi-automated strategy capturing medium-term price swings |

| Trading Style | Range-bound, multi-order execution | Trend-following or reversal-focused |

| Timeframe | Short to medium-term | Medium to long-term (days to weeks) |

| Risk Management | Built-in due to grid spacing, but exposed to trending markets | Stop-loss and position sizing critical |

| Profit Potential | Multiple small profits from frequent trades | Larger profits from major price moves |

| Complexity | Requires automated systems and parameter tuning | Needs market analysis and timing skill |

| Best For | Sideways markets with low volatility | Trending markets with clear swing opportunities |

Which is better?

Grid trading optimizes profits by systematically placing buy and sell orders at preset intervals, benefiting from market volatility without requiring precise trend predictions. Swing trading capitalizes on capturing short-to-medium term price movements, relying heavily on technical analysis to identify entry and exit points. Traders seeking automated, low-maintenance strategies may prefer grid trading, while those aiming for higher returns through market timing might choose swing trading.

Connection

Grid trading and swing trading both capitalize on market price fluctuations to maximize profits, with grid trading placing incremental buy and sell orders at set intervals around a price level and swing trading targeting larger price movements over days or weeks. Grid trading provides a structured approach to capture profits within a price range, complementing swing trading's momentum-based strategy that identifies trend reversals and continuations. Integrating grid trading techniques within swing trading can enhance risk management and optimize entry and exit points by exploiting market volatility effectively.

Key Terms

Entry/Exit Points

Swing trading targets entry and exit points by analyzing short- to medium-term price patterns and momentum, aiming to capitalize on expected market swings over days or weeks. Grid trading uses a systematic approach to place buy and sell orders at predefined intervals above and below a set price, generating profit from market volatility regardless of direction. Explore detailed strategies and risk management techniques to optimize your trading approach.

Price Range

Swing trading capitalizes on capturing profits from short- to medium-term price movements within defined price ranges, often holding positions for several days to weeks. Grid trading strategically places buy and sell orders at incrementally distributed price levels within a predetermined price range, aiming to profit from market volatility without predicting direction. Explore detailed strategies and risk management techniques to optimize trading within price ranges.

Position Sizing

Position sizing in swing trading typically involves adjusting trade size based on market volatility and risk tolerance to capture medium-term price movements. Grid trading employs fixed or adaptive position sizing in a systematic manner, placing buy and sell orders at predetermined price intervals to capitalize on market fluctuations. Explore comprehensive strategies and risk management techniques to optimize position sizing for both trading styles.

Source and External Links

Swing trading - Wikipedia - Swing trading is a speculative strategy where assets are held from a few days to weeks to profit from price swings, using technical or fundamental analysis to time entry and exits, often with rule-based trading systems.

What is swing trading & how does it work? - Saxo Bank - Swing trading aims to capture price moves using strategies like breakout trading and trend trading, employing technical indicators such as moving averages and volume to identify momentum and signals for buying or short selling.

Swing trading: A complete guide for investors | TD Direct Investing - Swing trading involves profiting from short-term price fluctuations by buying dips and shorting rises, with positions held for days or weeks, relying mainly on technical analysis and appealing to traders comfortable with frequent position changes.

dowidth.com

dowidth.com