Paper trading competitions simulate real market conditions, allowing participants to practice strategies and track performance without financial risk. Virtual trading games emphasize gamification elements such as leaderboards and rewards to engage users while teaching basic trading concepts. Explore the distinct benefits and mechanics of each to enhance your trading education.

Why it is important

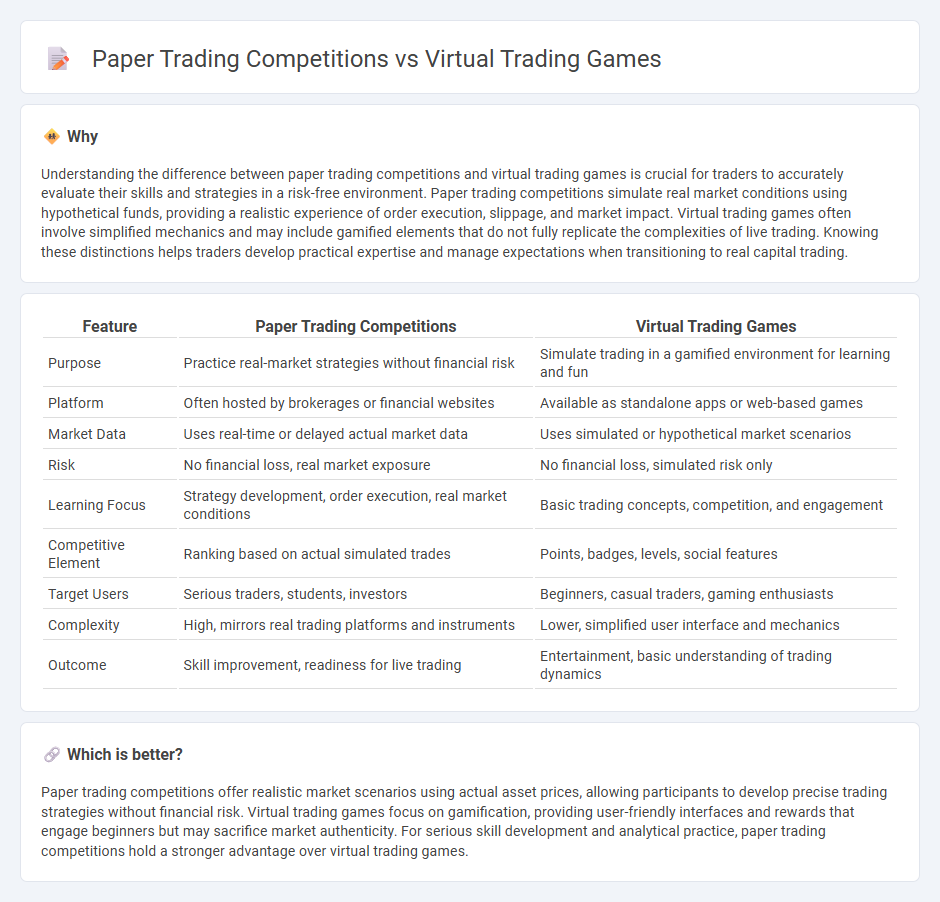

Understanding the difference between paper trading competitions and virtual trading games is crucial for traders to accurately evaluate their skills and strategies in a risk-free environment. Paper trading competitions simulate real market conditions using hypothetical funds, providing a realistic experience of order execution, slippage, and market impact. Virtual trading games often involve simplified mechanics and may include gamified elements that do not fully replicate the complexities of live trading. Knowing these distinctions helps traders develop practical expertise and manage expectations when transitioning to real capital trading.

Comparison Table

| Feature | Paper Trading Competitions | Virtual Trading Games |

|---|---|---|

| Purpose | Practice real-market strategies without financial risk | Simulate trading in a gamified environment for learning and fun |

| Platform | Often hosted by brokerages or financial websites | Available as standalone apps or web-based games |

| Market Data | Uses real-time or delayed actual market data | Uses simulated or hypothetical market scenarios |

| Risk | No financial loss, real market exposure | No financial loss, simulated risk only |

| Learning Focus | Strategy development, order execution, real market conditions | Basic trading concepts, competition, and engagement |

| Competitive Element | Ranking based on actual simulated trades | Points, badges, levels, social features |

| Target Users | Serious traders, students, investors | Beginners, casual traders, gaming enthusiasts |

| Complexity | High, mirrors real trading platforms and instruments | Lower, simplified user interface and mechanics |

| Outcome | Skill improvement, readiness for live trading | Entertainment, basic understanding of trading dynamics |

Which is better?

Paper trading competitions offer realistic market scenarios using actual asset prices, allowing participants to develop precise trading strategies without financial risk. Virtual trading games focus on gamification, providing user-friendly interfaces and rewards that engage beginners but may sacrifice market authenticity. For serious skill development and analytical practice, paper trading competitions hold a stronger advantage over virtual trading games.

Connection

Paper trading competitions and virtual trading games both simulate real market conditions, allowing participants to practice trading strategies without financial risk. These platforms utilize virtual portfolios and real-time data to enhance skills in decision-making, risk management, and market analysis. Engaging in such competitions improves traders' readiness for live trading by providing hands-on experience in a controlled environment.

Key Terms

**Virtual trading games:**

Virtual trading games simulate real market environments through interactive platforms, allowing users to practice trading stocks, forex, and cryptocurrencies without financial risk. These games often feature real-time market data, leaderboards, and rewards, enhancing both learning and engagement for novice and experienced traders. Explore how virtual trading games can accelerate skill development and trading confidence.

Simulation

Virtual trading games simulate real market conditions using dynamic price movements and interactive interfaces, offering immersive experiences for skill development. Paper trading competitions focus on recording trades on a static platform without real-time interaction, primarily emphasizing strategy testing rather than market simulation. Explore more to understand how these different simulation approaches impact trading proficiency.

Gamification

Virtual trading games leverage gamification elements such as leaderboards, rewards, and interactive challenges to enhance user engagement and simulate real market conditions more dynamically than traditional paper trading competitions. By incorporating real-time feedback, progress tracking, and competitive social features, virtual trading platforms offer a more immersive and motivating experience for novice and seasoned traders alike. Explore how gamification transforms trading education and practice by diving deeper into leading virtual trading platforms today.

Source and External Links

Stock Market Simulator: Free Practice Trading with Fake Money - Practice trading stocks, ETFs, options, and cryptos with $100,000 in virtual money using a free real-time stock market simulator that includes educational mini-courses and contests to compete with others.

Play - Dow Jones - Virtual Stock Exchange game lets you manage a $1,000,000 virtual portfolio with real-time market reactions, compete in over 40,000 live games, and try additional virtual financial games like loan shark and insurance simulations.

Free Virtual Stock Market Simulator Game For Students | TD Bank - A free stock market simulation for students and individuals to practice trading real stocks with real prices, featuring teacher resources, lesson plans, tutorials, and nationwide rankings.

dowidth.com

dowidth.com