Front running involves executing orders based on advance knowledge of large pending trades to capitalize on price movements, while basket trading entails simultaneously buying or selling a group of securities to mimic an index or strategy efficiently. Understanding the regulatory implications and market risks of front running and the diversification benefits of basket trading is crucial for effective portfolio management. Explore more to gain deeper insights into these trading strategies and optimize your investment approach.

Why it is important

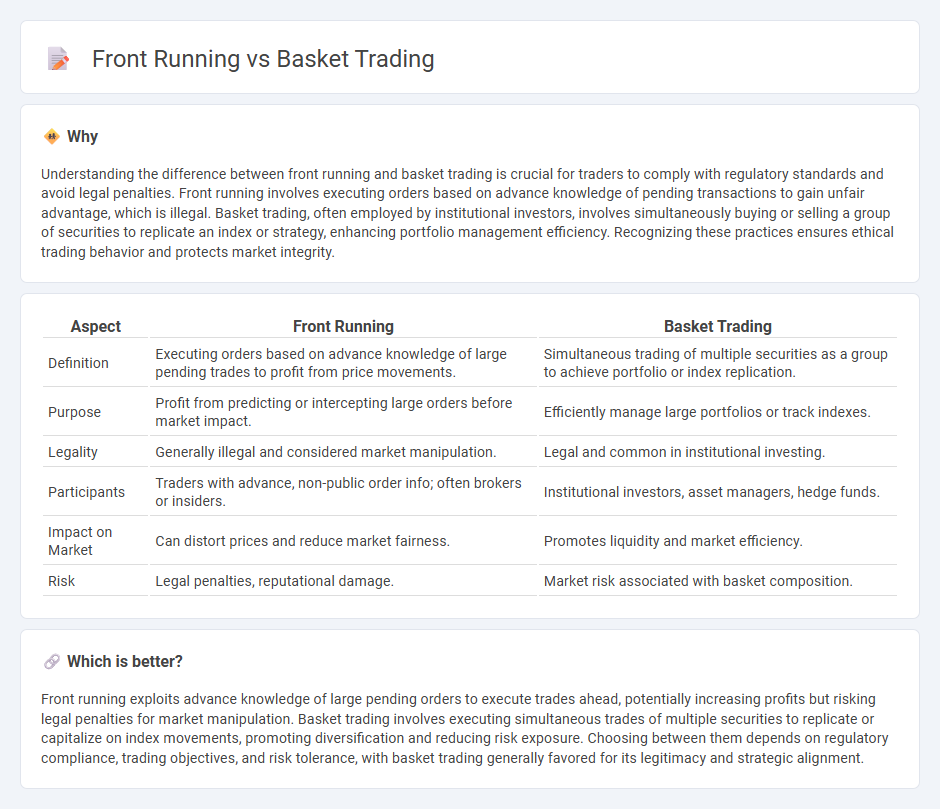

Understanding the difference between front running and basket trading is crucial for traders to comply with regulatory standards and avoid legal penalties. Front running involves executing orders based on advance knowledge of pending transactions to gain unfair advantage, which is illegal. Basket trading, often employed by institutional investors, involves simultaneously buying or selling a group of securities to replicate an index or strategy, enhancing portfolio management efficiency. Recognizing these practices ensures ethical trading behavior and protects market integrity.

Comparison Table

| Aspect | Front Running | Basket Trading |

|---|---|---|

| Definition | Executing orders based on advance knowledge of large pending trades to profit from price movements. | Simultaneous trading of multiple securities as a group to achieve portfolio or index replication. |

| Purpose | Profit from predicting or intercepting large orders before market impact. | Efficiently manage large portfolios or track indexes. |

| Legality | Generally illegal and considered market manipulation. | Legal and common in institutional investing. |

| Participants | Traders with advance, non-public order info; often brokers or insiders. | Institutional investors, asset managers, hedge funds. |

| Impact on Market | Can distort prices and reduce market fairness. | Promotes liquidity and market efficiency. |

| Risk | Legal penalties, reputational damage. | Market risk associated with basket composition. |

Which is better?

Front running exploits advance knowledge of large pending orders to execute trades ahead, potentially increasing profits but risking legal penalties for market manipulation. Basket trading involves executing simultaneous trades of multiple securities to replicate or capitalize on index movements, promoting diversification and reducing risk exposure. Choosing between them depends on regulatory compliance, trading objectives, and risk tolerance, with basket trading generally favored for its legitimacy and strategic alignment.

Connection

Front running and basket trading are interconnected through their impact on market dynamics and trading strategies. Front running involves executing orders ahead of anticipated large trades, often from basket trading, to capitalize on expected price movements. Basket trading, which aggregates multiple securities into a single trade, creates opportunities for front runners to exploit the latency between order placement and execution.

Key Terms

**Basket Trading:**

Basket trading involves executing a group of securities simultaneously to replicate an index or achieve portfolio diversification efficiently, minimizing transaction costs and market impact. This strategy is favored by institutional investors for managing large orders across multiple stocks in a single trade, enhancing liquidity and price stability. Explore our detailed guide to understand how basket trading can optimize your investment strategy.

Portfolio Diversification

Basket trading enables investors to buy or sell a group of securities simultaneously, enhancing portfolio diversification by spreading risk across multiple assets. Front running involves executing orders based on prior knowledge of large pending trades, which can undermine fair market practices and harm portfolio integrity. Explore how strategic basket trading can optimize diversification while mitigating risks associated with unethical practices like front running.

Order Execution

Basket trading involves executing multiple securities as a single order to achieve efficient portfolio rebalancing or strategic asset allocation, minimizing market impact and execution costs. Front running is an unethical practice where a trader exploits advance knowledge of a pending large order, executing trades ahead to profit from anticipated price movements, disrupting fair market order execution. Explore further to understand how regulatory frameworks and advanced technologies mitigate risks and enhance order execution integrity.

Source and External Links

Basket Trading: What it is, key aspects & examples. - Equirus Wealth - Basket trading is a strategy where you buy or sell a group of securities as one unit instead of placing multiple individual trades, allowing diversification, risk management, simplified trading, and flexible weighting across assets like stocks, commodities, currencies, and index funds.

What is Basket Trading? Types, Advantages, and Challenges ... - Motilal Oswal - Basket trading enables simultaneous buying or selling of many assets such as a set of stocks reflecting an index, allowing investors to achieve targeted exposure and manage risk efficiently with categories like equity baskets for stocks.

Basket Trade - Meaning, Types, Working and Benefits | Bajaj Broking - Basket trading involves buying or selling multiple securities (shares, bonds, commodities) at the same time, widely used by institutional investors for diversification, flexible weighting, and efficient portfolio management.

dowidth.com

dowidth.com