Gamma scalping focuses on managing the gamma exposure in options trading to maintain a delta-neutral position and capitalize on price movements. Vega neutral strategies aim to minimize volatility risk by balancing the portfolio's sensitivity to changes in implied volatility. Explore the key differences and practical applications of gamma scalping versus vega neutral approaches to enhance your trading strategy.

Why it is important

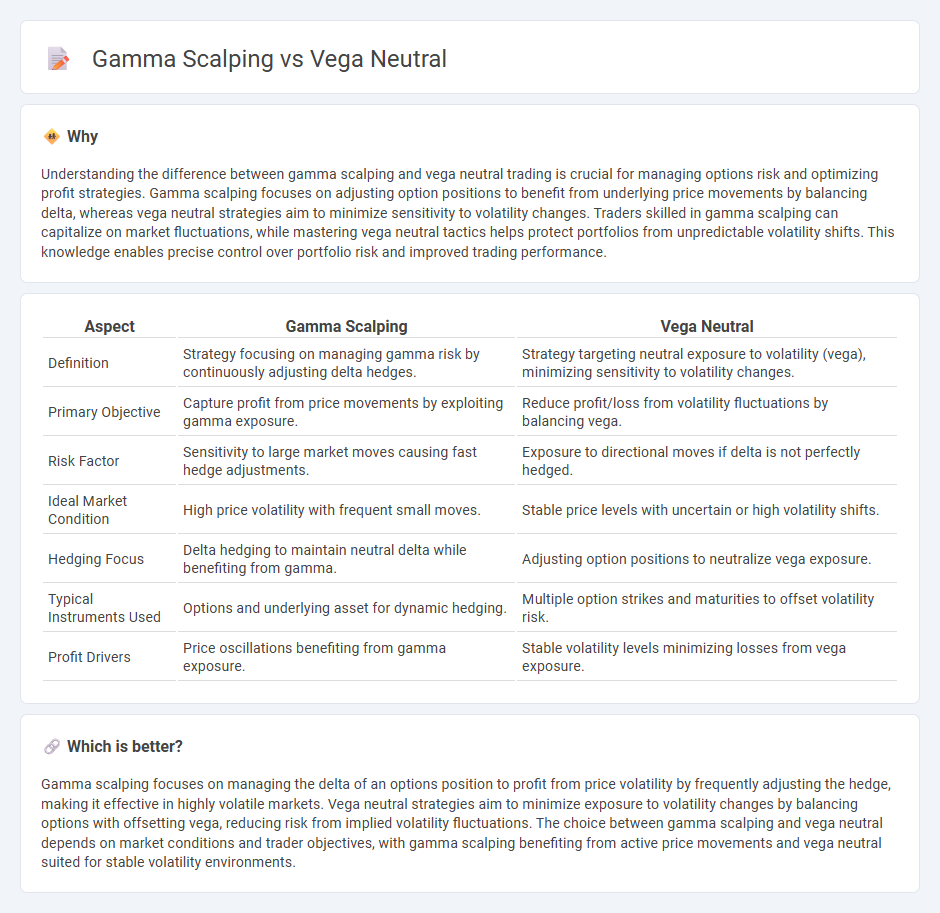

Understanding the difference between gamma scalping and vega neutral trading is crucial for managing options risk and optimizing profit strategies. Gamma scalping focuses on adjusting option positions to benefit from underlying price movements by balancing delta, whereas vega neutral strategies aim to minimize sensitivity to volatility changes. Traders skilled in gamma scalping can capitalize on market fluctuations, while mastering vega neutral tactics helps protect portfolios from unpredictable volatility shifts. This knowledge enables precise control over portfolio risk and improved trading performance.

Comparison Table

| Aspect | Gamma Scalping | Vega Neutral |

|---|---|---|

| Definition | Strategy focusing on managing gamma risk by continuously adjusting delta hedges. | Strategy targeting neutral exposure to volatility (vega), minimizing sensitivity to volatility changes. |

| Primary Objective | Capture profit from price movements by exploiting gamma exposure. | Reduce profit/loss from volatility fluctuations by balancing vega. |

| Risk Factor | Sensitivity to large market moves causing fast hedge adjustments. | Exposure to directional moves if delta is not perfectly hedged. |

| Ideal Market Condition | High price volatility with frequent small moves. | Stable price levels with uncertain or high volatility shifts. |

| Hedging Focus | Delta hedging to maintain neutral delta while benefiting from gamma. | Adjusting option positions to neutralize vega exposure. |

| Typical Instruments Used | Options and underlying asset for dynamic hedging. | Multiple option strikes and maturities to offset volatility risk. |

| Profit Drivers | Price oscillations benefiting from gamma exposure. | Stable volatility levels minimizing losses from vega exposure. |

Which is better?

Gamma scalping focuses on managing the delta of an options position to profit from price volatility by frequently adjusting the hedge, making it effective in highly volatile markets. Vega neutral strategies aim to minimize exposure to volatility changes by balancing options with offsetting vega, reducing risk from implied volatility fluctuations. The choice between gamma scalping and vega neutral depends on market conditions and trader objectives, with gamma scalping benefiting from active price movements and vega neutral suited for stable volatility environments.

Connection

Gamma scalping and vega neutrality are connected through their roles in managing options portfolios' sensitivity to underlying asset price and volatility changes. Gamma scalping involves adjusting the hedge ratio to capture profits from price movements by exploiting positive gamma, while maintaining a vega neutral position minimizes exposure to volatility fluctuations. This combined approach optimizes risk management and enhances returns by balancing delta, gamma, and vega sensitivities in trading strategies.

Key Terms

Implied Volatility

Vega neutral strategies aim to mitigate exposure to changes in implied volatility by balancing option positions to maintain a stable Vega, while gamma scalping focuses on managing the dynamic risk from price movements by frequently adjusting the underlying hedge to capitalize on gamma. Implied volatility serves as a critical factor for vega neutral traders seeking to maintain positions indifferent to volatility shifts, whereas gamma scalping requires constant attention to both volatility levels and price fluctuations to optimize profit and risk. Explore detailed analyses on how these strategies interact with implied volatility to refine trading performance.

Delta Hedging

Vega neutral and gamma scalping strategies both focus on delta hedging to manage risk in options trading, but they optimize based on different sensitivities: vega neutral aims to minimize exposure to volatility changes, while gamma scalping adjusts positions to profit from price fluctuations while keeping delta near zero. Traders use vega neutral strategies to protect portfolios from volatility swings, whereas gamma scalping requires frequent rebalancing to capture gains from underlying asset movements. Explore detailed techniques and risk management approaches to enhance your options trading strategy.

Position Adjustment

Vega neutral strategies aim to minimize exposure to volatility changes by adjusting option positions to keep vega close to zero, while gamma scalping focuses on managing the gamma risk by frequently hedging underlying asset movements to profit from price fluctuations. Both techniques require active position adjustment but differ in their core risk management focus--vega neutral targets volatility stability, and gamma scalping targets delta neutrality through continuous rebalancing. Explore detailed frameworks and practical applications of position adjustment in these strategies to enhance your options trading expertise.

Source and External Links

Vega Neutral - Overview, How It Works, How To Create - Vega neutral is a risk management strategy in options trading where a portfolio is constructed such that its total vega equals zero, meaning changes in implied volatility have no impact on the portfolio's value.

Vega-Neutral Trading | Managing Volatility Like a Pro - Vega-neutral trading involves structuring a portfolio with minimal or no exposure to implied volatility changes, focusing profit and loss mostly on price movement and time decay rather than volatility shifts.

Vega Neutral Option Strategies - Vega neutrality means the overall vega from a combined option position is near zero, canceling out volatility effects, commonly achieved through strategies like spreads, collars, and synthetic positions.

dowidth.com

dowidth.com