Liquidity mining incentivizes users to provide assets to decentralized finance (DeFi) pools, earning rewards while increasing market depth and reducing slippage. Synthetic assets replicate the value of traditional financial instruments using blockchain technology, enabling exposure to a wide range of markets without owning the underlying assets. Explore how these innovative trading mechanisms reshape decentralized markets and investment strategies.

Why it is important

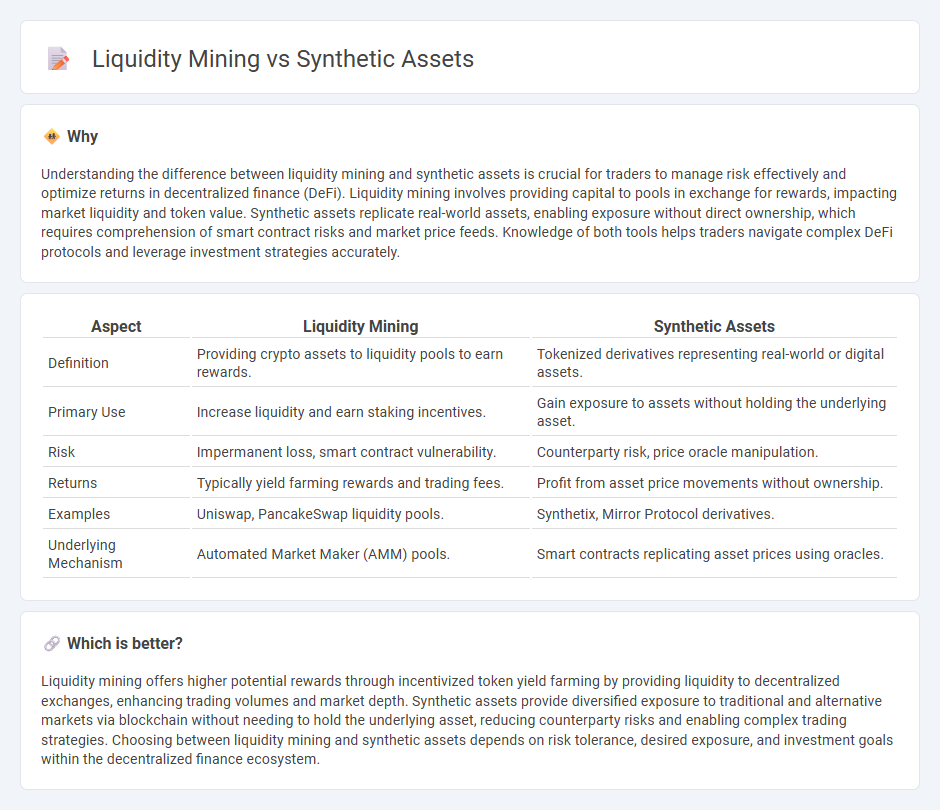

Understanding the difference between liquidity mining and synthetic assets is crucial for traders to manage risk effectively and optimize returns in decentralized finance (DeFi). Liquidity mining involves providing capital to pools in exchange for rewards, impacting market liquidity and token value. Synthetic assets replicate real-world assets, enabling exposure without direct ownership, which requires comprehension of smart contract risks and market price feeds. Knowledge of both tools helps traders navigate complex DeFi protocols and leverage investment strategies accurately.

Comparison Table

| Aspect | Liquidity Mining | Synthetic Assets |

|---|---|---|

| Definition | Providing crypto assets to liquidity pools to earn rewards. | Tokenized derivatives representing real-world or digital assets. |

| Primary Use | Increase liquidity and earn staking incentives. | Gain exposure to assets without holding the underlying asset. |

| Risk | Impermanent loss, smart contract vulnerability. | Counterparty risk, price oracle manipulation. |

| Returns | Typically yield farming rewards and trading fees. | Profit from asset price movements without ownership. |

| Examples | Uniswap, PancakeSwap liquidity pools. | Synthetix, Mirror Protocol derivatives. |

| Underlying Mechanism | Automated Market Maker (AMM) pools. | Smart contracts replicating asset prices using oracles. |

Which is better?

Liquidity mining offers higher potential rewards through incentivized token yield farming by providing liquidity to decentralized exchanges, enhancing trading volumes and market depth. Synthetic assets provide diversified exposure to traditional and alternative markets via blockchain without needing to hold the underlying asset, reducing counterparty risks and enabling complex trading strategies. Choosing between liquidity mining and synthetic assets depends on risk tolerance, desired exposure, and investment goals within the decentralized finance ecosystem.

Connection

Liquidity mining enhances decentralized finance by incentivizing users to provide capital, increasing market liquidity essential for synthetic asset trading. Synthetic assets rely on liquidity pools funded through liquidity mining to ensure seamless asset issuance and redemption. This synergy optimizes price stability and trading efficiency within decentralized exchanges.

Key Terms

Derivatives

Synthetic assets are derivatives that replicate the value of real-world assets without requiring ownership, enabling diverse exposure in decentralized finance. Liquidity mining incentivizes users to provide capital to decentralized exchanges or derivative platforms by rewarding tokens, enhancing market depth and trading efficiency. Explore how these mechanisms transform DeFi derivatives by deepening your understanding of their protocols and use cases.

Yield Farming

Synthetic assets enable yield farmers to gain exposure to diverse financial instruments without owning the underlying assets, increasing portfolio flexibility. Liquidity mining involves providing crypto liquidity to decentralized exchanges or protocols in return for yield rewards, often in the form of governance tokens. Explore the mechanisms and benefits of both approaches to optimize your yield farming strategy.

Collateralization

Synthetic assets rely on over-collateralization with assets such as ETH or stablecoins to maintain price stability and minimize liquidation risks, ensuring the synthetic asset's value closely tracks the underlying real-world asset. Liquidity mining does not inherently require collateral but incentivizes users to provide liquidity by rewarding them with tokens, exposing participants to impermanent loss and market volatility. Explore the nuances of collateralization to understand risk management in synthetic assets versus yield strategies in liquidity mining.

Source and External Links

Unlocking Crypto Synthetic Assets: Explained - Synthetic assets are blockchain-based financial instruments that mimic the value and behavior of real assets like stocks, commodities, or currencies, allowing DeFi users to access diverse markets without owning the underlying assets, but they come with added complexity and risks.

Crypto synthetic assets, explained - Crypto synthetic assets are digital tokens created using smart contracts on blockchains like Ethereum to replicate real-world financial assets, providing increased accessibility and programmability though with unique risks compared to traditional tangible assets.

Synthetic Asset Definition - Synthetic assets (or synths) are tokenized derivatives representing assets on the blockchain, combining cryptocurrency and traditional derivatives to enable anonymous, secure trading tracked on distributed ledgers.

dowidth.com

dowidth.com