High-frequency trading (HFT) leverages sophisticated algorithms and ultra-fast data networks to execute thousands of trades within seconds, aiming to capitalize on minimal price discrepancies. In contrast, position trading involves long-term investment strategies where traders hold assets for weeks or months to benefit from sustained market trends. Discover the key differences and strategies behind these trading approaches to optimize your investment portfolio.

Why it is important

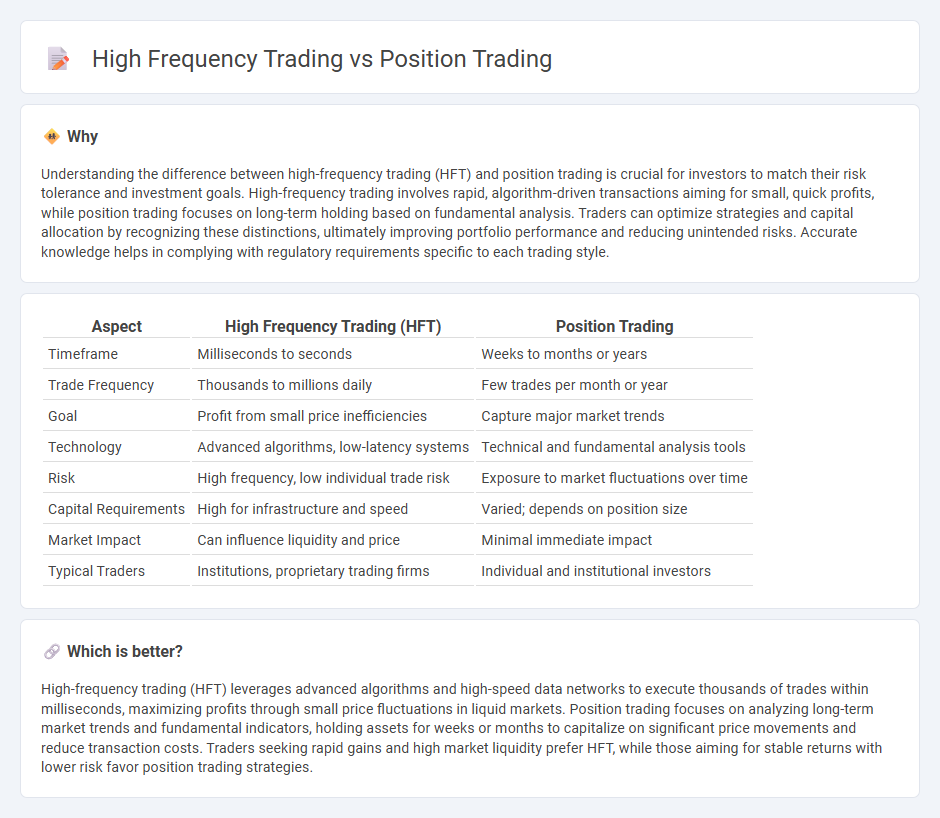

Understanding the difference between high-frequency trading (HFT) and position trading is crucial for investors to match their risk tolerance and investment goals. High-frequency trading involves rapid, algorithm-driven transactions aiming for small, quick profits, while position trading focuses on long-term holding based on fundamental analysis. Traders can optimize strategies and capital allocation by recognizing these distinctions, ultimately improving portfolio performance and reducing unintended risks. Accurate knowledge helps in complying with regulatory requirements specific to each trading style.

Comparison Table

| Aspect | High Frequency Trading (HFT) | Position Trading |

|---|---|---|

| Timeframe | Milliseconds to seconds | Weeks to months or years |

| Trade Frequency | Thousands to millions daily | Few trades per month or year |

| Goal | Profit from small price inefficiencies | Capture major market trends |

| Technology | Advanced algorithms, low-latency systems | Technical and fundamental analysis tools |

| Risk | High frequency, low individual trade risk | Exposure to market fluctuations over time |

| Capital Requirements | High for infrastructure and speed | Varied; depends on position size |

| Market Impact | Can influence liquidity and price | Minimal immediate impact |

| Typical Traders | Institutions, proprietary trading firms | Individual and institutional investors |

Which is better?

High-frequency trading (HFT) leverages advanced algorithms and high-speed data networks to execute thousands of trades within milliseconds, maximizing profits through small price fluctuations in liquid markets. Position trading focuses on analyzing long-term market trends and fundamental indicators, holding assets for weeks or months to capitalize on significant price movements and reduce transaction costs. Traders seeking rapid gains and high market liquidity prefer HFT, while those aiming for stable returns with lower risk favor position trading strategies.

Connection

High frequency trading (HFT) and position trading intersect through the shared goal of capitalizing on market inefficiencies, though they operate on vastly different time scales and strategies. HFT relies on executing numerous rapid trades using sophisticated algorithms to profit from minuscule price movements, while position trading involves holding assets for extended periods based on fundamental analysis and trend forecasting. Both methods contribute to market liquidity and price discovery, making them integral components of modern trading ecosystems.

Key Terms

Position Trading:

Position trading involves holding assets for weeks, months, or even years, capitalizing on long-term market trends and fundamental analysis rather than short-term price fluctuations. Traders rely on economic indicators, company performance, and macroeconomic factors to make informed decisions, minimizing the impact of market noise. Discover more insights on how position trading can align with your investment strategy.

Holding Period

Position trading involves holding assets for weeks to months, capitalizing on long-term market trends and minimizing transaction costs. High-frequency trading executes thousands of trades per second, holding positions for mere seconds or milliseconds to exploit minute price discrepancies. Explore the key differences in holding periods and strategies to optimize your trading approach.

Fundamental Analysis

Position trading relies heavily on fundamental analysis to evaluate long-term asset value by examining economic indicators, company financials, and market trends, aiming to capitalize on sustained price movements. High frequency trading, in contrast, prioritizes speed and algorithmic execution over fundamental data, exploiting short-term inefficiencies and price discrepancies within milliseconds. Explore the nuances of these trading strategies to optimize your investment approach.

Source and External Links

A guide to position trading: definition, examples and ... - Position trading is a style that seeks to identify and benefit from ongoing market trends, holding trades for weeks or months using strategies like trend, breakout, and pullback trading to maximize profits over the long term.

Position Trading 101: A Beginner's Guide With Examples - Position trading is an active strategy involving buying and selling financial products over weeks to months to ride up and down trends, differing from buy-and-hold by enabling traders to go long/short and time market exits.

Position Trading Strategy: How To Use It - Position trading involves holding positions over months to years, aiming to capture larger market moves with fewer trades, reduced monitoring, and lower transaction costs compared to day or swing trading.

dowidth.com

dowidth.com