Pair trading relies on identifying correlated asset pairs to exploit price divergences, offering a market-neutral hedge that reduces directional risk. Algorithmic trading employs complex algorithms to execute high-frequency trades based on pre-set criteria, enhancing speed and precision in volatile markets. Explore further to understand which strategy aligns with your trading goals and risk tolerance.

Why it is important

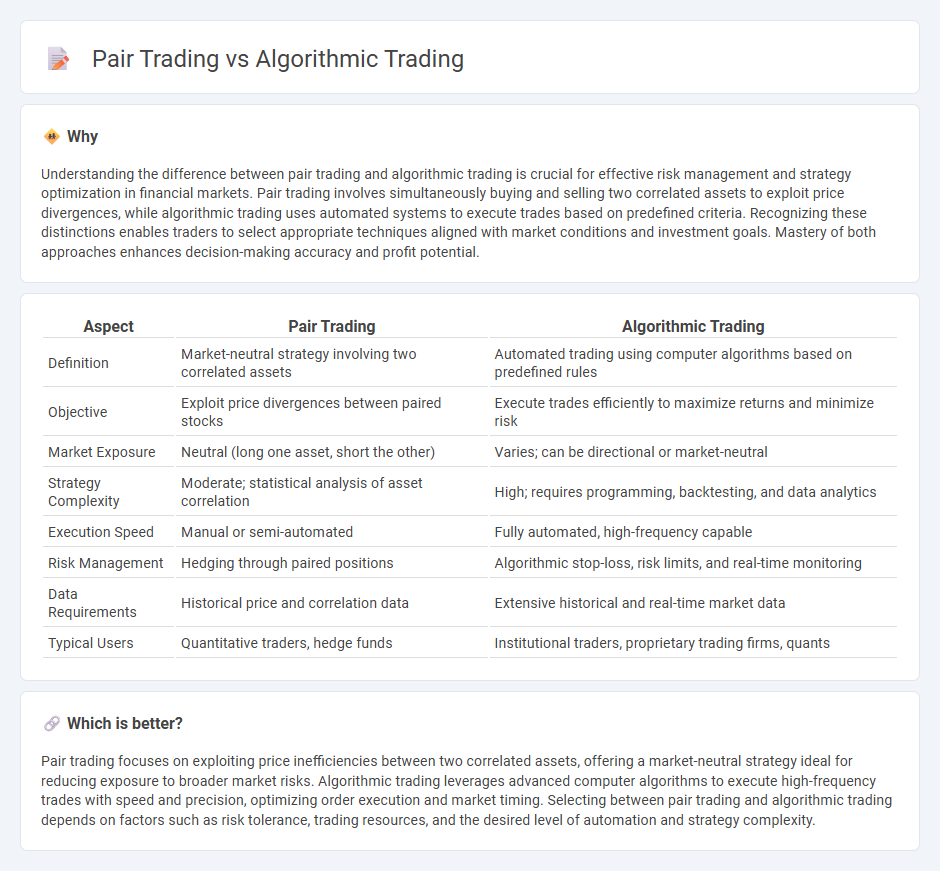

Understanding the difference between pair trading and algorithmic trading is crucial for effective risk management and strategy optimization in financial markets. Pair trading involves simultaneously buying and selling two correlated assets to exploit price divergences, while algorithmic trading uses automated systems to execute trades based on predefined criteria. Recognizing these distinctions enables traders to select appropriate techniques aligned with market conditions and investment goals. Mastery of both approaches enhances decision-making accuracy and profit potential.

Comparison Table

| Aspect | Pair Trading | Algorithmic Trading |

|---|---|---|

| Definition | Market-neutral strategy involving two correlated assets | Automated trading using computer algorithms based on predefined rules |

| Objective | Exploit price divergences between paired stocks | Execute trades efficiently to maximize returns and minimize risk |

| Market Exposure | Neutral (long one asset, short the other) | Varies; can be directional or market-neutral |

| Strategy Complexity | Moderate; statistical analysis of asset correlation | High; requires programming, backtesting, and data analytics |

| Execution Speed | Manual or semi-automated | Fully automated, high-frequency capable |

| Risk Management | Hedging through paired positions | Algorithmic stop-loss, risk limits, and real-time monitoring |

| Data Requirements | Historical price and correlation data | Extensive historical and real-time market data |

| Typical Users | Quantitative traders, hedge funds | Institutional traders, proprietary trading firms, quants |

Which is better?

Pair trading focuses on exploiting price inefficiencies between two correlated assets, offering a market-neutral strategy ideal for reducing exposure to broader market risks. Algorithmic trading leverages advanced computer algorithms to execute high-frequency trades with speed and precision, optimizing order execution and market timing. Selecting between pair trading and algorithmic trading depends on factors such as risk tolerance, trading resources, and the desired level of automation and strategy complexity.

Connection

Pair trading and algorithmic trading are interconnected through their reliance on quantitative models to identify trading opportunities in correlated asset pairs. Algorithmic trading automates the execution of pair trades by continuously scanning for pricing divergences and managing trades with speed and precision. This synergy enhances market efficiency, reduces emotional bias, and maximizes the profitability of statistical arbitrage strategies.

Key Terms

Algorithmic Trading:

Algorithmic trading leverages computer algorithms to execute trades at high speed and volume, using predefined rules based on technical indicators, market data, and mathematical models to optimize execution and minimize human error. This approach can incorporate various strategies, including trend-following, arbitrage, and market making, enabling traders to capitalize on short-term price movements with precision. Explore more to understand how algorithmic trading transforms market efficiency and risk management.

Backtesting

Algorithmic trading employs automated systems to execute trades based on predefined strategies, enabling efficient backtesting of large datasets for performance evaluation. Pair trading, a market-neutral strategy, involves simultaneous buying and selling of correlated asset pairs and requires rigorous backtesting to validate cointegration and minimize risk. Discover more about optimizing backtesting techniques for both trading approaches through advanced tools and methods.

Execution Speed

Algorithmic trading leverages advanced computational algorithms to execute orders at blazing speeds, often in milliseconds, maximizing market opportunities through rapid decision-making and minimal latency. Pair trading, a market-neutral strategy, relies on identifying two correlated assets and executing trades based on their price divergence, where execution speed is important but secondary to the accuracy of signal detection. Explore how execution speed nuances impact these strategies and their effectiveness in today's high-frequency trading environment.

Source and External Links

What is Algorithmic Trading and How Do You Get Started? - IG - Algorithmic trading uses computer-coded rules to automatically open and close trades based on price movements or technical indicators, popular strategies include price action and technical analysis, with customizable parameters for market, time frame, and risk management.

Algorithmic Trading - Definition, Example, Pros, Cons - Algorithmic trading involves programming computers with pre-set trading rules to buy or sell based on conditions like moving averages, allowing large trades to be executed in smaller batches to avoid market distortion.

Algorithmic trading - Wikipedia - Algorithmic trading automates order execution using programmed instructions based on variables such as price and time, and has evolved with machine learning techniques like deep reinforcement learning to dynamically adapt to market conditions and improve profitability.

dowidth.com

dowidth.com