Volatility harvesting leverages market fluctuations by systematically rebalancing asset allocations to capture gains during volatility, contrasting with the buy and hold strategy that maintains investments regardless of market changes. This approach aims to enhance returns by exploiting short-term price movements while buy and hold relies on long-term market growth and dividend accumulation. Explore the nuances and effectiveness of both strategies to determine which aligns best with your investment goals.

Why it is important

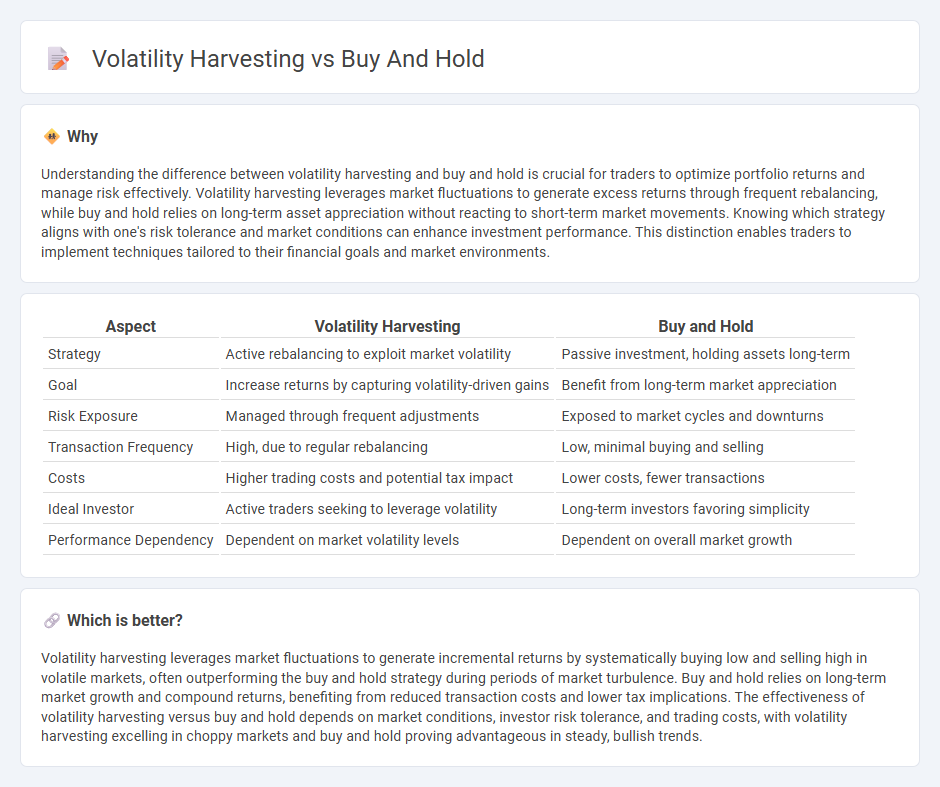

Understanding the difference between volatility harvesting and buy and hold is crucial for traders to optimize portfolio returns and manage risk effectively. Volatility harvesting leverages market fluctuations to generate excess returns through frequent rebalancing, while buy and hold relies on long-term asset appreciation without reacting to short-term market movements. Knowing which strategy aligns with one's risk tolerance and market conditions can enhance investment performance. This distinction enables traders to implement techniques tailored to their financial goals and market environments.

Comparison Table

| Aspect | Volatility Harvesting | Buy and Hold |

|---|---|---|

| Strategy | Active rebalancing to exploit market volatility | Passive investment, holding assets long-term |

| Goal | Increase returns by capturing volatility-driven gains | Benefit from long-term market appreciation |

| Risk Exposure | Managed through frequent adjustments | Exposed to market cycles and downturns |

| Transaction Frequency | High, due to regular rebalancing | Low, minimal buying and selling |

| Costs | Higher trading costs and potential tax impact | Lower costs, fewer transactions |

| Ideal Investor | Active traders seeking to leverage volatility | Long-term investors favoring simplicity |

| Performance Dependency | Dependent on market volatility levels | Dependent on overall market growth |

Which is better?

Volatility harvesting leverages market fluctuations to generate incremental returns by systematically buying low and selling high in volatile markets, often outperforming the buy and hold strategy during periods of market turbulence. Buy and hold relies on long-term market growth and compound returns, benefiting from reduced transaction costs and lower tax implications. The effectiveness of volatility harvesting versus buy and hold depends on market conditions, investor risk tolerance, and trading costs, with volatility harvesting excelling in choppy markets and buy and hold proving advantageous in steady, bullish trends.

Connection

Volatility harvesting leverages market fluctuations to systematically rebalance portfolios, enhancing returns through strategic buying and selling during volatile periods. Buy and hold benefits from volatility harvesting by capturing downside risk reductions and compounding gains more effectively over time. Integrating volatility harvesting with buy and hold strategies can improve risk-adjusted performance and optimize long-term wealth accumulation.

Key Terms

Time Horizon

Buy and hold strategies benefit from long time horizons by capitalizing on market growth and compounding returns, minimizing the impact of short-term volatility. Volatility harvesting, in contrast, leverages frequent rebalancing to exploit price fluctuations and generate incremental gains, making it more effective over shorter to medium timeframes. Explore how these approaches align with your investment goals and risk tolerance to optimize portfolio performance.

Rebalancing

Buy and hold investing emphasizes maintaining a portfolio without frequent adjustments, relying on long-term asset appreciation, while volatility harvesting leverages systematic rebalancing to capture gains from market fluctuations and reduce risk. Regular rebalancing aligns portfolio weights with target allocations, enhancing returns by selling overperforming assets and buying undervalued ones, which is central to volatility harvesting strategies. Explore more about how disciplined rebalancing can optimize your investment outcomes and risk management.

Risk Management

Buy and hold strategies prioritize long-term growth by maintaining investments despite market fluctuations, minimizing transaction costs and tax implications. Volatility harvesting leverages market fluctuations by systematically rebalancing portfolios to capture gains from asset price volatility, enhancing risk-adjusted returns. Explore in-depth risk management techniques to determine which approach aligns best with your investment goals.

Source and External Links

Buy and hold - Wikipedia - Buy and hold is an investment strategy where an investor purchases assets to hold long term, aiming for price appreciation despite market volatility, and it is a form of passive management endorsed by notable investors like Warren Buffett and Jack Bogle.

Buy-and-Hold Investing: Is It the Right Investment Strategy? - This strategy involves buying stocks or assets and holding them over the medium to long term while ignoring short-term price fluctuations, providing a stable portfolio and capital appreciation potential.

Buy-and-hold as an investing strategy: Weigh the pluses and minuses - Buy-and-hold is suited for long-term investors who accept stock market risks in exchange for potential returns, focusing on purchasing quality stocks or funds and holding for years to benefit from the market's historical growth.

dowidth.com

dowidth.com