Liquidity sweeps target large orders by aggressively consuming visible and hidden liquidity across multiple price levels to reveal the true market depth, often causing rapid price movements. Iceberg orders conceal the full order size by displaying only a fraction of the total quantity, reducing market impact and signaling risk. Explore further to understand how these strategies influence trading efficiency and market dynamics.

Why it is important

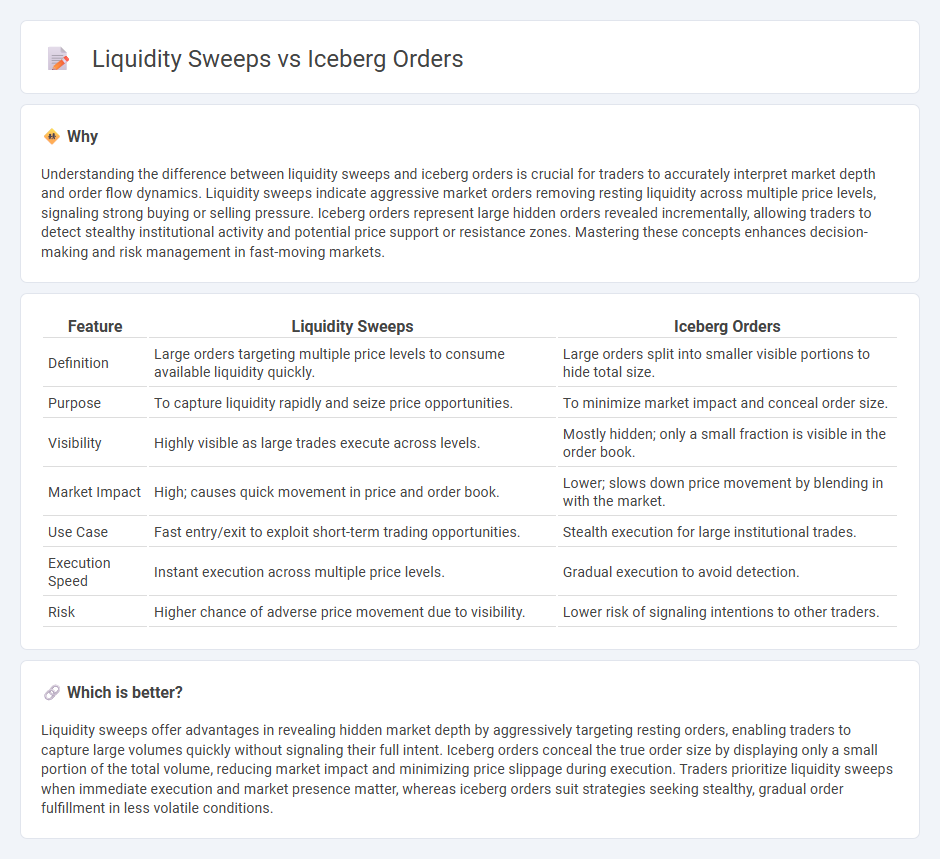

Understanding the difference between liquidity sweeps and iceberg orders is crucial for traders to accurately interpret market depth and order flow dynamics. Liquidity sweeps indicate aggressive market orders removing resting liquidity across multiple price levels, signaling strong buying or selling pressure. Iceberg orders represent large hidden orders revealed incrementally, allowing traders to detect stealthy institutional activity and potential price support or resistance zones. Mastering these concepts enhances decision-making and risk management in fast-moving markets.

Comparison Table

| Feature | Liquidity Sweeps | Iceberg Orders |

|---|---|---|

| Definition | Large orders targeting multiple price levels to consume available liquidity quickly. | Large orders split into smaller visible portions to hide total size. |

| Purpose | To capture liquidity rapidly and seize price opportunities. | To minimize market impact and conceal order size. |

| Visibility | Highly visible as large trades execute across levels. | Mostly hidden; only a small fraction is visible in the order book. |

| Market Impact | High; causes quick movement in price and order book. | Lower; slows down price movement by blending in with the market. |

| Use Case | Fast entry/exit to exploit short-term trading opportunities. | Stealth execution for large institutional trades. |

| Execution Speed | Instant execution across multiple price levels. | Gradual execution to avoid detection. |

| Risk | Higher chance of adverse price movement due to visibility. | Lower risk of signaling intentions to other traders. |

Which is better?

Liquidity sweeps offer advantages in revealing hidden market depth by aggressively targeting resting orders, enabling traders to capture large volumes quickly without signaling their full intent. Iceberg orders conceal the true order size by displaying only a small portion of the total volume, reducing market impact and minimizing price slippage during execution. Traders prioritize liquidity sweeps when immediate execution and market presence matter, whereas iceberg orders suit strategies seeking stealthy, gradual order fulfillment in less volatile conditions.

Connection

Liquidity sweeps and iceberg orders are connected through their impact on market transparency and order execution strategies. Iceberg orders conceal the full size of a trade by only displaying a fraction of the total volume, while liquidity sweeps aggressively target these hidden orders by rapidly consuming visible and hidden liquidity across multiple price levels. This interaction maximizes execution efficiency and minimizes market impact for large traders seeking to avoid signaling their full intent.

Key Terms

Hidden Orders

Iceberg orders conceal large trade intentions by revealing only a portion of the order size to the market, enhancing anonymity and reducing market impact. Liquidity sweeps aggressively target available hidden liquidity across multiple price levels, effectively capturing concealed limit orders such as those in iceberg formations. Discover how understanding hidden orders can optimize trading strategies and improve market execution efficiency.

Order Book Depth

Iceberg orders strategically conceal the full size of a large trade by displaying only a fraction in the order book, preserving market depth and minimizing price impact. Liquidity sweeps aggressively remove standing orders across multiple price levels, rapidly consuming order book depth to capitalize on short-term price movements. Explore how these tactics influence trading strategies and market dynamics in depth.

Market Impact

Iceberg orders strategically conceal large trade sizes by revealing only small portions, minimizing immediate market impact and avoiding price fluctuations. Liquidity sweeps aggressively consume available liquidity across multiple price levels, often causing significant short-term price movements and volatility. Explore how these execution tactics influence market dynamics and trading strategies in greater detail.

Source and External Links

Iceberg Order - Overview, How It Works, and Example - An iceberg order breaks a large buy or sell order into smaller visible chunks to conceal the total order size, helping large traders execute without significantly impacting the market price.

Iceberg Orders - Kraken Support - An iceberg order shows only a portion of the total order in the order book and reveals more as each visible part executes, allowing large limit orders to be placed without causing market disruption.

What are Iceberg orders, and how to use them? - Support Zerodha - Iceberg orders slice large orders into smaller legs, sent sequentially to minimize market impact and keep the true order size hidden, primarily using limit order types to reduce impact cost.

dowidth.com

dowidth.com