High frequency trading (HFT) bots execute thousands of trades per second using complex algorithms to capitalize on minute price discrepancies, leveraging ultra-low latency connections for optimal performance. Scalping bots, on the other hand, target small price movements over short periods, focusing on quick entry and exit positions to accumulate profits steadily throughout the trading session. Explore the distinct strategies and technologies behind these trading bots to enhance your market approach.

Why it is important

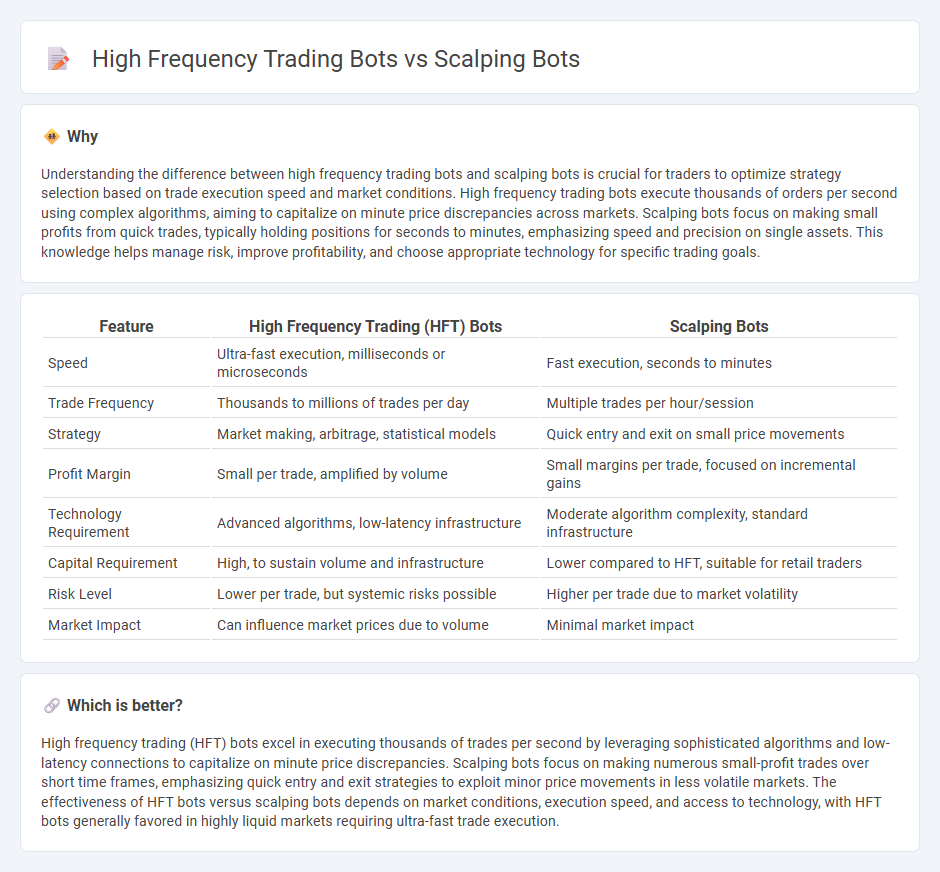

Understanding the difference between high frequency trading bots and scalping bots is crucial for traders to optimize strategy selection based on trade execution speed and market conditions. High frequency trading bots execute thousands of orders per second using complex algorithms, aiming to capitalize on minute price discrepancies across markets. Scalping bots focus on making small profits from quick trades, typically holding positions for seconds to minutes, emphasizing speed and precision on single assets. This knowledge helps manage risk, improve profitability, and choose appropriate technology for specific trading goals.

Comparison Table

| Feature | High Frequency Trading (HFT) Bots | Scalping Bots |

|---|---|---|

| Speed | Ultra-fast execution, milliseconds or microseconds | Fast execution, seconds to minutes |

| Trade Frequency | Thousands to millions of trades per day | Multiple trades per hour/session |

| Strategy | Market making, arbitrage, statistical models | Quick entry and exit on small price movements |

| Profit Margin | Small per trade, amplified by volume | Small margins per trade, focused on incremental gains |

| Technology Requirement | Advanced algorithms, low-latency infrastructure | Moderate algorithm complexity, standard infrastructure |

| Capital Requirement | High, to sustain volume and infrastructure | Lower compared to HFT, suitable for retail traders |

| Risk Level | Lower per trade, but systemic risks possible | Higher per trade due to market volatility |

| Market Impact | Can influence market prices due to volume | Minimal market impact |

Which is better?

High frequency trading (HFT) bots excel in executing thousands of trades per second by leveraging sophisticated algorithms and low-latency connections to capitalize on minute price discrepancies. Scalping bots focus on making numerous small-profit trades over short time frames, emphasizing quick entry and exit strategies to exploit minor price movements in less volatile markets. The effectiveness of HFT bots versus scalping bots depends on market conditions, execution speed, and access to technology, with HFT bots generally favored in highly liquid markets requiring ultra-fast trade execution.

Connection

High-frequency trading (HFT) bots and scalping bots both execute rapid trades to capitalize on small price fluctuations, leveraging advanced algorithms and low-latency data feeds. Scalping bots focus on short-term profit by making numerous quick trades within seconds or minutes, while HFT bots operate at even faster speeds, often executing thousands of orders per second to exploit minute market inefficiencies. Both rely on speed, precision, and algorithmic strategies to enhance liquidity and generate consistent profits in volatile trading environments.

Key Terms

Trade Execution Speed

Scalping bots excel in trade execution speed by targeting small price gaps and completing multiple quick trades within seconds, leveraging algorithms that rapidly place and exit positions. High-frequency trading (HFT) bots operate with ultra-low latency infrastructures, executing thousands of orders per second across multiple markets to exploit minimal price discrepancies. Discover more about the critical differences in speed and strategy between these trading technologies.

Order Size

Scalping bots typically execute numerous small orders to profit from minor price fluctuations, emphasizing rapid order placement with minimal size to reduce market impact. High frequency trading (HFT) bots, conversely, often manage larger order volumes with sophisticated algorithms that capitalize on market inefficiencies at microsecond speeds. Discover the key differences in order size strategies and their impact on market dynamics.

Holding Time

Scalping bots execute trades with extremely short holding times, often seconds or milliseconds, capitalizing on small price movements to generate quick profits. High-frequency trading (HFT) bots operate on similar rapid timeframes but focus on executing thousands of trades per second across multiple markets to exploit fleeting arbitrage opportunities and market inefficiencies. Explore the nuances and impact of holding time differences on trading performance and strategies to understand which approach suits your investment goals.

Source and External Links

Scalper Bots: What They Are and How to Fight Them - Arkose Labs - Scalper bots are automated programs that create fake accounts and use stolen credit cards to quickly buy high-demand goods online, outpacing genuine consumers and causing inventory shortages while sometimes using stolen IP addresses to evade fraud defenses.

Scalping Bot: Automate Your High-Frequency Trades - WunderTrading - Scalping bots are trading software designed to execute high-frequency trades in financial markets rapidly, aiming to make small profits on price fluctuations by using technical analysis and pre-set algorithms.

Scalping Bots: Everything You Need to Know - Queue-it - Scalping bots include scraping and footprinting bots which monitor websites for restocks or hidden product pages to buy goods early or in bulk, giving scalpers unfair advantages especially during high-demand product launches like gaming consoles.

dowidth.com

dowidth.com