Quantitative backtesting involves testing trading strategies using historical market data to evaluate their effectiveness and risk metrics before real-time application. Simulation trading replicates live market conditions in a virtual environment, allowing traders to practice orders and strategy adjustments without financial risk. Explore the nuances between these methods to optimize your trading performance and decision-making.

Why it is important

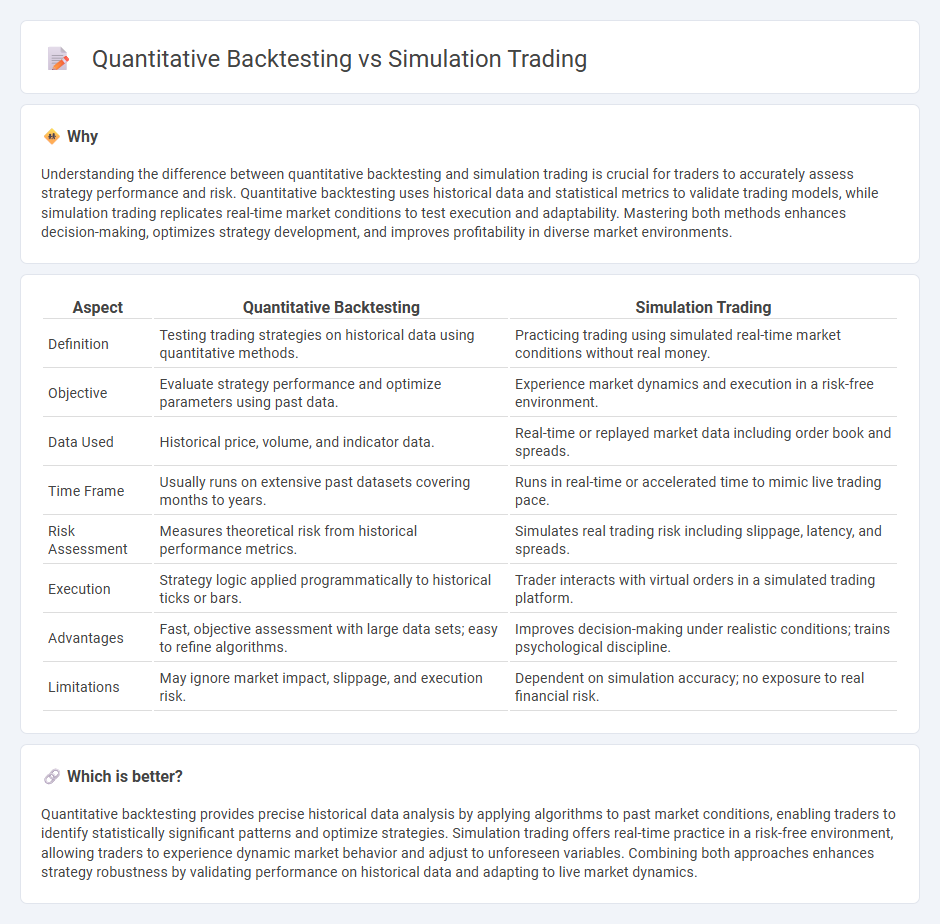

Understanding the difference between quantitative backtesting and simulation trading is crucial for traders to accurately assess strategy performance and risk. Quantitative backtesting uses historical data and statistical metrics to validate trading models, while simulation trading replicates real-time market conditions to test execution and adaptability. Mastering both methods enhances decision-making, optimizes strategy development, and improves profitability in diverse market environments.

Comparison Table

| Aspect | Quantitative Backtesting | Simulation Trading |

|---|---|---|

| Definition | Testing trading strategies on historical data using quantitative methods. | Practicing trading using simulated real-time market conditions without real money. |

| Objective | Evaluate strategy performance and optimize parameters using past data. | Experience market dynamics and execution in a risk-free environment. |

| Data Used | Historical price, volume, and indicator data. | Real-time or replayed market data including order book and spreads. |

| Time Frame | Usually runs on extensive past datasets covering months to years. | Runs in real-time or accelerated time to mimic live trading pace. |

| Risk Assessment | Measures theoretical risk from historical performance metrics. | Simulates real trading risk including slippage, latency, and spreads. |

| Execution | Strategy logic applied programmatically to historical ticks or bars. | Trader interacts with virtual orders in a simulated trading platform. |

| Advantages | Fast, objective assessment with large data sets; easy to refine algorithms. | Improves decision-making under realistic conditions; trains psychological discipline. |

| Limitations | May ignore market impact, slippage, and execution risk. | Dependent on simulation accuracy; no exposure to real financial risk. |

Which is better?

Quantitative backtesting provides precise historical data analysis by applying algorithms to past market conditions, enabling traders to identify statistically significant patterns and optimize strategies. Simulation trading offers real-time practice in a risk-free environment, allowing traders to experience dynamic market behavior and adjust to unforeseen variables. Combining both approaches enhances strategy robustness by validating performance on historical data and adapting to live market dynamics.

Connection

Quantitative backtesting uses historical market data to evaluate the performance of trading algorithms, providing statistically grounded insights into their potential effectiveness. Simulation trading replicates real-time market conditions, allowing traders to test these algorithms dynamically without financial risk. Together, they enable systematic validation and refinement of trading strategies before deploying capital in live markets.

Key Terms

Historical Data

Simulation trading leverages real-time and historical market data to emulate trading strategies within a live environment, allowing traders to experience market dynamics and adjust tactics accordingly. Quantitative backtesting, however, utilizes historical data exclusively to statistically evaluate the performance of trading algorithms over specified time frames, ensuring that strategies are optimized before deployment. Explore in-depth comparisons and practical applications of both methods for robust strategy development.

Execution Model

Simulation trading replicates real-time market conditions to test execution models incorporating latency, slippage, and order book dynamics, providing realistic performance insights. Quantitative backtesting uses historical price data and often simplifies execution assumptions, potentially overlooking market impact and order fill uncertainties. Explore further to understand which method best aligns with your trading strategy and risk management goals.

Performance Metrics

Simulation trading evaluates strategies in real-time market conditions, capturing slippage, latency, and execution risks crucial for accurate performance metrics like Sharpe ratio and max drawdown. Quantitative backtesting analyzes historical data, providing insights into predictive accuracy and risk-adjusted returns but often overlooks live market dynamics. Explore detailed comparisons to optimize your trading strategy's performance evaluation.

Source and External Links

Test Your Strategies With Our Trading Simulator - TradeStation - TradeStation offers a comprehensive trading simulator for stocks, options, and futures that supports real-time data, advanced charting, and algorithmic trading with EasyLanguage, allowing users to backtest and forward-test strategies without risking capital.

Free Futures Trading Simulator | NinjaTrader - NinjaTrader provides a risk-free trading simulation platform with live streaming market data, unlimited paper trading, and a powerful backtesting engine, ideal for testing futures strategies and gaining real market experience without financial risk.

Day Trading Simulator - Trade Stocks, Futures & Crypto - Tradingsim offers a session-based replay simulator synchronizing multiple symbols and charts for realistic practice in equities, futures, and crypto markets, featuring advanced replay controls and extended hours data for thorough strategy refinement.

dowidth.com

dowidth.com