Delta neutral strategy minimizes risk by balancing long and short positions to maintain a portfolio with zero net delta, effectively hedging against price movements in the underlying asset. High-frequency trading (HFT) uses powerful algorithms and ultra-fast execution to capitalize on small price disparities within milliseconds, focusing on volume and speed rather than directional market trends. Discover the key differences and applications of these trading approaches to optimize your investment strategy.

Why it is important

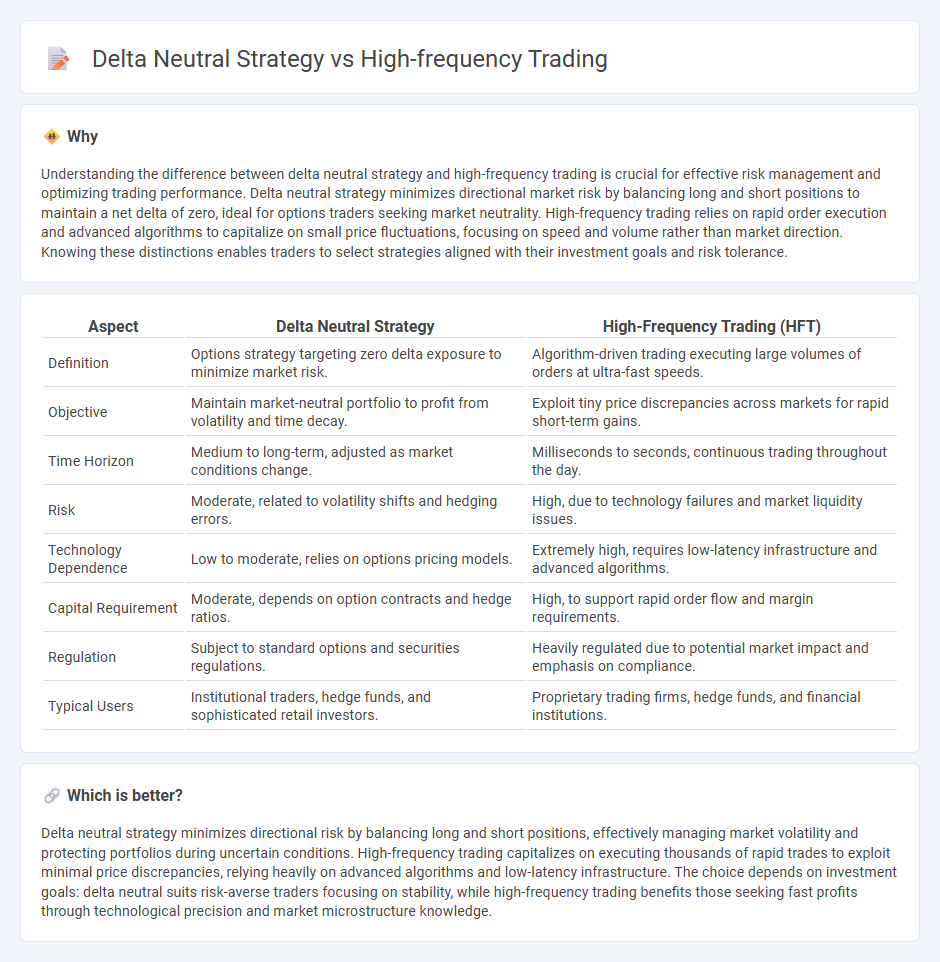

Understanding the difference between delta neutral strategy and high-frequency trading is crucial for effective risk management and optimizing trading performance. Delta neutral strategy minimizes directional market risk by balancing long and short positions to maintain a net delta of zero, ideal for options traders seeking market neutrality. High-frequency trading relies on rapid order execution and advanced algorithms to capitalize on small price fluctuations, focusing on speed and volume rather than market direction. Knowing these distinctions enables traders to select strategies aligned with their investment goals and risk tolerance.

Comparison Table

| Aspect | Delta Neutral Strategy | High-Frequency Trading (HFT) |

|---|---|---|

| Definition | Options strategy targeting zero delta exposure to minimize market risk. | Algorithm-driven trading executing large volumes of orders at ultra-fast speeds. |

| Objective | Maintain market-neutral portfolio to profit from volatility and time decay. | Exploit tiny price discrepancies across markets for rapid short-term gains. |

| Time Horizon | Medium to long-term, adjusted as market conditions change. | Milliseconds to seconds, continuous trading throughout the day. |

| Risk | Moderate, related to volatility shifts and hedging errors. | High, due to technology failures and market liquidity issues. |

| Technology Dependence | Low to moderate, relies on options pricing models. | Extremely high, requires low-latency infrastructure and advanced algorithms. |

| Capital Requirement | Moderate, depends on option contracts and hedge ratios. | High, to support rapid order flow and margin requirements. |

| Regulation | Subject to standard options and securities regulations. | Heavily regulated due to potential market impact and emphasis on compliance. |

| Typical Users | Institutional traders, hedge funds, and sophisticated retail investors. | Proprietary trading firms, hedge funds, and financial institutions. |

Which is better?

Delta neutral strategy minimizes directional risk by balancing long and short positions, effectively managing market volatility and protecting portfolios during uncertain conditions. High-frequency trading capitalizes on executing thousands of rapid trades to exploit minimal price discrepancies, relying heavily on advanced algorithms and low-latency infrastructure. The choice depends on investment goals: delta neutral suits risk-averse traders focusing on stability, while high-frequency trading benefits those seeking fast profits through technological precision and market microstructure knowledge.

Connection

Delta neutral strategy in trading involves maintaining a balance between long and short positions to hedge against price movements, reducing directional risk. High-frequency trading (HFT) employs ultra-fast algorithms to execute numerous trades in milliseconds, often utilizing delta neutral techniques to exploit small price inefficiencies without exposure to market volatility. By combining delta neutral strategies with HFT, traders can achieve consistent, low-risk profits through rapid adjustments in their portfolios in response to real-time market data.

Key Terms

**High-Frequency Trading:**

High-frequency trading (HFT) employs sophisticated algorithms and ultra-low latency technology to execute thousands of trades within milliseconds, capitalizing on minuscule price discrepancies across markets. HFT strategies rely on rapid data processing, co-location with exchange servers, and advanced statistical models to optimize trade execution and profitability. Explore more details about the mechanics and applications of high-frequency trading strategies.

Latency

High-frequency trading (HFT) leverages ultra-low latency technology to execute thousands of trades per second, capitalizing on tiny price discrepancies before competitors can react. Delta neutral strategies prioritize maintaining a balanced portfolio with minimal directional risk, focusing less on execution speed and more on risk management through options and hedging. Explore deeper insights on how latency impacts these trading approaches and their performance in dynamic markets.

Algorithmic execution

High-frequency trading (HFT) relies on ultra-fast algorithmic execution to capitalize on microsecond market inefficiencies, employing advanced order types and colocation to minimize latency. Delta neutral strategies use algorithmic execution to maintain a hedged position by dynamically adjusting asset holdings, aiming to minimize directional risk while profiting from volatility or time decay. Explore detailed insights into how these algorithms optimize trading efficiency and risk management.

Source and External Links

High-Frequency Trading Explained: What Is It and How Do You Get ... - High-frequency trading (HFT) is automated trading using powerful computers and software to execute a very large number of trades at extremely high speeds, capitalizing on tiny, fleeting price differences across exchanges to generate profits.

High Frequency Trading (HFT) - Definition, Pros and Cons - HFT is algorithmic trading defined by high-speed execution, massive transaction volume, and short investment horizons, mostly used by institutional investors to profit from small price fluctuations and arbitrage opportunities across markets.

High-frequency trading - Wikipedia - High-frequency trading involves quantitative algorithms making rapid trading decisions based on large data processing, focusing on strategies like market-making and arbitrage to exploit minute and short-lived market inefficiencies.

dowidth.com

dowidth.com