Option selling strategies like the wheel and iron condor focus on generating income through premium collection while managing risk exposure differently. The wheel strategy revolves around selling put options to acquire stocks and then selling covered calls to generate continuous returns, whereas the iron condor employs a combination of call and put spreads to profit from low volatility within a specific price range. Explore the detailed mechanics and risk profiles of each to determine which best suits your trading objectives.

Why it is important

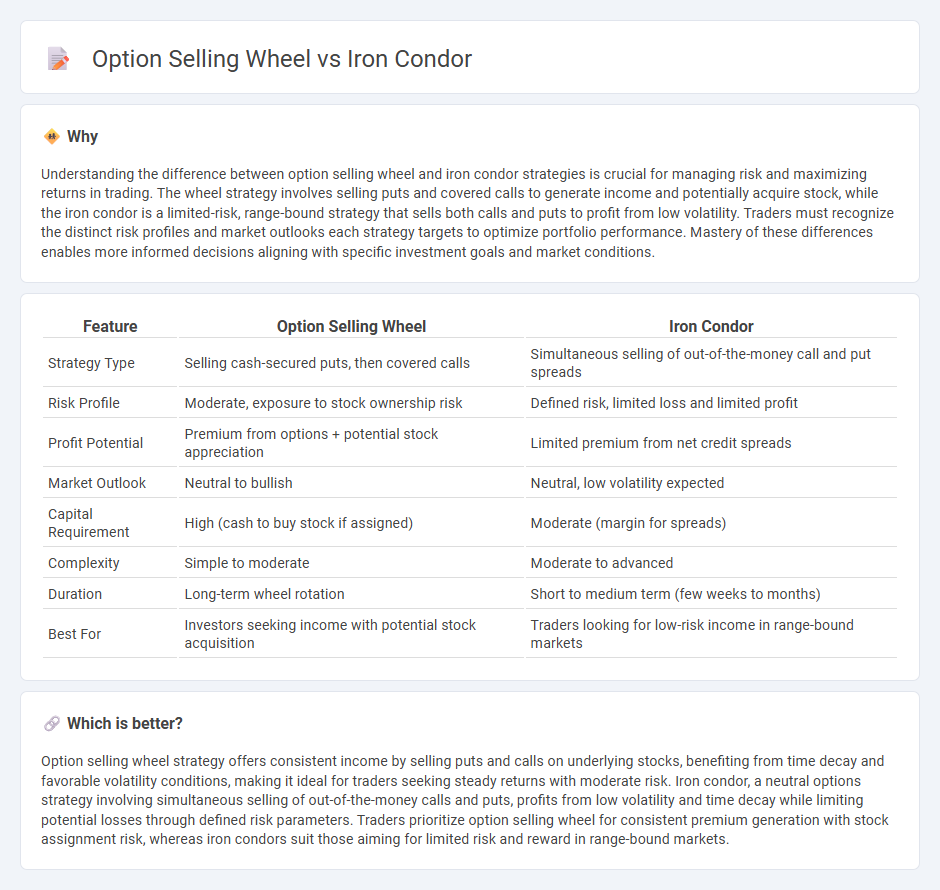

Understanding the difference between option selling wheel and iron condor strategies is crucial for managing risk and maximizing returns in trading. The wheel strategy involves selling puts and covered calls to generate income and potentially acquire stock, while the iron condor is a limited-risk, range-bound strategy that sells both calls and puts to profit from low volatility. Traders must recognize the distinct risk profiles and market outlooks each strategy targets to optimize portfolio performance. Mastery of these differences enables more informed decisions aligning with specific investment goals and market conditions.

Comparison Table

| Feature | Option Selling Wheel | Iron Condor |

|---|---|---|

| Strategy Type | Selling cash-secured puts, then covered calls | Simultaneous selling of out-of-the-money call and put spreads |

| Risk Profile | Moderate, exposure to stock ownership risk | Defined risk, limited loss and limited profit |

| Profit Potential | Premium from options + potential stock appreciation | Limited premium from net credit spreads |

| Market Outlook | Neutral to bullish | Neutral, low volatility expected |

| Capital Requirement | High (cash to buy stock if assigned) | Moderate (margin for spreads) |

| Complexity | Simple to moderate | Moderate to advanced |

| Duration | Long-term wheel rotation | Short to medium term (few weeks to months) |

| Best For | Investors seeking income with potential stock acquisition | Traders looking for low-risk income in range-bound markets |

Which is better?

Option selling wheel strategy offers consistent income by selling puts and calls on underlying stocks, benefiting from time decay and favorable volatility conditions, making it ideal for traders seeking steady returns with moderate risk. Iron condor, a neutral options strategy involving simultaneous selling of out-of-the-money calls and puts, profits from low volatility and time decay while limiting potential losses through defined risk parameters. Traders prioritize option selling wheel for consistent premium generation with stock assignment risk, whereas iron condors suit those aiming for limited risk and reward in range-bound markets.

Connection

Option selling strategies like the wheel and iron condor both focus on generating income through premium collection, leveraging market-neutral approaches to minimize risk. The wheel strategy involves selling cash-secured puts followed by covered calls, cycling through options to accumulate gains, while the iron condor combines selling out-of-the-money call and put spreads to profit from low volatility. Both techniques optimize risk-reward profiles by capitalizing on time decay and controlled market exposure within defined price ranges.

Key Terms

Strike Prices

Iron condor strategy involves selling an out-of-the-money call and put while simultaneously buying further out-of-the-money call and put options, aiming to profit from low volatility within a specific strike price range. The option selling wheel focuses on selling puts at strike prices where the seller is willing to purchase the underlying asset and then selling calls at strike prices to generate premium once assigned. Explore detailed strike price selection tips and risk management techniques to master both strategies effectively.

Premium Collection

The Iron Condor strategy enables traders to collect premiums by selling out-of-the-money call and put spreads, limiting risk while capturing gains from low volatility environments. The Option Selling Wheel focuses on sequentially selling cash-secured puts and covered calls to generate consistent premium income, benefiting from stock assignment cycles. Explore detailed comparisons to determine which premium collection strategy suits your trading goals best.

Assignment

Iron condors involve simultaneously selling out-of-the-money put and call spreads, minimizing assignment risk by limiting exposure and maintaining defined risk parameters. The option selling wheel strategy centers on selling cash-secured puts and covered calls, carrying a higher assignment probability as shares may be acquired or called away through the process. Explore deeper into how assignment impacts risk management in both strategies for optimized option trading results.

Source and External Links

Iron Condor Options Trading Strategy - tastylive - The iron condor is a directionally neutral, defined risk strategy that profits when the stock price remains within a certain range, combining an out-of-the-money short put credit spread and an out-of-the-money short call credit spread to benefit from time decay and decreased volatility.

Iron Condors & Butterflies Explained - TradeStation - Iron condors involve selling two out-of-the-money credit spreads simultaneously to collect premiums, aiming for the options to expire worthless and profit maximally if the underlying price stays between the short put and call strikes, with defined limited risk compared to a short strangle.

Iron condor - Wikipedia - The iron condor uses two vertical spreads (put spread and call spread) at different strikes with the same expiration; its long version is a net debit trade with maximum potential loss being the debit and profit defined by the spread width less paid premium.

dowidth.com

dowidth.com