Prop firm challenges require traders to demonstrate skill through performance benchmarks and risk management strategies in a competitive environment. Robo-advisors utilize algorithm-driven models to automate trading decisions based on market data and investor preferences. Explore the key differences and benefits of prop firm challenges and robo-advisors to determine the best fit for your trading goals.

Why it is important

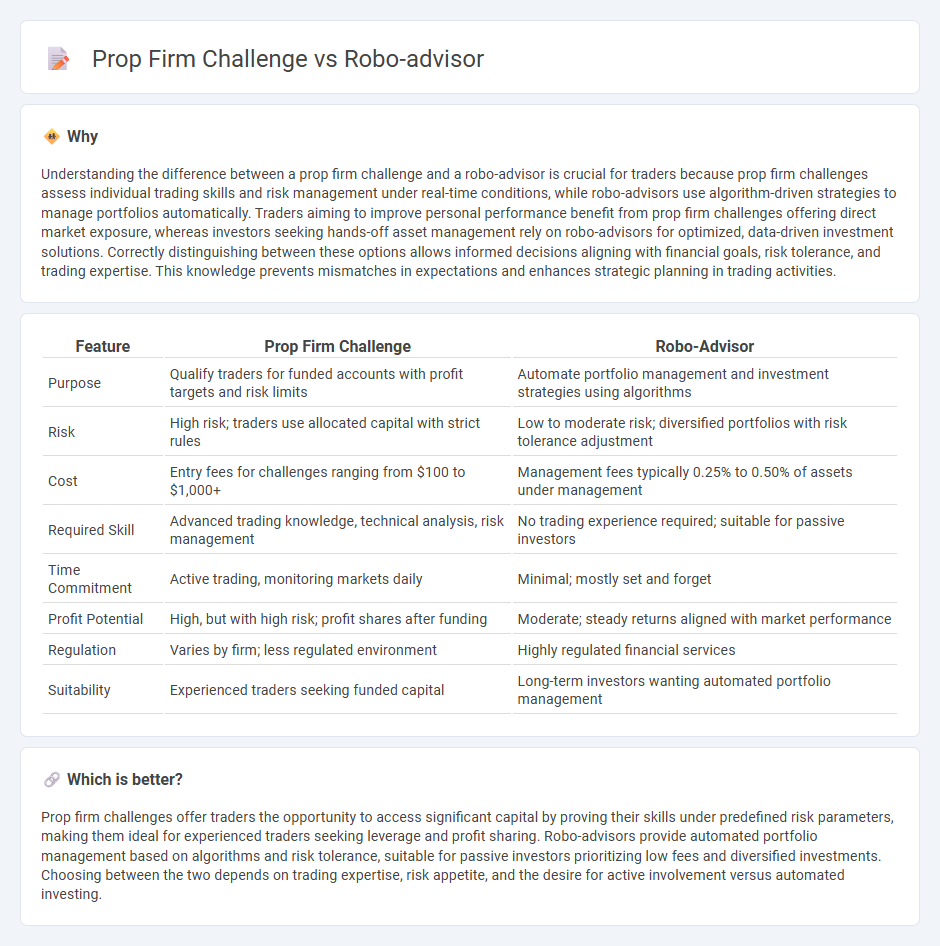

Understanding the difference between a prop firm challenge and a robo-advisor is crucial for traders because prop firm challenges assess individual trading skills and risk management under real-time conditions, while robo-advisors use algorithm-driven strategies to manage portfolios automatically. Traders aiming to improve personal performance benefit from prop firm challenges offering direct market exposure, whereas investors seeking hands-off asset management rely on robo-advisors for optimized, data-driven investment solutions. Correctly distinguishing between these options allows informed decisions aligning with financial goals, risk tolerance, and trading expertise. This knowledge prevents mismatches in expectations and enhances strategic planning in trading activities.

Comparison Table

| Feature | Prop Firm Challenge | Robo-Advisor |

|---|---|---|

| Purpose | Qualify traders for funded accounts with profit targets and risk limits | Automate portfolio management and investment strategies using algorithms |

| Risk | High risk; traders use allocated capital with strict rules | Low to moderate risk; diversified portfolios with risk tolerance adjustment |

| Cost | Entry fees for challenges ranging from $100 to $1,000+ | Management fees typically 0.25% to 0.50% of assets under management |

| Required Skill | Advanced trading knowledge, technical analysis, risk management | No trading experience required; suitable for passive investors |

| Time Commitment | Active trading, monitoring markets daily | Minimal; mostly set and forget |

| Profit Potential | High, but with high risk; profit shares after funding | Moderate; steady returns aligned with market performance |

| Regulation | Varies by firm; less regulated environment | Highly regulated financial services |

| Suitability | Experienced traders seeking funded capital | Long-term investors wanting automated portfolio management |

Which is better?

Prop firm challenges offer traders the opportunity to access significant capital by proving their skills under predefined risk parameters, making them ideal for experienced traders seeking leverage and profit sharing. Robo-advisors provide automated portfolio management based on algorithms and risk tolerance, suitable for passive investors prioritizing low fees and diversified investments. Choosing between the two depends on trading expertise, risk appetite, and the desire for active involvement versus automated investing.

Connection

Prop firm challenges evaluate traders' skills by requiring them to meet profit targets under strict risk parameters, which aligns with robo-advisor technology that uses algorithms to optimize investment strategies and manage risk automatically. Both systems emphasize disciplined risk management and data-driven decision making to achieve consistent trading performance. Integration of robo-advisors in prop firms enhances real-time analytics and automated position adjustments, supporting traders in meeting challenge requirements efficiently.

Key Terms

**Robo-advisor:**

Robo-advisors utilize advanced algorithms and artificial intelligence to manage investment portfolios with minimal human intervention, offering cost-effective, personalized financial advice based on user risk tolerance and goals. They provide automated asset allocation, rebalancing, and tax optimization, making them a preferred choice for passive investors seeking convenience and lower fees compared to traditional portfolio managers. Discover how robo-advisors can effectively streamline your investment strategy and boost portfolio performance.

Algorithmic Portfolio Management

Algorithmic portfolio management in robo-advisors employs data-driven models to optimize asset allocation and rebalance portfolios automatically, enhancing efficiency and minimizing human bias. Prop firm challenges, by contrast, test traders' skills in live markets, often lacking the systematic approach inherent in robo-advisory algorithms. Explore the distinct advantages of algorithmic strategies in portfolio management to make informed investment decisions.

Automated Rebalancing

Automated rebalancing in robo-advisors uses algorithms to adjust portfolios systematically, ensuring optimal asset allocation with minimal manual intervention. Prop firm challenges typically emphasize trader skill over automation, offering limited or no automated rebalancing, which can impact risk management and consistency. Explore how automated rebalancing enhances investment strategies and compare its advantages in different trading environments.

Source and External Links

Robo-advisor - Wikipedia - Robo-advisors are digital financial advisers that use algorithms to provide personalized investment management and financial advice online, minimizing human intervention and making wealth management accessible and affordable for a broader audience.

What is a robo advisor? | Robo advisory services - Fidelity Investments - A robo advisor automates investing by using technology and investor-provided info like risk tolerance to build and manage a portfolio affordably with minimal human involvement but some human support behind the scenes.

The Best Robo-Advisors of 2025 - Morningstar - Robo-advisors provide automated, semitailored asset-allocation portfolios to retail investors using algorithms, bridging the gap between traditional wealth managers and DIY platforms, often coupled with financial planning tools and optional human advisors.

dowidth.com

dowidth.com