Microstructure trading focuses on the analysis of order types, bid-ask spreads, and the impact of market participants on price formation within financial markets. High-Frequency Trading (HFT) employs sophisticated algorithms and ultra-low latency technology to execute large volumes of trades at speeds measured in microseconds, capitalizing on minute price discrepancies. Explore the distinctions and strategic advantages between microstructure trading and high-frequency trading to optimize your trading approach.

Why it is important

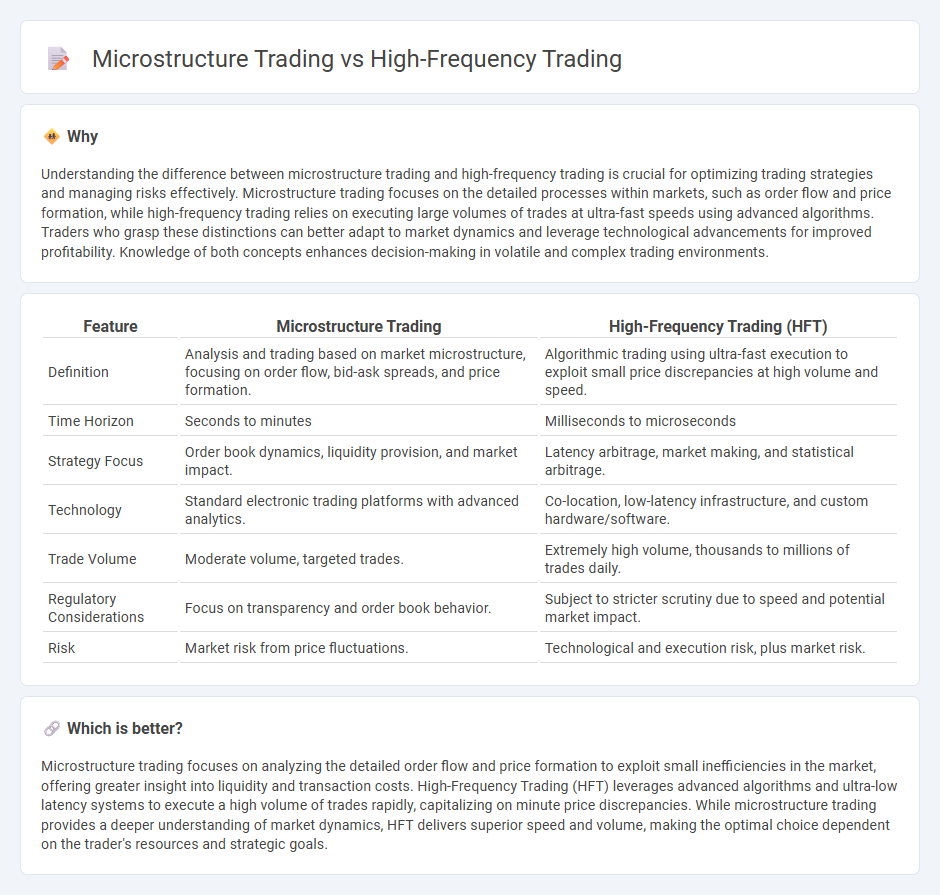

Understanding the difference between microstructure trading and high-frequency trading is crucial for optimizing trading strategies and managing risks effectively. Microstructure trading focuses on the detailed processes within markets, such as order flow and price formation, while high-frequency trading relies on executing large volumes of trades at ultra-fast speeds using advanced algorithms. Traders who grasp these distinctions can better adapt to market dynamics and leverage technological advancements for improved profitability. Knowledge of both concepts enhances decision-making in volatile and complex trading environments.

Comparison Table

| Feature | Microstructure Trading | High-Frequency Trading (HFT) |

|---|---|---|

| Definition | Analysis and trading based on market microstructure, focusing on order flow, bid-ask spreads, and price formation. | Algorithmic trading using ultra-fast execution to exploit small price discrepancies at high volume and speed. |

| Time Horizon | Seconds to minutes | Milliseconds to microseconds |

| Strategy Focus | Order book dynamics, liquidity provision, and market impact. | Latency arbitrage, market making, and statistical arbitrage. |

| Technology | Standard electronic trading platforms with advanced analytics. | Co-location, low-latency infrastructure, and custom hardware/software. |

| Trade Volume | Moderate volume, targeted trades. | Extremely high volume, thousands to millions of trades daily. |

| Regulatory Considerations | Focus on transparency and order book behavior. | Subject to stricter scrutiny due to speed and potential market impact. |

| Risk | Market risk from price fluctuations. | Technological and execution risk, plus market risk. |

Which is better?

Microstructure trading focuses on analyzing the detailed order flow and price formation to exploit small inefficiencies in the market, offering greater insight into liquidity and transaction costs. High-Frequency Trading (HFT) leverages advanced algorithms and ultra-low latency systems to execute a high volume of trades rapidly, capitalizing on minute price discrepancies. While microstructure trading provides a deeper understanding of market dynamics, HFT delivers superior speed and volume, making the optimal choice dependent on the trader's resources and strategic goals.

Connection

Microstructure trading analyzes the detailed processes and order flows within financial markets, providing insights into liquidity, bid-ask spreads, and price formation that are crucial for High-Frequency Trading (HFT) strategies. HFT relies on advanced algorithms and ultra-low latency execution to capitalize on microstructural patterns and market inefficiencies identified through microstructure analysis. This close connection enables HFT firms to optimize trade timing and order placement, enhancing profit potential while minimizing market impact.

Key Terms

Latency

High-frequency trading (HFT) exploits ultra-low latency to execute large volumes of trades within microseconds, leveraging rapid data processing and co-location with exchanges to gain competitive advantages. Microstructure trading analyzes the detailed mechanisms of order execution, price formation, and latency impacts on market efficiency, focusing on the interplay between trader behavior and technological speed. Discover more insights on how latency shapes both strategies and revolutionizes market dynamics.

Order Book

High-frequency trading (HFT) leverages speed and advanced algorithms to execute large volumes of orders rapidly, capitalizing on minute price discrepancies in the order book. Microstructure trading emphasizes understanding the dynamics within the order book, such as bid-ask spreads and order flow, to predict short-term price movements and optimize trade executions. Explore our comprehensive analysis to deepen your insight into order book strategies in both high-frequency and microstructure trading.

Market Maker

High-frequency trading (HFT) leverages advanced algorithms and ultra-low latency data to execute a large volume of trades within milliseconds, aiming for small profits on each transaction. Microstructure trading centers on understanding and exploiting the intricacies of market microstructure, such as bid-ask spreads and order book dynamics, with market makers playing a crucial role by providing liquidity and narrowing spreads. Explore how HFT and microstructure techniques shape market maker strategies and impact trading efficiency.

Source and External Links

High-Frequency Trading Explained: What Is It and How Do You Get ... - High-frequency trading (HFT) uses powerful computers and advanced software to execute vast numbers of trades in microseconds or milliseconds, capitalizing on tiny price differences across exchanges for profit through rapid, automated transactions.

High Frequency Trading (HFT) - Definition, Pros and Cons - HFT is algorithmic trading involving very high-speed execution, large transaction volumes, and short-term holding, allowing institutions to profit from small price fluctuations and improve market liquidity by narrowing bid-ask spreads.

High-frequency trading - Wikipedia - High-frequency trading is a quantitative automated trading method using complex algorithms to process large volumes of data instantaneously, focusing on strategies like market-making and arbitrage executed at extremely fast speeds to exploit small market inefficiencies.

dowidth.com

dowidth.com