On-chain analytics provide real-time insights by tracking blockchain transactions and wallet activities, enabling traders to assess market sentiment and identify whale movements. Options flow analysis focuses on monitoring large options trades and open interest changes to predict potential price movements and volatility spikes. Explore more to understand how combining these tools can enhance your trading strategy.

Why it is important

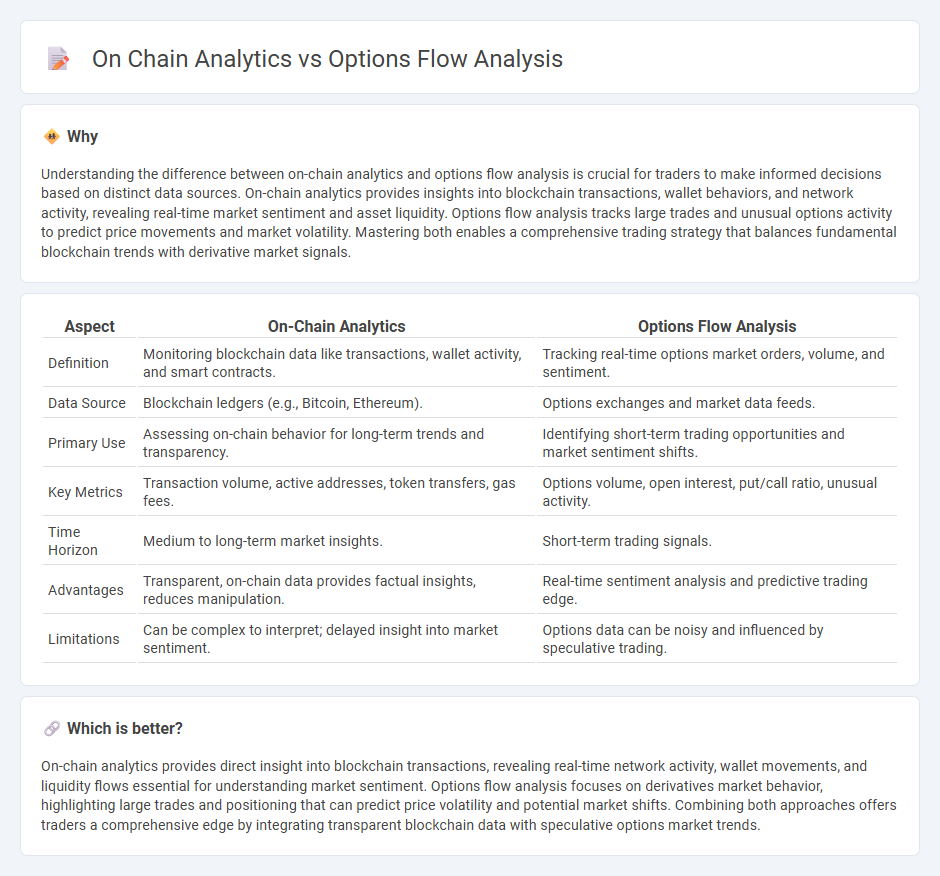

Understanding the difference between on-chain analytics and options flow analysis is crucial for traders to make informed decisions based on distinct data sources. On-chain analytics provides insights into blockchain transactions, wallet behaviors, and network activity, revealing real-time market sentiment and asset liquidity. Options flow analysis tracks large trades and unusual options activity to predict price movements and market volatility. Mastering both enables a comprehensive trading strategy that balances fundamental blockchain trends with derivative market signals.

Comparison Table

| Aspect | On-Chain Analytics | Options Flow Analysis |

|---|---|---|

| Definition | Monitoring blockchain data like transactions, wallet activity, and smart contracts. | Tracking real-time options market orders, volume, and sentiment. |

| Data Source | Blockchain ledgers (e.g., Bitcoin, Ethereum). | Options exchanges and market data feeds. |

| Primary Use | Assessing on-chain behavior for long-term trends and transparency. | Identifying short-term trading opportunities and market sentiment shifts. |

| Key Metrics | Transaction volume, active addresses, token transfers, gas fees. | Options volume, open interest, put/call ratio, unusual activity. |

| Time Horizon | Medium to long-term market insights. | Short-term trading signals. |

| Advantages | Transparent, on-chain data provides factual insights, reduces manipulation. | Real-time sentiment analysis and predictive trading edge. |

| Limitations | Can be complex to interpret; delayed insight into market sentiment. | Options data can be noisy and influenced by speculative trading. |

Which is better?

On-chain analytics provides direct insight into blockchain transactions, revealing real-time network activity, wallet movements, and liquidity flows essential for understanding market sentiment. Options flow analysis focuses on derivatives market behavior, highlighting large trades and positioning that can predict price volatility and potential market shifts. Combining both approaches offers traders a comprehensive edge by integrating transparent blockchain data with speculative options market trends.

Connection

On-chain analytics provide real-time blockchain data revealing transaction patterns and wallet behaviors, which enhances options flow analysis by identifying underlying asset movements that influence option pricing and market sentiment. Options flow analysis interprets large option trades and unusual activity, enabling traders to anticipate potential price shifts linked to on-chain events such as token transfers or smart contract interactions. The integration of these tools offers a comprehensive view of market dynamics, increasing trading accuracy and strategic decision-making efficiency.

Key Terms

Options flow analysis:

Options flow analysis examines real-time market sentiment by tracking large trades, unusual volume, and order types to predict price movements and volatility. This technique provides insights into trader behavior and potential market direction by analyzing options market activity rather than historical on-chain transaction data. Explore options flow analysis further to enhance strategic trading decisions and market timing.

Unusual Options Activity

Unusual options activity reveals significant market sentiment shifts by tracking large or atypical trades, providing traders with actionable signals on potential price movements. On-chain analytics offers insights into blockchain transactions, wallet behaviors, and network patterns, but lacks the direct market sentiment data that options flow analysis captures. Explore how combining unusual options activity with on-chain data can enhance your trading strategy.

Open Interest

Options flow analysis provides real-time insight into market sentiment by tracking large trades and unusual activity in options contracts, highlighting potential price movements. On chain analytics examines blockchain data such as open interest, reflecting the total number of outstanding derivative contracts without liquidation, offering a deep view of market positioning and trader behavior. Explore the detailed methodologies and tools behind options flow and on chain open interest analytics for enhanced trading strategies.

Source and External Links

Options Flow the Basics - BlackBoxStocks - Options flow analysis monitors institutional money moving into options trades, providing real-time data on option purchases to help traders understand market sentiment and make informed decisions.

Options Order Flow: Everything You Need To Know - Options order flow reveals details of institutional transactions, including volume and trade types, enabling traders to identify market trends and potential price movements through volume and liquidity analysis.

OptionStrat Flow | Real-time Unusual Options Activity - Options flow can be used to find new trading ideas and confirm existing strategies by analyzing directional flow and repeated trades, often linked to upcoming events or news impacting price movements.

dowidth.com

dowidth.com