Tokenized assets represent fractional ownership of real estate through blockchain technology, enabling increased liquidity and accessibility compared to traditional real estate investments. This innovative approach allows investors to buy, sell, and trade property shares seamlessly without the complexities of physical asset management. Discover how tokenized assets are transforming real estate investment strategies and market participation.

Why it is important

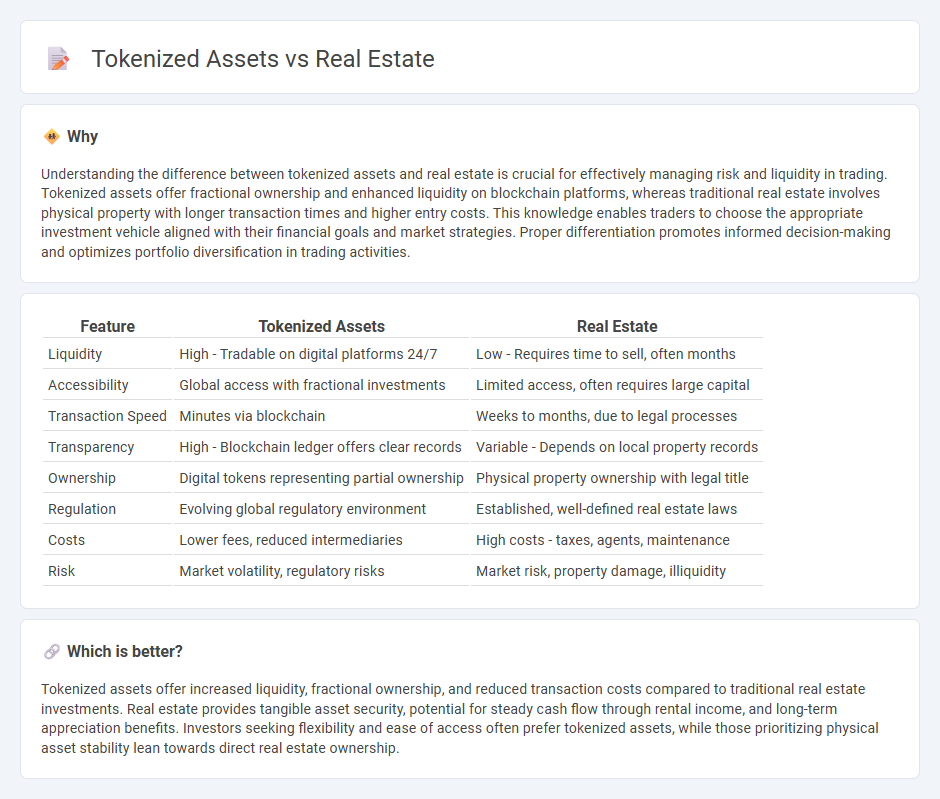

Understanding the difference between tokenized assets and real estate is crucial for effectively managing risk and liquidity in trading. Tokenized assets offer fractional ownership and enhanced liquidity on blockchain platforms, whereas traditional real estate involves physical property with longer transaction times and higher entry costs. This knowledge enables traders to choose the appropriate investment vehicle aligned with their financial goals and market strategies. Proper differentiation promotes informed decision-making and optimizes portfolio diversification in trading activities.

Comparison Table

| Feature | Tokenized Assets | Real Estate |

|---|---|---|

| Liquidity | High - Tradable on digital platforms 24/7 | Low - Requires time to sell, often months |

| Accessibility | Global access with fractional investments | Limited access, often requires large capital |

| Transaction Speed | Minutes via blockchain | Weeks to months, due to legal processes |

| Transparency | High - Blockchain ledger offers clear records | Variable - Depends on local property records |

| Ownership | Digital tokens representing partial ownership | Physical property ownership with legal title |

| Regulation | Evolving global regulatory environment | Established, well-defined real estate laws |

| Costs | Lower fees, reduced intermediaries | High costs - taxes, agents, maintenance |

| Risk | Market volatility, regulatory risks | Market risk, property damage, illiquidity |

Which is better?

Tokenized assets offer increased liquidity, fractional ownership, and reduced transaction costs compared to traditional real estate investments. Real estate provides tangible asset security, potential for steady cash flow through rental income, and long-term appreciation benefits. Investors seeking flexibility and ease of access often prefer tokenized assets, while those prioritizing physical asset stability lean towards direct real estate ownership.

Connection

Tokenized assets revolutionize real estate by converting property ownership into tradable digital tokens on blockchain platforms, enabling fractional ownership and increased liquidity. This connection facilitates seamless transactions, reduces barriers to entry for investors, and enhances transparency through immutable ledger records. By integrating smart contracts, tokenized real estate assets automate compliance and streamline property management, transforming traditional trading practices.

Key Terms

Liquidity

Traditional real estate investments often face limited liquidity due to lengthy transaction processes and market constraints, making it difficult to quickly buy or sell properties. Tokenized assets leverage blockchain technology to enable fractional ownership and faster, more flexible trading, significantly enhancing liquidity in real estate markets. Explore how tokenization is transforming asset liquidity and investment accessibility in real estate.

Fractional Ownership

Fractional ownership in real estate traditionally involves multiple investors sharing equity in a property, offering diversified risk and shared financial responsibility. Tokenized assets utilize blockchain technology to digitize property shares, providing enhanced liquidity, transparency, and lower entry barriers compared to conventional real estate investments. Explore how tokenized real estate could revolutionize your investment portfolio with greater accessibility and efficiency.

Regulatory Compliance

Real estate investments are subject to well-established regulatory frameworks including SEC regulations, zoning laws, and property rights enforcement to ensure investor protection and market stability. Tokenized assets operate under emerging regulatory environments, often navigating complex compliance issues such as securities laws, AML/KYC requirements, and cross-jurisdictional oversight due to their blockchain-based nature. Discover the evolving landscape of regulatory compliance for both traditional real estate and tokenized assets to make informed investment decisions.

Source and External Links

Real estate - Wikipedia - Real estate refers to land and the buildings on it, including natural resources, housing types, environmental impacts, and sustainability considerations.

Search for Real Estate, Property & Homes - realestate.com.au - Australia's top property website provides home listings, price estimates, market news, finance options, suburb research, and tools for buyers and renters.

California Department of Real Estate - The official regulatory agency for real estate licenses, laws, education, and consumer protection in California.

dowidth.com

dowidth.com