Algorithmic arbitrage exploits price discrepancies across different markets using predefined rules, while high-frequency trading (HFT) focuses on executing large volumes of trades at extremely fast speeds to capitalize on minimal price movements. Both strategies rely heavily on advanced algorithms and low-latency systems to maximize profitability. Discover more about the distinctions and applications of algorithmic arbitrage and high-frequency trading in modern financial markets.

Why it is important

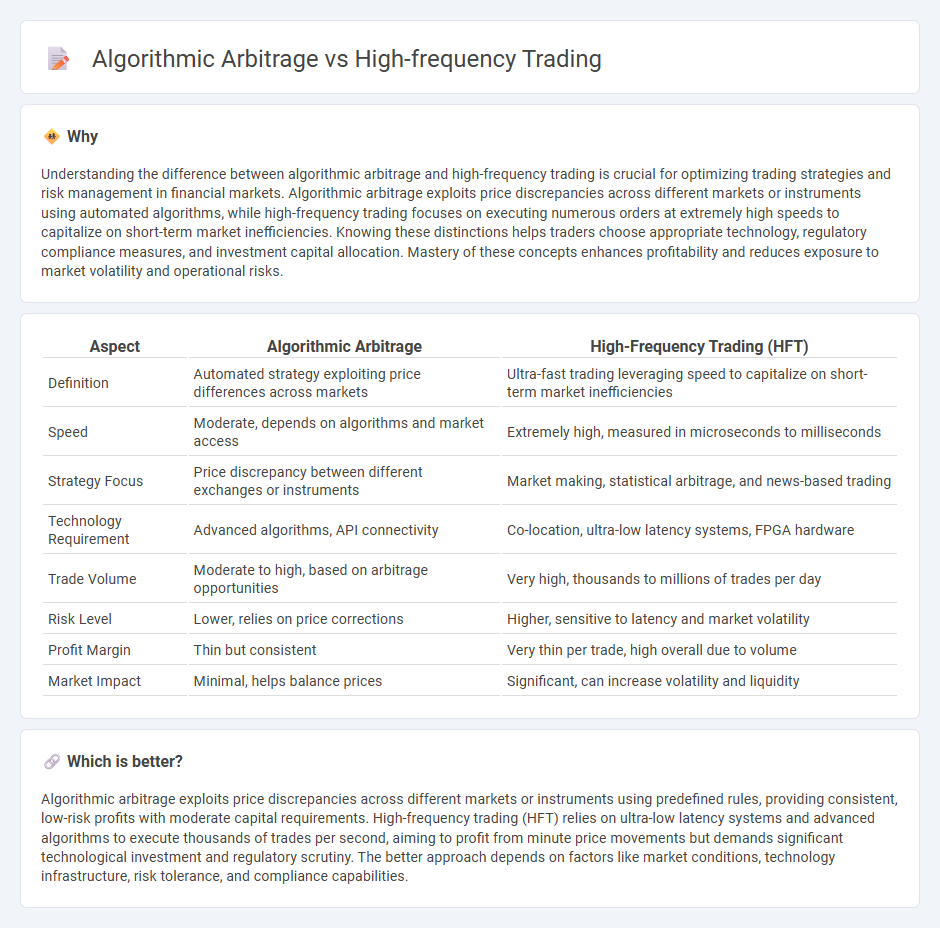

Understanding the difference between algorithmic arbitrage and high-frequency trading is crucial for optimizing trading strategies and risk management in financial markets. Algorithmic arbitrage exploits price discrepancies across different markets or instruments using automated algorithms, while high-frequency trading focuses on executing numerous orders at extremely high speeds to capitalize on short-term market inefficiencies. Knowing these distinctions helps traders choose appropriate technology, regulatory compliance measures, and investment capital allocation. Mastery of these concepts enhances profitability and reduces exposure to market volatility and operational risks.

Comparison Table

| Aspect | Algorithmic Arbitrage | High-Frequency Trading (HFT) |

|---|---|---|

| Definition | Automated strategy exploiting price differences across markets | Ultra-fast trading leveraging speed to capitalize on short-term market inefficiencies |

| Speed | Moderate, depends on algorithms and market access | Extremely high, measured in microseconds to milliseconds |

| Strategy Focus | Price discrepancy between different exchanges or instruments | Market making, statistical arbitrage, and news-based trading |

| Technology Requirement | Advanced algorithms, API connectivity | Co-location, ultra-low latency systems, FPGA hardware |

| Trade Volume | Moderate to high, based on arbitrage opportunities | Very high, thousands to millions of trades per day |

| Risk Level | Lower, relies on price corrections | Higher, sensitive to latency and market volatility |

| Profit Margin | Thin but consistent | Very thin per trade, high overall due to volume |

| Market Impact | Minimal, helps balance prices | Significant, can increase volatility and liquidity |

Which is better?

Algorithmic arbitrage exploits price discrepancies across different markets or instruments using predefined rules, providing consistent, low-risk profits with moderate capital requirements. High-frequency trading (HFT) relies on ultra-low latency systems and advanced algorithms to execute thousands of trades per second, aiming to profit from minute price movements but demands significant technological investment and regulatory scrutiny. The better approach depends on factors like market conditions, technology infrastructure, risk tolerance, and compliance capabilities.

Connection

Algorithmic arbitrage leverages automated algorithms to identify and exploit price discrepancies across different markets or assets, while high-frequency trading (HFT) executes these strategies at extremely rapid speeds to maximize profit margins. The connection lies in HFT's ability to perform algorithmic arbitrage efficiently by processing vast amounts of market data in milliseconds and executing large volumes of trades instantly. This synergy enhances liquidity, reduces spreads, and allows traders to capitalize on fleeting market inefficiencies.

Key Terms

**High-Frequency Trading:**

High-frequency trading (HFT) leverages ultra-low latency systems and advanced algorithms to execute a massive number of orders within microseconds, capitalizing on minute price discrepancies. This strategy relies heavily on co-location services and direct market access to minimize execution delays and maximize profit margins. Explore how HFT transforms modern financial markets and its impact on liquidity and price discovery.

Latency

High-frequency trading (HFT) leverages ultra-low latency to execute a vast number of trades within microseconds, capitalizing on minimal price differentials across markets. Algorithmic arbitrage employs sophisticated algorithms to identify and exploit price inefficiencies, with latency playing a critical role in maintaining the profitability of these strategies by ensuring timely execution. Explore further to understand how latency optimization drives competitive advantage in these trading methodologies.

Order Flow

Order flow plays a critical role in high-frequency trading (HFT) by enabling rapid analysis of market microstructures to execute trades within milliseconds, capitalizing on short-term price fluctuations. In contrast, algorithmic arbitrage leverages order flow data to identify and exploit price discrepancies across different markets or assets, focusing on risk-adjusted returns rather than speed alone. Discover how advanced order flow analytics transform trading strategies in both HFT and algorithmic arbitrage.

Source and External Links

High-Frequency Trading Explained: What Is It and How Do You Get ... - High-frequency trading (HFT) uses powerful computers and advanced algorithms to execute a very large number of trades at extremely high speeds, capitalizing on tiny price differences across markets in milliseconds or microseconds.

High Frequency Trading (HFT) - Definition, Pros and Cons - HFT is characterized by high-speed trade execution, massive transaction volume, and very short-term positions, allowing institutional investors like hedge funds to profit from small fluctuations and arbitrage across markets, while also enhancing market liquidity and price efficiency.

High-frequency trading - Wikipedia - HFT employs quantitative, algorithm-driven strategies with extremely short portfolio holdings and high turnover, leveraging speed to exploit minor market inefficiencies; while controversial, investigations found HFT contributed to both volatility and recovery in incidents like the 2010 Flash Crash.

dowidth.com

dowidth.com