Market microstructure examines the mechanisms and processes that facilitate trading, including order types, bid-ask spreads, and price formation dynamics. Auction markets, as a fundamental component, operate through competitive bidding where buyers and sellers submit orders that determine transaction prices and market liquidity. Explore the detailed distinctions and implications of market microstructure versus auction markets for a deeper understanding of trading environments.

Why it is important

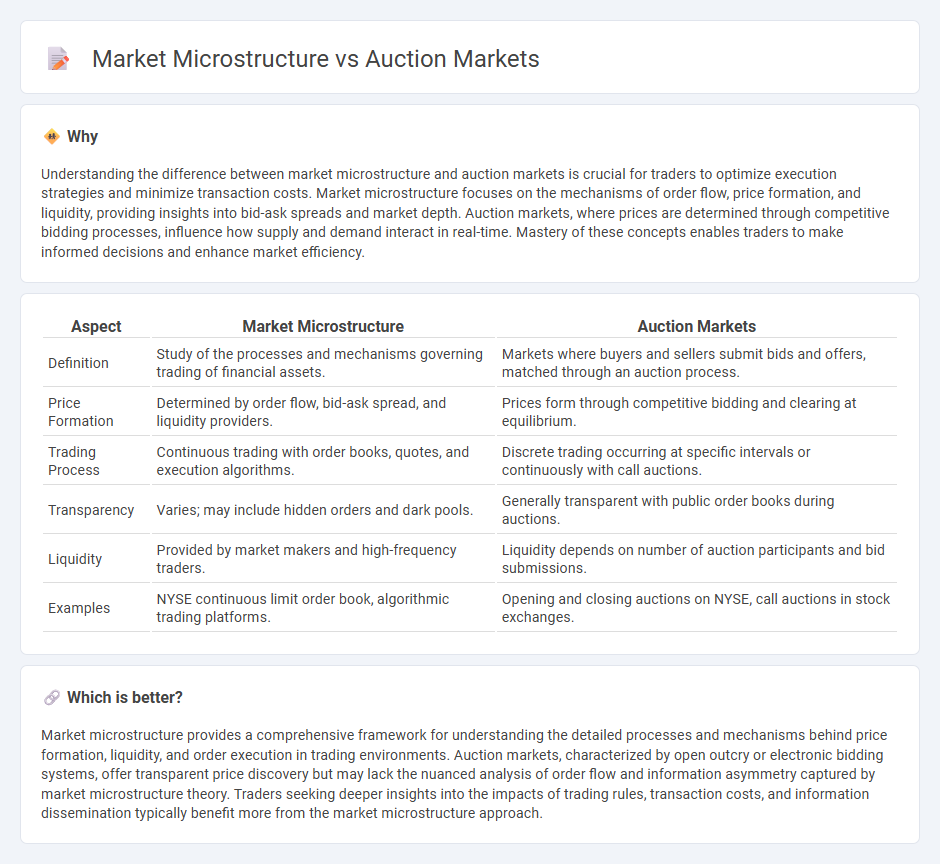

Understanding the difference between market microstructure and auction markets is crucial for traders to optimize execution strategies and minimize transaction costs. Market microstructure focuses on the mechanisms of order flow, price formation, and liquidity, providing insights into bid-ask spreads and market depth. Auction markets, where prices are determined through competitive bidding processes, influence how supply and demand interact in real-time. Mastery of these concepts enables traders to make informed decisions and enhance market efficiency.

Comparison Table

| Aspect | Market Microstructure | Auction Markets |

|---|---|---|

| Definition | Study of the processes and mechanisms governing trading of financial assets. | Markets where buyers and sellers submit bids and offers, matched through an auction process. |

| Price Formation | Determined by order flow, bid-ask spread, and liquidity providers. | Prices form through competitive bidding and clearing at equilibrium. |

| Trading Process | Continuous trading with order books, quotes, and execution algorithms. | Discrete trading occurring at specific intervals or continuously with call auctions. |

| Transparency | Varies; may include hidden orders and dark pools. | Generally transparent with public order books during auctions. |

| Liquidity | Provided by market makers and high-frequency traders. | Liquidity depends on number of auction participants and bid submissions. |

| Examples | NYSE continuous limit order book, algorithmic trading platforms. | Opening and closing auctions on NYSE, call auctions in stock exchanges. |

Which is better?

Market microstructure provides a comprehensive framework for understanding the detailed processes and mechanisms behind price formation, liquidity, and order execution in trading environments. Auction markets, characterized by open outcry or electronic bidding systems, offer transparent price discovery but may lack the nuanced analysis of order flow and information asymmetry captured by market microstructure theory. Traders seeking deeper insights into the impacts of trading rules, transaction costs, and information dissemination typically benefit more from the market microstructure approach.

Connection

Market microstructure analyzes the processes and mechanisms through which securities are traded, focusing on price formation, order execution, and information flow within auction markets. Auction markets rely on structured bidding systems where market participants submit buy and sell orders, allowing microstructure theory to explain how these interactions determine asset prices and liquidity. Understanding this connection enhances trading strategies by revealing how order types, bid-ask spreads, and market depth influence efficiency and volatility in financial markets.

Key Terms

Price Discovery

Auction markets facilitate price discovery through competitive bidding and transparent transactions, allowing buyers and sellers to reveal true asset values efficiently. Market microstructure examines the detailed mechanisms, including order types and trading protocols, that influence price formation, liquidity, and transaction costs within these markets. Explore our deep dive to understand how auction designs and microstructural elements impact accurate price discovery.

Order Flow

Auction markets operate by matching buy and sell orders at specific intervals, creating price discovery through order books that aggregate supply and demand. Market microstructure examines the intricate processes governing the execution, timing, and pricing of these orders, analyzing factors like order flow, bid-ask spread, and information asymmetry. Explore deeper insights into how order flow shapes liquidity and price formation in various trading environments.

Liquidity

Auction markets facilitate liquidity by matching buyers and sellers through transparent bidding processes, enabling price discovery and efficient trade execution. Market microstructure examines the mechanisms and protocols governing trade execution, order flow, and information asymmetry that directly impact liquidity levels. Explore how different auction designs and microstructural elements influence liquidity in diverse trading environments.

Source and External Links

Auction markets: What is it, types, Importance, Example, FAQ | POEMS - An auction market is a market where buyers and sellers compete to trade assets like stocks, bonds, and commodities, utilizing matching algorithms to create efficient trades, occurring either in physical or electronic venues such as the New York Stock Exchange or Nasdaq.

Auction markets - Ch2sec5 - Auction markets typically have physical locations like Wall Street and include large organized exchanges such as the New York Stock Exchange, where most equity shares of large firms are traded in a competitive bidding environment.

Behind the Scenes | An Insider's Guide to the NYSE Closing Auction - The NYSE closing auction is a critical daily event during which the final price of over 200 million shares is set through a sophisticated blend of technology and human judgment, reflecting the market's last price point of the trading day.

dowidth.com

dowidth.com