Bid-ask spread capture involves profiting from the difference between a security's buying and selling prices, providing immediate but often smaller gains. Price improvement focuses on executing trades at better prices than the current bid or ask, potentially increasing overall profitability with better trade execution. Explore strategies to balance these approaches and maximize trading performance.

Why it is important

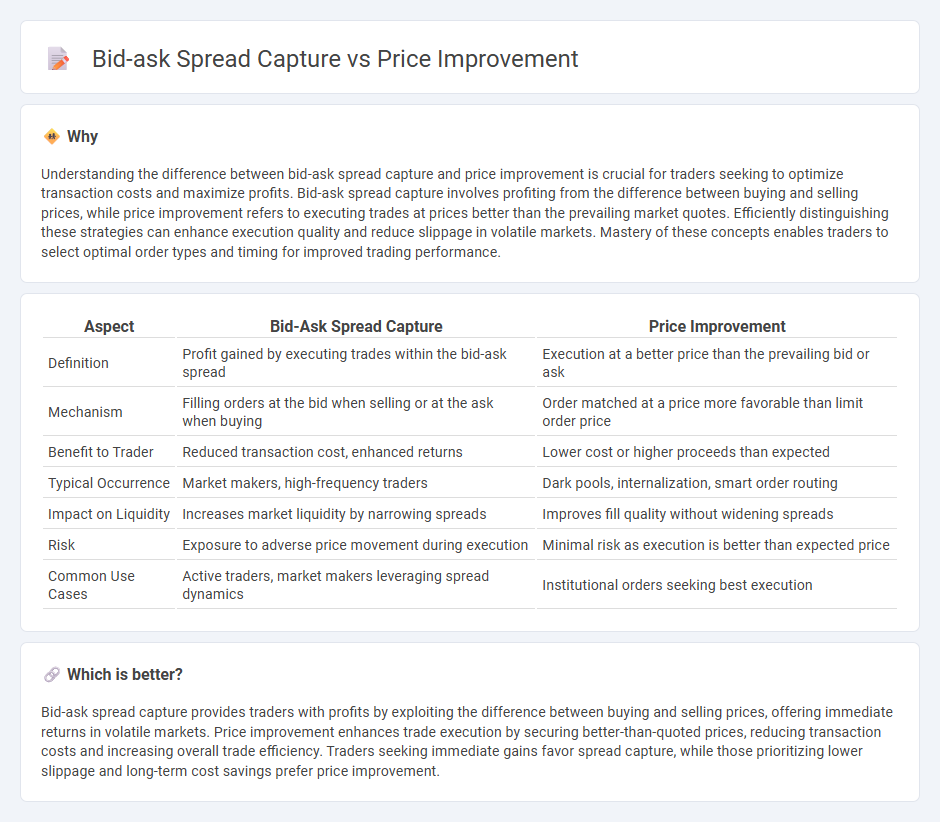

Understanding the difference between bid-ask spread capture and price improvement is crucial for traders seeking to optimize transaction costs and maximize profits. Bid-ask spread capture involves profiting from the difference between buying and selling prices, while price improvement refers to executing trades at prices better than the prevailing market quotes. Efficiently distinguishing these strategies can enhance execution quality and reduce slippage in volatile markets. Mastery of these concepts enables traders to select optimal order types and timing for improved trading performance.

Comparison Table

| Aspect | Bid-Ask Spread Capture | Price Improvement |

|---|---|---|

| Definition | Profit gained by executing trades within the bid-ask spread | Execution at a better price than the prevailing bid or ask |

| Mechanism | Filling orders at the bid when selling or at the ask when buying | Order matched at a price more favorable than limit order price |

| Benefit to Trader | Reduced transaction cost, enhanced returns | Lower cost or higher proceeds than expected |

| Typical Occurrence | Market makers, high-frequency traders | Dark pools, internalization, smart order routing |

| Impact on Liquidity | Increases market liquidity by narrowing spreads | Improves fill quality without widening spreads |

| Risk | Exposure to adverse price movement during execution | Minimal risk as execution is better than expected price |

| Common Use Cases | Active traders, market makers leveraging spread dynamics | Institutional orders seeking best execution |

Which is better?

Bid-ask spread capture provides traders with profits by exploiting the difference between buying and selling prices, offering immediate returns in volatile markets. Price improvement enhances trade execution by securing better-than-quoted prices, reducing transaction costs and increasing overall trade efficiency. Traders seeking immediate gains favor spread capture, while those prioritizing lower slippage and long-term cost savings prefer price improvement.

Connection

The bid-ask spread capture occurs when traders execute orders within the spread, allowing them to buy below the ask price or sell above the bid price, effectively securing a better price than the prevailing market quotes. Price improvement happens when the execution price is more favorable than the best current bid or ask, often facilitated by market makers or smart order routing algorithms that capitalize on liquidity and spread variations. This connection benefits traders by reducing transaction costs and enhancing trade profitability through optimized execution strategies within the bid-ask spread framework.

Key Terms

Execution Quality

Price improvement occurs when a trade executes at a better price than the current best bid or offer, enhancing execution quality by reducing transaction costs and increasing investor returns. Bid-ask spread capture involves profiting from the difference between the buying price and selling price, often benefiting market makers but potentially increasing costs for retail investors. Explore how these execution strategies affect trading efficiency and cost savings in various market conditions.

Market Maker

Market makers achieve price improvement by executing orders at better prices than the current bid-ask spread, enhancing trader value and liquidity provision. Price improvement often surpasses the passive profit earned from capturing the bid-ask spread, reflecting efficient market-making strategies. Discover how market makers optimize these mechanisms to maximize trading advantages.

Order Routing

Price improvement occurs when an order is executed at a better price than the current national best bid or offer (NBBO), enhancing trader value by reducing execution costs. Bid-ask spread capture involves profiting from the difference between buyers' and sellers' prices by actively routing orders to venues with favorable spreads, optimizing trade execution. Explore the intricacies of order routing strategies to maximize trade efficiency and profitability.

Source and External Links

Understanding Price Improvement | Charles Schwab - Price improvement happens when your trade executes at a better price than the National Best Bid and Offer (NBBO), saving you money, for example buying shares slightly below the current quoted price.

Price improvement, tick harmonization & investor benefit - NYSE - Price improvement refers to getting a better-than-expected price on trades, and harmonizing price increments across markets could yield billions annually in investor savings by enabling more precise price improvements.

Cboe U.S. Equities Exchanges Retail Price Improvement - Cboe offers a Retail Price Improvement program allowing orders to price improve in increments as small as $0.001, with retail orders receiving an average price improvement of about $0.86 per 100 shares during 2023.

dowidth.com

dowidth.com