Smart Money Concepts leverage sophisticated analysis of institutional trading activities, focusing on market manipulation, liquidity zones, and order flow to predict price movements. Retail Trading Strategies often rely on technical indicators and patterns with less emphasis on understanding market structure or institutional influence. Explore the differences in depth to enhance your trading approach and improve profitability.

Why it is important

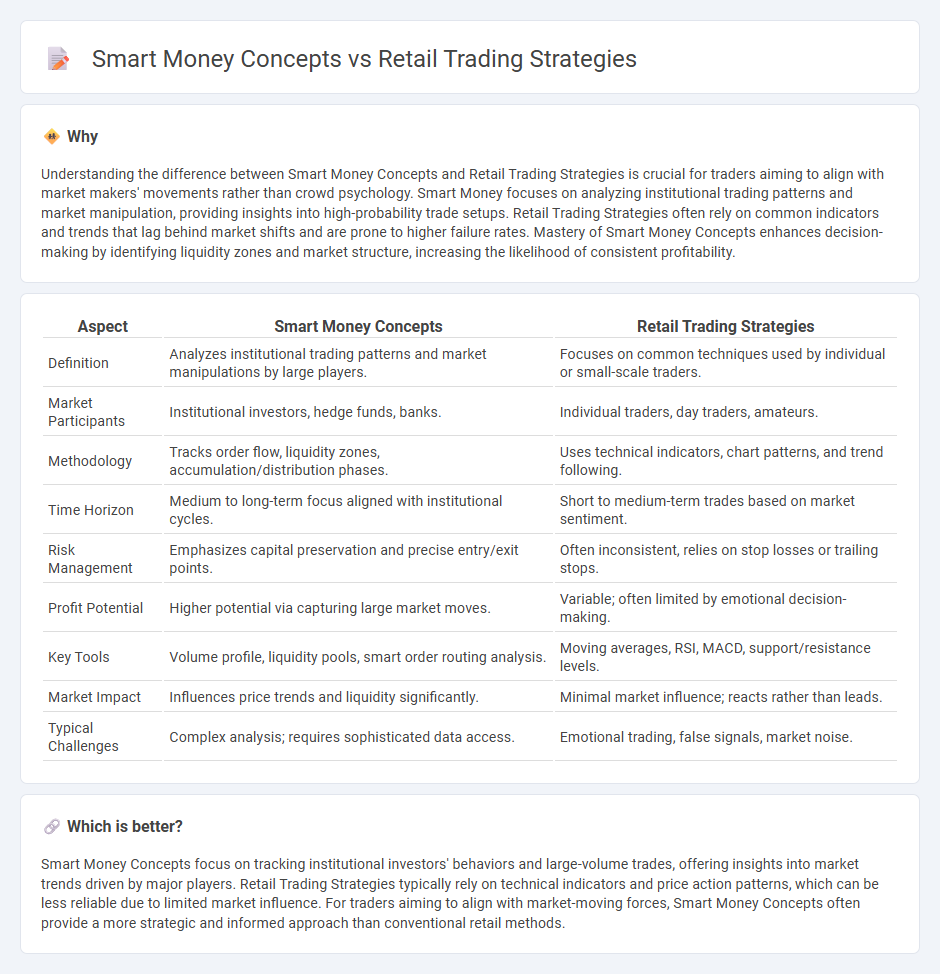

Understanding the difference between Smart Money Concepts and Retail Trading Strategies is crucial for traders aiming to align with market makers' movements rather than crowd psychology. Smart Money focuses on analyzing institutional trading patterns and market manipulation, providing insights into high-probability trade setups. Retail Trading Strategies often rely on common indicators and trends that lag behind market shifts and are prone to higher failure rates. Mastery of Smart Money Concepts enhances decision-making by identifying liquidity zones and market structure, increasing the likelihood of consistent profitability.

Comparison Table

| Aspect | Smart Money Concepts | Retail Trading Strategies |

|---|---|---|

| Definition | Analyzes institutional trading patterns and market manipulations by large players. | Focuses on common techniques used by individual or small-scale traders. |

| Market Participants | Institutional investors, hedge funds, banks. | Individual traders, day traders, amateurs. |

| Methodology | Tracks order flow, liquidity zones, accumulation/distribution phases. | Uses technical indicators, chart patterns, and trend following. |

| Time Horizon | Medium to long-term focus aligned with institutional cycles. | Short to medium-term trades based on market sentiment. |

| Risk Management | Emphasizes capital preservation and precise entry/exit points. | Often inconsistent, relies on stop losses or trailing stops. |

| Profit Potential | Higher potential via capturing large market moves. | Variable; often limited by emotional decision-making. |

| Key Tools | Volume profile, liquidity pools, smart order routing analysis. | Moving averages, RSI, MACD, support/resistance levels. |

| Market Impact | Influences price trends and liquidity significantly. | Minimal market influence; reacts rather than leads. |

| Typical Challenges | Complex analysis; requires sophisticated data access. | Emotional trading, false signals, market noise. |

Which is better?

Smart Money Concepts focus on tracking institutional investors' behaviors and large-volume trades, offering insights into market trends driven by major players. Retail Trading Strategies typically rely on technical indicators and price action patterns, which can be less reliable due to limited market influence. For traders aiming to align with market-moving forces, Smart Money Concepts often provide a more strategic and informed approach than conventional retail methods.

Connection

Smart money concepts focus on tracking institutional investors' movements, which often influence market trends and liquidity. Retail trading strategies can be enhanced by analyzing smart money indicators such as volume spikes, order flow, and market sentiment to align trades with larger market forces. Understanding this connection helps retail traders make informed decisions, reducing risks and improving potential returns.

Key Terms

Order Flow

Retail trading strategies often rely on technical indicators and chart patterns, while smart money concepts prioritize understanding institutional order flow to anticipate market moves. Order flow analysis reveals the real-time buying and selling activity of large market participants, providing insights into price direction and liquidity. Explore deeper into order flow methods to enhance trading precision and align with smart money behavior.

Liquidity

Retail trading strategies often rely on technical indicators and predictable price patterns, targeting easily accessible liquidity pools created by novice traders. Smart money concepts prioritize understanding liquidity hotspots where institutional players accumulate or distribute positions, exploiting market inefficiencies. Explore how mastering liquidity dynamics can enhance your trading performance.

Market Structure

Retail trading strategies often rely on technical indicators and short-term price patterns, whereas smart money concepts emphasize the understanding of market structure through supply and demand zones, order flow, and institutional activity. Market structure analysis identifies key support and resistance levels created by large market participants, allowing traders to anticipate potential reversals or continuations with higher accuracy. Discover how mastering market structure can enhance your trading edge by exploring in-depth smart money concepts and retail strategy comparisons.

Source and External Links

Top Trading Strategies for Retail Traders: Tips and Tricks for Success - Discusses popular retail trading strategies including technical analysis, fundamental analysis, and trend following, providing insights into using charts and market data to predict price movements and succeed in trading.

Retail Algorithmic Trading: A Complete Guide - QuantInsti Blog - Explains how retail traders can start algorithmic trading, covering strategy types like trend following, mean reversion, and statistical arbitrage, emphasizing automation benefits such as speed, accuracy, and emotionless execution.

The Top 8 Trading Strategies for 2025 | Hantec Markets - Reviews eight key trading strategies for retail traders including position, swing, day, price action, algorithmic, news, scalping, and trend following, summarizing their pros, cons, and suitability based on trader personality and market conditions.

dowidth.com

dowidth.com