Quantitative backtesting uses historical market data to test trading strategies by simulating past trades and measuring performance metrics like return, drawdown, and Sharpe ratio. Walk-forward analysis improves robustness by continuously optimizing and validating strategies on rolling windows of data, minimizing overfitting and adapting to market changes. Explore detailed comparisons and methodologies to enhance your trading strategy evaluation.

Why it is important

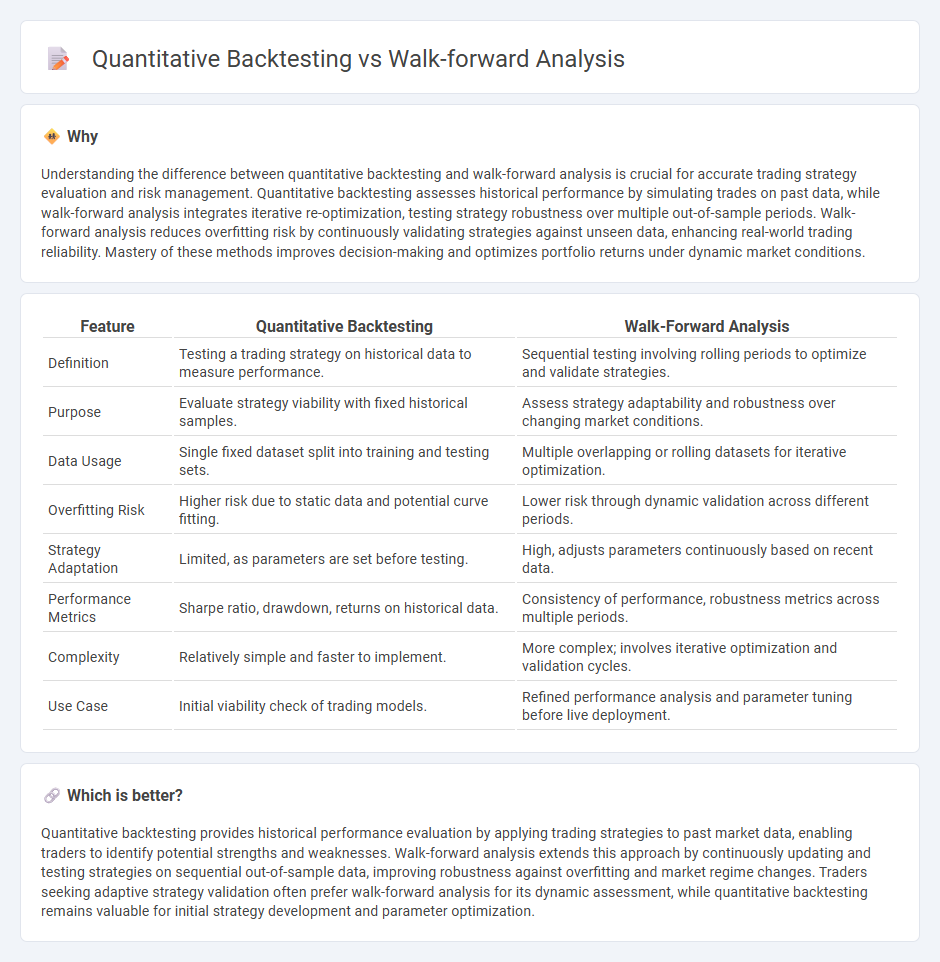

Understanding the difference between quantitative backtesting and walk-forward analysis is crucial for accurate trading strategy evaluation and risk management. Quantitative backtesting assesses historical performance by simulating trades on past data, while walk-forward analysis integrates iterative re-optimization, testing strategy robustness over multiple out-of-sample periods. Walk-forward analysis reduces overfitting risk by continuously validating strategies against unseen data, enhancing real-world trading reliability. Mastery of these methods improves decision-making and optimizes portfolio returns under dynamic market conditions.

Comparison Table

| Feature | Quantitative Backtesting | Walk-Forward Analysis |

|---|---|---|

| Definition | Testing a trading strategy on historical data to measure performance. | Sequential testing involving rolling periods to optimize and validate strategies. |

| Purpose | Evaluate strategy viability with fixed historical samples. | Assess strategy adaptability and robustness over changing market conditions. |

| Data Usage | Single fixed dataset split into training and testing sets. | Multiple overlapping or rolling datasets for iterative optimization. |

| Overfitting Risk | Higher risk due to static data and potential curve fitting. | Lower risk through dynamic validation across different periods. |

| Strategy Adaptation | Limited, as parameters are set before testing. | High, adjusts parameters continuously based on recent data. |

| Performance Metrics | Sharpe ratio, drawdown, returns on historical data. | Consistency of performance, robustness metrics across multiple periods. |

| Complexity | Relatively simple and faster to implement. | More complex; involves iterative optimization and validation cycles. |

| Use Case | Initial viability check of trading models. | Refined performance analysis and parameter tuning before live deployment. |

Which is better?

Quantitative backtesting provides historical performance evaluation by applying trading strategies to past market data, enabling traders to identify potential strengths and weaknesses. Walk-forward analysis extends this approach by continuously updating and testing strategies on sequential out-of-sample data, improving robustness against overfitting and market regime changes. Traders seeking adaptive strategy validation often prefer walk-forward analysis for its dynamic assessment, while quantitative backtesting remains valuable for initial strategy development and parameter optimization.

Connection

Quantitative backtesting evaluates trading strategies by simulating their performance on historical data to gauge effectiveness and identify potential weaknesses. Walk-forward analysis extends this by continuously updating the model with new data, optimizing parameters, and testing on subsequent unseen periods to prevent overfitting. Together, they ensure robust strategy validation, combining rigorous historical testing with adaptive forward-looking assessment for improved trading performance.

Key Terms

Out-of-Sample Testing

Walk-forward analysis provides dynamic out-of-sample testing by iteratively training models on historical data segments and validating on subsequent unseen data, enhancing robustness against overfitting. Quantitative backtesting relies on fixed in-sample and out-of-sample splits, which may not fully capture evolving market conditions or model performance stability. Explore detailed methodologies and benefits of walk-forward analysis for adaptive trading strategies to improve out-of-sample validation accuracy.

Parameter Optimization

Walk-forward analysis evaluates model performance on sequential data segments to prevent overfitting during parameter optimization, ensuring adaptive robustness in dynamic markets. Quantitative backtesting relies on static historical data and fixed parameters, risking overfitting and reduced out-of-sample validity. Explore in-depth methodologies to enhance strategy reliability through optimized parameter tuning.

Historical Data

Walk-forward analysis continuously updates the model using sequential historical data segments, improving robustness and reducing overfitting compared to static quantitative backtesting that evaluates strategies on fixed historical datasets. Quantitative backtesting relies heavily on historical price and volume data to simulate trades, but may be prone to curve-fitting without dynamic recalibration. Explore detailed methodologies and comparative performance metrics to understand their impact on trading strategy validation.

Source and External Links

How to Use Walk Forward Analysis: You May Be Doing It Wrong - Walk Forward Analysis evaluates trading system robustness by optimizing parameters on an in-sample period and then testing them out of sample, repeating this process across multiple time windows to ensure consistent performance.

Walk forward optimization - Walk Forward Optimization is a finance method for optimizing trading strategy parameters and testing them consecutively on forward data segments, providing a robust validation mechanism for trading systems.

Walk-Forward Optimization: How It Works, Its Limitations, ... - Walk-forward optimization reduces overfitting by continually re-optimizing strategy parameters on new data segments, mimicking real-time trading dynamics and allowing traders to validate strategies across multiple market conditions.

dowidth.com

dowidth.com