Penny jump and liquidity sweep are advanced trading tactics used to optimize market entry and exit. Penny jump involves placing orders just ahead of the current bid or ask price to quickly capture favorable price movements. Explore how mastering these strategies can enhance trading precision and profitability.

Why it is important

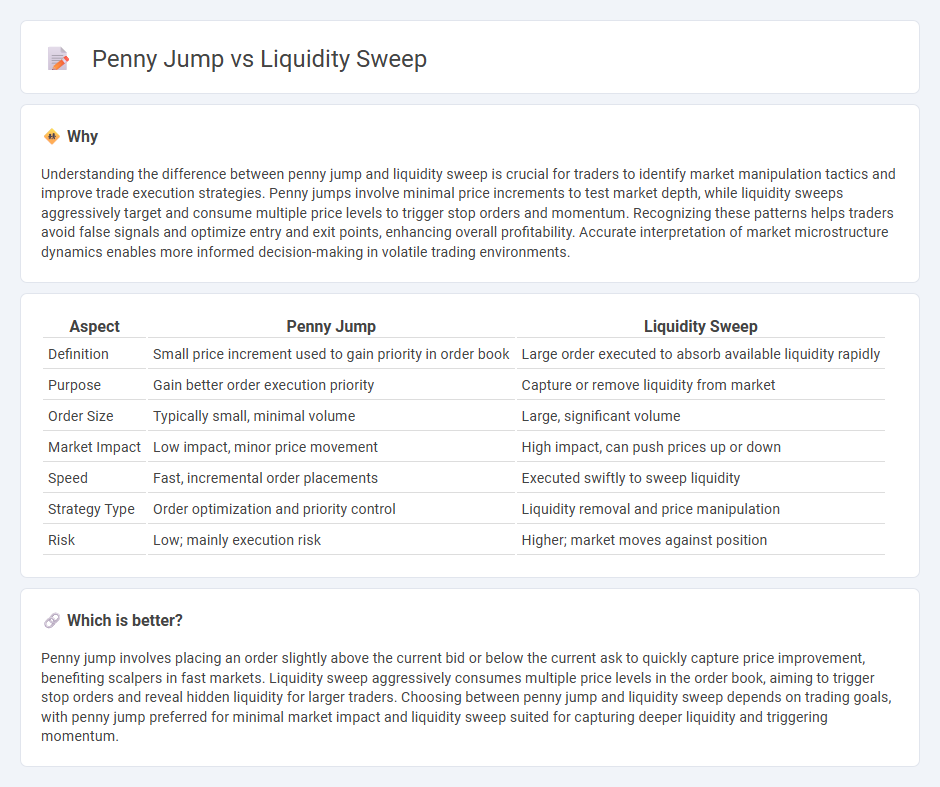

Understanding the difference between penny jump and liquidity sweep is crucial for traders to identify market manipulation tactics and improve trade execution strategies. Penny jumps involve minimal price increments to test market depth, while liquidity sweeps aggressively target and consume multiple price levels to trigger stop orders and momentum. Recognizing these patterns helps traders avoid false signals and optimize entry and exit points, enhancing overall profitability. Accurate interpretation of market microstructure dynamics enables more informed decision-making in volatile trading environments.

Comparison Table

| Aspect | Penny Jump | Liquidity Sweep |

|---|---|---|

| Definition | Small price increment used to gain priority in order book | Large order executed to absorb available liquidity rapidly |

| Purpose | Gain better order execution priority | Capture or remove liquidity from market |

| Order Size | Typically small, minimal volume | Large, significant volume |

| Market Impact | Low impact, minor price movement | High impact, can push prices up or down |

| Speed | Fast, incremental order placements | Executed swiftly to sweep liquidity |

| Strategy Type | Order optimization and priority control | Liquidity removal and price manipulation |

| Risk | Low; mainly execution risk | Higher; market moves against position |

Which is better?

Penny jump involves placing an order slightly above the current bid or below the current ask to quickly capture price improvement, benefiting scalpers in fast markets. Liquidity sweep aggressively consumes multiple price levels in the order book, aiming to trigger stop orders and reveal hidden liquidity for larger traders. Choosing between penny jump and liquidity sweep depends on trading goals, with penny jump preferred for minimal market impact and liquidity sweep suited for capturing deeper liquidity and triggering momentum.

Connection

Penny jumps often trigger liquidity sweeps by rapidly moving prices just enough to consume resting orders at key levels, causing a sudden imbalance in supply and demand. Liquidity sweeps capitalize on these micro price changes to attract stop-loss orders and market makers, amplifying momentum and volatility. This dynamic interplay between penny jumps and liquidity sweeps enables traders to exploit short-term inefficiencies in order flow and price discovery.

Key Terms

Order book

Liquidity sweep involves aggressive market orders consuming multiple price levels in the order book, quickly removing liquidity and causing sharp price moves. Penny jump refers to minute price changes, often by one cent, reflecting subtle shifts in order book depth and trader sentiment. Explore detailed analysis to understand their impact on market microstructure and trading strategies.

Slippage

Liquidity sweep reduces slippage by executing large orders through multiple smaller trades across various liquidity sources, minimizing price impact. Penny jump, commonly seen in low liquidity markets, causes slippage when price moves incrementally by the smallest tick size, often leading to less favorable fills. Explore more about how these mechanisms affect trading strategies and execution quality.

Bid-ask spread

A liquidity sweep targets multiple price levels within the bid-ask spread to capture available liquidity and execute large orders efficiently, minimizing market impact. In contrast, a penny jump narrows the spread by placing an order just one cent better than the current best bid or ask, aiming to quickly improve execution price and gain priority. Explore the nuances and effectiveness of both strategies in managing bid-ask spreads for optimized trading results.

Source and External Links

What is Liquidity Sweep: Everything You Need to Know - Quadcode - A liquidity sweep is when large market players trigger pending buy or sell orders around liquidity zones to enter or exit positions advantageously, often causing rapid price movements to sweep through those orders and create momentum in the market.

Liquidity Sweeps: A Complete Guide to Smart Money Manipulation! - A liquidity sweep occurs when price briefly moves beyond key levels to trigger stop-loss orders and lure breakout traders, allowing smart money to fill large orders without excessive slippage before reversing the price direction.

What is a Liquidity Sweep and How to Trade It? - Institutional players intentionally trigger stop losses and buying or selling pressure in supply or demand zones by sweeping through these areas, creating bear or bull traps before reversing price direction for better trade executions.

dowidth.com

dowidth.com