Execution algorithms focus on optimizing individual trade orders to minimize market impact and reduce transaction costs by using techniques such as VWAP, TWAP, and iceberg orders. Portfolio trading aggregates multiple securities into a single execution strategy, improving overall efficiency and risk management by reducing fragmentation and leveraging diversification benefits. Discover more about how these trading approaches can enhance strategy performance and execution quality.

Why it is important

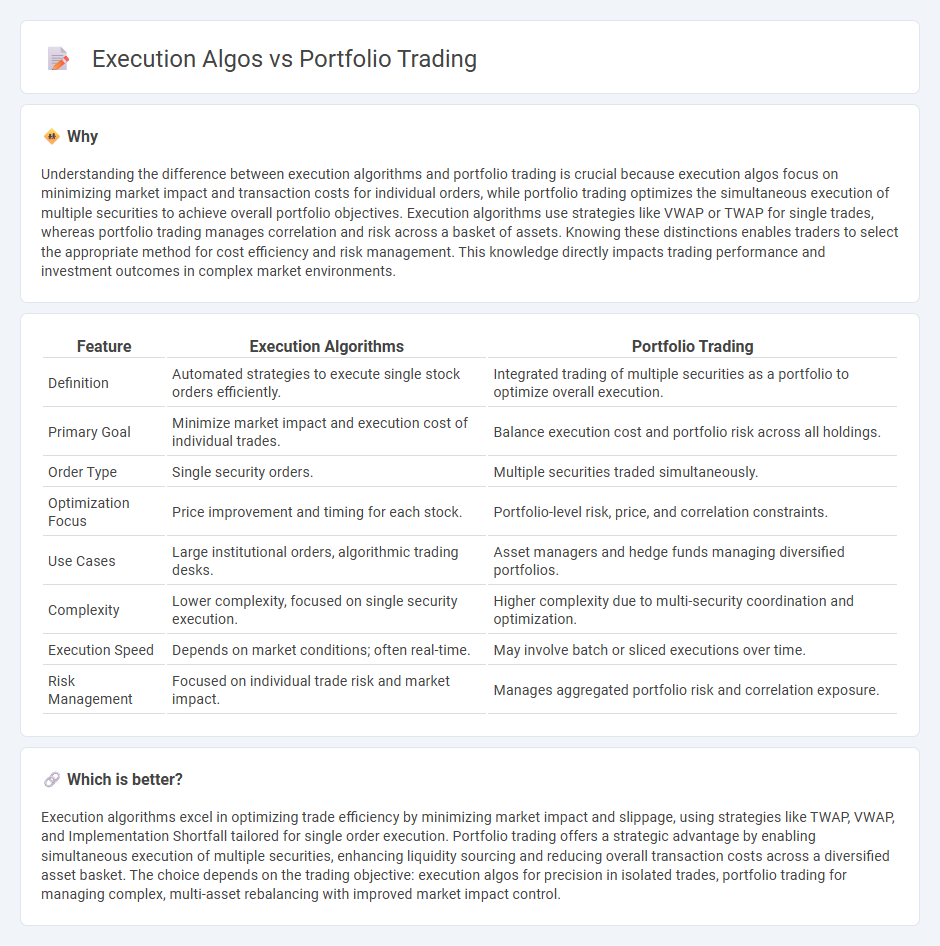

Understanding the difference between execution algorithms and portfolio trading is crucial because execution algos focus on minimizing market impact and transaction costs for individual orders, while portfolio trading optimizes the simultaneous execution of multiple securities to achieve overall portfolio objectives. Execution algorithms use strategies like VWAP or TWAP for single trades, whereas portfolio trading manages correlation and risk across a basket of assets. Knowing these distinctions enables traders to select the appropriate method for cost efficiency and risk management. This knowledge directly impacts trading performance and investment outcomes in complex market environments.

Comparison Table

| Feature | Execution Algorithms | Portfolio Trading |

|---|---|---|

| Definition | Automated strategies to execute single stock orders efficiently. | Integrated trading of multiple securities as a portfolio to optimize overall execution. |

| Primary Goal | Minimize market impact and execution cost of individual trades. | Balance execution cost and portfolio risk across all holdings. |

| Order Type | Single security orders. | Multiple securities traded simultaneously. |

| Optimization Focus | Price improvement and timing for each stock. | Portfolio-level risk, price, and correlation constraints. |

| Use Cases | Large institutional orders, algorithmic trading desks. | Asset managers and hedge funds managing diversified portfolios. |

| Complexity | Lower complexity, focused on single security execution. | Higher complexity due to multi-security coordination and optimization. |

| Execution Speed | Depends on market conditions; often real-time. | May involve batch or sliced executions over time. |

| Risk Management | Focused on individual trade risk and market impact. | Manages aggregated portfolio risk and correlation exposure. |

Which is better?

Execution algorithms excel in optimizing trade efficiency by minimizing market impact and slippage, using strategies like TWAP, VWAP, and Implementation Shortfall tailored for single order execution. Portfolio trading offers a strategic advantage by enabling simultaneous execution of multiple securities, enhancing liquidity sourcing and reducing overall transaction costs across a diversified asset basket. The choice depends on the trading objective: execution algos for precision in isolated trades, portfolio trading for managing complex, multi-asset rebalancing with improved market impact control.

Connection

Execution algorithms optimize trade orders by breaking them into smaller parts to minimize market impact and reduce transaction costs. Portfolio trading involves executing large baskets of securities simultaneously, relying on execution algos to efficiently manage and time these multi-asset trades. The integration of execution algorithms within portfolio trading enhances liquidity access and improves overall execution quality across diverse asset classes.

Key Terms

Diversification

Portfolio trading leverages sophisticated algorithms to execute large, basket trades across multiple securities simultaneously, enhancing diversification by balancing risk and maximizing returns. Execution algorithms optimize trade timing and order slicing to minimize market impact and transaction costs within individual securities. Explore deeper distinctions and strategic advantages between portfolio trading and execution algos to refine your investment approach.

VWAP (Volume Weighted Average Price)

Portfolio trading aggregates multiple securities into a single order to optimize execution and reduce market impact, while execution algorithms like VWAP strategically spread trades over time to match volume patterns and achieve price efficiency. VWAP calculates the average price weighted by volume, enabling traders to execute closer to the day's average market price, minimizing slippage and market impact. Explore detailed strategies and performance metrics to understand how VWAP and portfolio trading can enhance your order execution.

Basket Orders

Portfolio trading allows simultaneous execution of multiple securities to minimize market impact and maintain portfolio integrity, especially effective for large basket orders. Execution algorithms tailor strategies to optimize timing, minimize transaction costs, and adapt to real-time market conditions, enhancing efficiency in complex order management. Explore how these tools transform basket order execution for institutional investors.

Source and External Links

Understanding Portfolio Trading - Tradeweb - Portfolio trading allows asset managers to trade a basket of bonds as a single transaction, helping reduce market slippage, operational risk, and execution costs while enabling efficient portfolio rebalancing and benchmark replication.

Portfolio trading is on the up but only some can make it pay - Portfolio trading lets traders execute a basket of stocks in a single transaction to minimize costs and bundle less liquid assets with liquid ones, gaining momentum especially in electronic trading over recent years.

Credit Portfolio Trading Booms - ICE - Portfolio trading in bonds allows simultaneous offers of thousands of bonds, accelerating execution, reducing operational risk, and improving pricing especially for illiquid bonds by packaging them with more liquid ones.

dowidth.com

dowidth.com