Stop hunting manipulates market prices to trigger stop-loss orders, causing rapid price movements that benefit larger traders by forcing smaller traders out of their positions. Wash trading involves buying and selling the same asset simultaneously or within a short timeframe to create misleading market activity and inflate volume figures, often used to deceive other market participants. Explore the differences and implications of stop hunting versus wash trading to better understand market manipulation strategies.

Why it is important

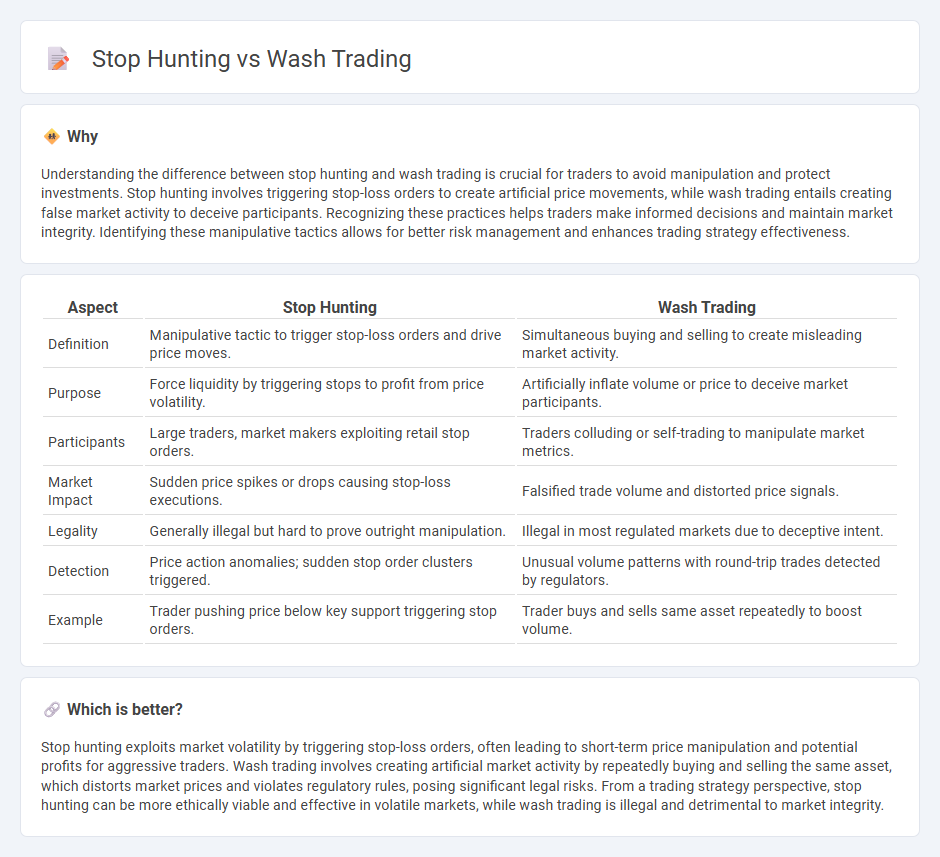

Understanding the difference between stop hunting and wash trading is crucial for traders to avoid manipulation and protect investments. Stop hunting involves triggering stop-loss orders to create artificial price movements, while wash trading entails creating false market activity to deceive participants. Recognizing these practices helps traders make informed decisions and maintain market integrity. Identifying these manipulative tactics allows for better risk management and enhances trading strategy effectiveness.

Comparison Table

| Aspect | Stop Hunting | Wash Trading |

|---|---|---|

| Definition | Manipulative tactic to trigger stop-loss orders and drive price moves. | Simultaneous buying and selling to create misleading market activity. |

| Purpose | Force liquidity by triggering stops to profit from price volatility. | Artificially inflate volume or price to deceive market participants. |

| Participants | Large traders, market makers exploiting retail stop orders. | Traders colluding or self-trading to manipulate market metrics. |

| Market Impact | Sudden price spikes or drops causing stop-loss executions. | Falsified trade volume and distorted price signals. |

| Legality | Generally illegal but hard to prove outright manipulation. | Illegal in most regulated markets due to deceptive intent. |

| Detection | Price action anomalies; sudden stop order clusters triggered. | Unusual volume patterns with round-trip trades detected by regulators. |

| Example | Trader pushing price below key support triggering stop orders. | Trader buys and sells same asset repeatedly to boost volume. |

Which is better?

Stop hunting exploits market volatility by triggering stop-loss orders, often leading to short-term price manipulation and potential profits for aggressive traders. Wash trading involves creating artificial market activity by repeatedly buying and selling the same asset, which distorts market prices and violates regulatory rules, posing significant legal risks. From a trading strategy perspective, stop hunting can be more ethically viable and effective in volatile markets, while wash trading is illegal and detrimental to market integrity.

Connection

Stop hunting and wash trading are connected through their manipulation of market orders to create false signals. Stop hunting triggers stop-loss orders by pushing prices to specific levels, while wash trading involves executing trades between related parties to simulate volume and liquidity. Both practices distort market transparency, misleading traders and impacting price discovery.

Key Terms

**Wash Trading:**

Wash trading involves executing buy and sell orders for the same asset to create misleading market activity and inflate volume artificially, often used to manipulate prices or evade taxes. It is illegal in many regulatory environments because it distorts true market dynamics and undermines investor confidence. Explore further to understand how wash trading impacts market integrity and detection methods.

Artificial Volume

Wash trading manipulates artificial volume by executing buy and sell orders within the same entity to create misleading market activity, inflating perceived liquidity. Stop hunting exploits artificial volume spikes to trigger stop-loss orders, forcing price movements beneficial to larger traders. Explore how artificial volume plays a crucial role in distinguishing wash trading from stop hunting strategies.

Market Manipulation

Wash trading involves traders simultaneously buying and selling the same financial instrument to create artificial volume, misleading other market participants about demand or liquidity. Stop hunting is a strategy where manipulators push prices to trigger stop-loss orders, causing abrupt price movements that benefit their positions. Explore how these tactics distort markets and impact trading integrity.

Source and External Links

What is Wash Trading? - NICE Actimize - Wash trading is a deceptive practice where traders simultaneously buy and sell the same security to create false market activity, inflating trading volume and manipulating prices without actual change in ownership.

What is Wash Trading? - Winston & Strawn - Wash trading involves collusion between buyer and seller to mislead the market by circulating securities and cash back and forth, artificially inflating value without real risk or position changes; it has been illegal since 1936.

Wash Trading - Overview, How It Works, and Example - CFI - Wash trading, also known as round-trip trading, is illegal market manipulation where an investor buys and sells the same financial instruments to create fake volume, often selling securities to themselves to mislead market demand.

dowidth.com

dowidth.com