Trading on modular blockchains offers enhanced scalability, flexibility, and interoperability by separating consensus, execution, and data availability layers. Perpetual contracts trading provides continuous leverage without expiration, enabling traders to speculate on asset price movements with efficient liquidity and risk management. Explore the differences to optimize your trading strategies in decentralized finance ecosystems.

Why it is important

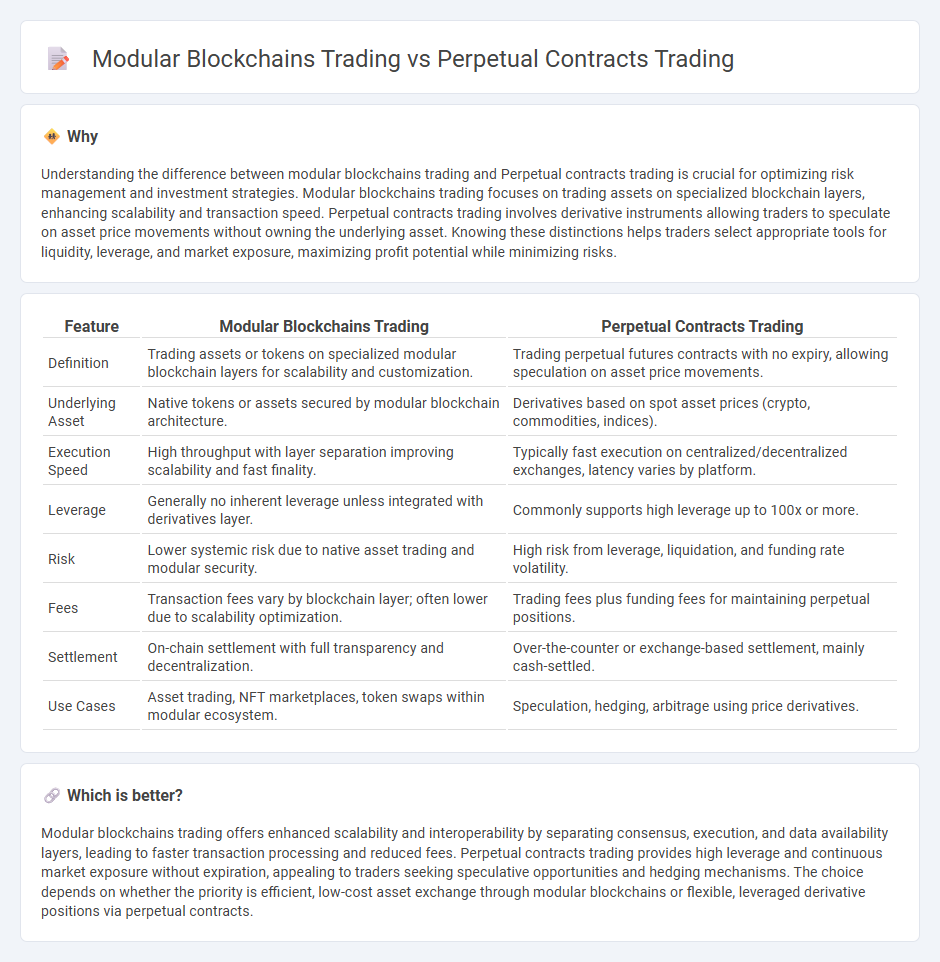

Understanding the difference between modular blockchains trading and Perpetual contracts trading is crucial for optimizing risk management and investment strategies. Modular blockchains trading focuses on trading assets on specialized blockchain layers, enhancing scalability and transaction speed. Perpetual contracts trading involves derivative instruments allowing traders to speculate on asset price movements without owning the underlying asset. Knowing these distinctions helps traders select appropriate tools for liquidity, leverage, and market exposure, maximizing profit potential while minimizing risks.

Comparison Table

| Feature | Modular Blockchains Trading | Perpetual Contracts Trading |

|---|---|---|

| Definition | Trading assets or tokens on specialized modular blockchain layers for scalability and customization. | Trading perpetual futures contracts with no expiry, allowing speculation on asset price movements. |

| Underlying Asset | Native tokens or assets secured by modular blockchain architecture. | Derivatives based on spot asset prices (crypto, commodities, indices). |

| Execution Speed | High throughput with layer separation improving scalability and fast finality. | Typically fast execution on centralized/decentralized exchanges, latency varies by platform. |

| Leverage | Generally no inherent leverage unless integrated with derivatives layer. | Commonly supports high leverage up to 100x or more. |

| Risk | Lower systemic risk due to native asset trading and modular security. | High risk from leverage, liquidation, and funding rate volatility. |

| Fees | Transaction fees vary by blockchain layer; often lower due to scalability optimization. | Trading fees plus funding fees for maintaining perpetual positions. |

| Settlement | On-chain settlement with full transparency and decentralization. | Over-the-counter or exchange-based settlement, mainly cash-settled. |

| Use Cases | Asset trading, NFT marketplaces, token swaps within modular ecosystem. | Speculation, hedging, arbitrage using price derivatives. |

Which is better?

Modular blockchains trading offers enhanced scalability and interoperability by separating consensus, execution, and data availability layers, leading to faster transaction processing and reduced fees. Perpetual contracts trading provides high leverage and continuous market exposure without expiration, appealing to traders seeking speculative opportunities and hedging mechanisms. The choice depends on whether the priority is efficient, low-cost asset exchange through modular blockchains or flexible, leveraged derivative positions via perpetual contracts.

Connection

Modular blockchains trading enhances efficiency and scalability by separating consensus, execution, and data availability layers, enabling faster and more secure transactions for Perpetual contracts trading. Perpetual contracts trading relies on this optimized infrastructure to execute high-frequency, leveraged positions with reduced latency and lower gas fees. This synergy allows traders to access deeper liquidity pools and improved pricing mechanisms within decentralized finance ecosystems.

Key Terms

**Perpetual contracts trading:**

Perpetual contracts trading enables traders to speculate on asset prices without an expiry date, offering continuous market exposure and high leverage options primarily on platforms like Binance and BitMEX. This trading form benefits from deep liquidity pools and real-time price discovery, driven by a highly dynamic ecosystem of market makers and arbitrageurs. Explore further to understand the risk management strategies and technological infrastructure powering perpetual contracts trading.

Funding Rate

Perpetual contracts trading involves continuous funding rate payments between long and short positions to maintain price alignment with the underlying asset, typically resetting every 8 hours. Modular blockchains trading uses layered structures that separate execution, settlement, and consensus, enabling lower latency and potentially reduced slippage without relying on traditional funding rates. Explore the mechanics behind funding rates and their impact on trading efficiency to deepen your understanding.

Leverage

Perpetual contracts trading offers traders high leverage, often up to 100x, enabling significant exposure with minimal capital, but it involves higher risk due to price volatility and potential liquidation. Modular blockchains trading, built on scalable architectures, tends to provide more flexible leverage options integrated with lower latency and customizable risk parameters, enhancing trade execution efficiency. Explore how leverage mechanisms impact trading strategies across these platforms to optimize your investment approach.

Source and External Links

Perpetual Futures: How They Work & Pros and Cons - Perpetual futures are derivatives allowing speculation on an asset's price without expiration, involving initial and maintenance margins, funding rates to align with spot prices, and possible liquidation if margins fall short, offering leveraged long or short positions but carrying higher risk due to volatility and leverage.

What are perpetual futures contracts? - Trading perpetual futures involves funding an account to cover margin requirements, choosing a contract, and entering buy or sell positions; these contracts allow price speculation without owning the asset but require understanding risks and using risk management.

Perpetual Futures Contracts and Cryptocurrency Market Quality - Perpetual futures, or "perps," dominate crypto derivatives trading by enabling indefinite holding and use a funding fee every eight hours to keep prices aligned with the spot market, increasing trading activity, costs, and informed trading in crypto markets.

dowidth.com

dowidth.com