Quantitative backtesting relies on algorithmic strategies and historical data to objectively evaluate trading models, minimizing emotional bias and enabling precise risk management. Discretionary backtesting involves trader judgment and intuition, which can adapt to market nuances but may introduce subjective errors and inconsistency. Explore the advantages and limitations of these backtesting methods to optimize your trading approach.

Why it is important

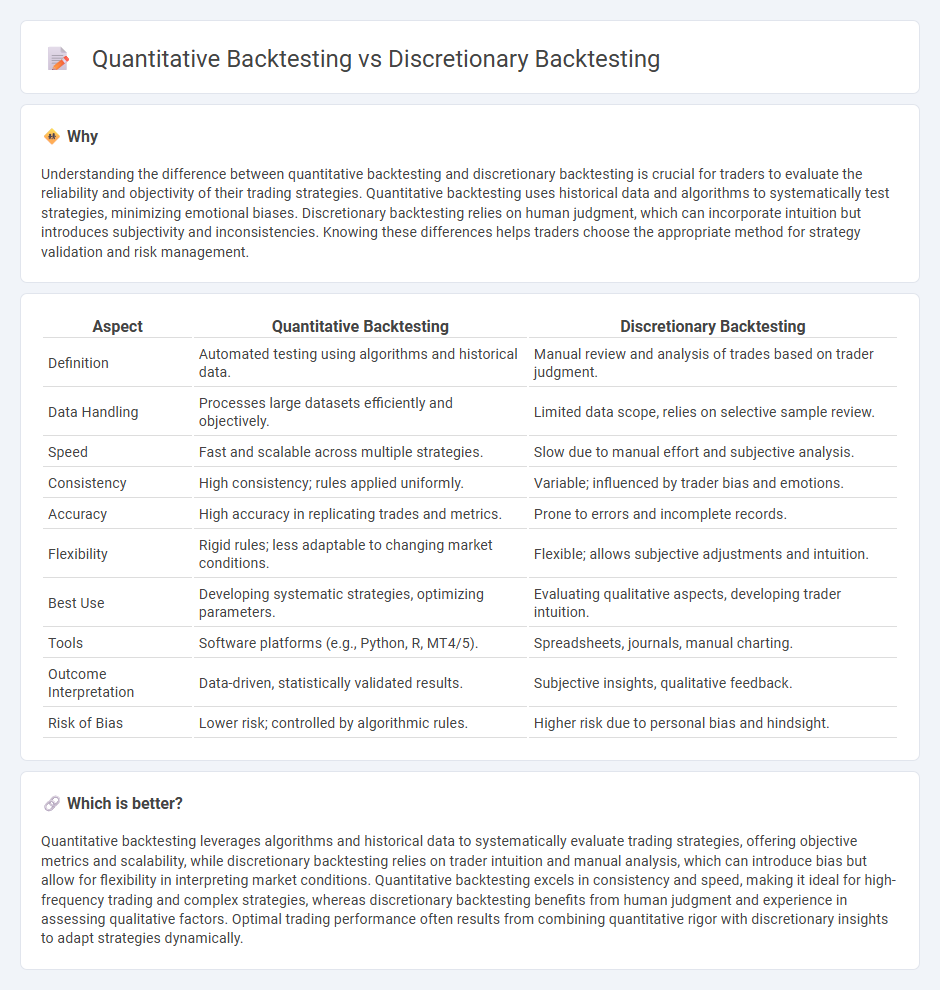

Understanding the difference between quantitative backtesting and discretionary backtesting is crucial for traders to evaluate the reliability and objectivity of their trading strategies. Quantitative backtesting uses historical data and algorithms to systematically test strategies, minimizing emotional biases. Discretionary backtesting relies on human judgment, which can incorporate intuition but introduces subjectivity and inconsistencies. Knowing these differences helps traders choose the appropriate method for strategy validation and risk management.

Comparison Table

| Aspect | Quantitative Backtesting | Discretionary Backtesting |

|---|---|---|

| Definition | Automated testing using algorithms and historical data. | Manual review and analysis of trades based on trader judgment. |

| Data Handling | Processes large datasets efficiently and objectively. | Limited data scope, relies on selective sample review. |

| Speed | Fast and scalable across multiple strategies. | Slow due to manual effort and subjective analysis. |

| Consistency | High consistency; rules applied uniformly. | Variable; influenced by trader bias and emotions. |

| Accuracy | High accuracy in replicating trades and metrics. | Prone to errors and incomplete records. |

| Flexibility | Rigid rules; less adaptable to changing market conditions. | Flexible; allows subjective adjustments and intuition. |

| Best Use | Developing systematic strategies, optimizing parameters. | Evaluating qualitative aspects, developing trader intuition. |

| Tools | Software platforms (e.g., Python, R, MT4/5). | Spreadsheets, journals, manual charting. |

| Outcome Interpretation | Data-driven, statistically validated results. | Subjective insights, qualitative feedback. |

| Risk of Bias | Lower risk; controlled by algorithmic rules. | Higher risk due to personal bias and hindsight. |

Which is better?

Quantitative backtesting leverages algorithms and historical data to systematically evaluate trading strategies, offering objective metrics and scalability, while discretionary backtesting relies on trader intuition and manual analysis, which can introduce bias but allow for flexibility in interpreting market conditions. Quantitative backtesting excels in consistency and speed, making it ideal for high-frequency trading and complex strategies, whereas discretionary backtesting benefits from human judgment and experience in assessing qualitative factors. Optimal trading performance often results from combining quantitative rigor with discretionary insights to adapt strategies dynamically.

Connection

Quantitative backtesting uses algorithms and historical data to systematically evaluate trading strategies, providing objective performance metrics. Discretionary backtesting incorporates trader judgment and contextual interpretation to refine and adapt strategies beyond purely quantitative results. Combining both methods leverages data-driven insights with human experience, enhancing strategy robustness and adaptability in dynamic markets.

Key Terms

Subjectivity vs. Objectivity

Discretionary backtesting relies on subjective judgment, allowing traders to adjust strategies based on personal insights and market intuition, which can introduce bias and reduce consistency. Quantitative backtesting employs objective, data-driven models that systematically test trading strategies against historical data to ensure reproducibility and statistical validity. Explore more to understand when to apply each approach for optimal trading performance.

Manual Analysis vs. Algorithmic Simulation

Discretionary backtesting revolves around manual analysis where traders apply subjective judgment to historical data, identifying patterns that might not fit rigid algorithms. Quantitative backtesting employs algorithmic simulation, utilizing predefined statistical models and automation to systematically evaluate trading strategies over extensive datasets. Explore detailed comparisons and practical applications to deepen your understanding of these backtesting methodologies.

Human Judgment vs. Rule-Based Systems

Discretionary backtesting relies on human judgment to interpret market conditions and adapt strategies dynamically, whereas quantitative backtesting uses rule-based systems to test strategies against historical data with mathematical precision and consistency. Discretionary methods offer flexibility and nuanced decision-making, while quantitative approaches provide reproducibility and statistical rigor. Explore the advantages and challenges of each backtesting method to optimize your trading strategy.

Source and External Links

Discretionary Trading - QuantifiedStrategies.com - Discretionary backtesting involves manually validating trading strategies that incorporate qualitative factors like intuition or sentiment on historical data, which is challenging but important to assess potential profitability and risk while avoiding common pitfalls like overfitting and survivorship bias.

Discretionary Trading: Strategies for Savvy Investors - Backtesting in discretionary trading enables traders to evaluate and refine their judgment-based decisions using historical data, thereby improving decision-making confidence and adapting strategies flexibly to changing market conditions.

Backtesting Limitations (Manual and Automated) - Manual backtesting of discretionary trading strategies allows personal intuition to be applied but introduces human biases that require consistent logic and multiple testing iterations to ensure reliability before live trading.

dowidth.com

dowidth.com