Front running involves executing orders based on advance knowledge of pending trades to gain an unfair market advantage, often exploiting non-public information. Quote stuffing entails rapidly placing and canceling large volumes of orders to create market confusion and manipulate prices. Discover how these trading strategies impact market integrity and investor trust.

Why it is important

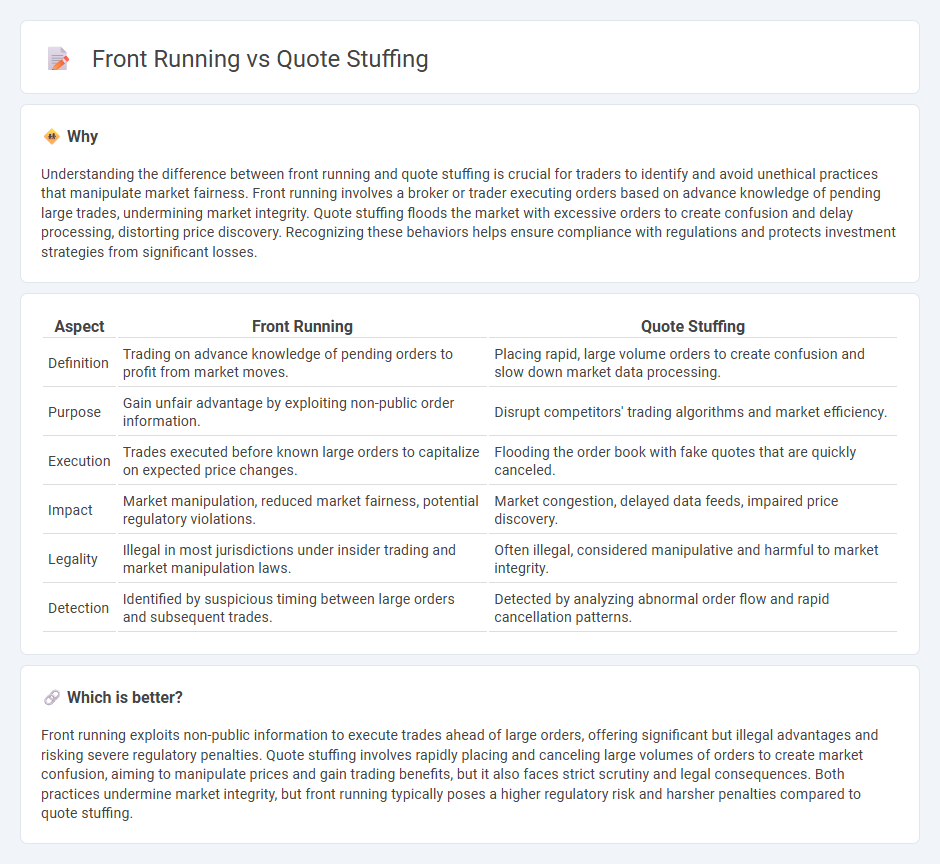

Understanding the difference between front running and quote stuffing is crucial for traders to identify and avoid unethical practices that manipulate market fairness. Front running involves a broker or trader executing orders based on advance knowledge of pending large trades, undermining market integrity. Quote stuffing floods the market with excessive orders to create confusion and delay processing, distorting price discovery. Recognizing these behaviors helps ensure compliance with regulations and protects investment strategies from significant losses.

Comparison Table

| Aspect | Front Running | Quote Stuffing |

|---|---|---|

| Definition | Trading on advance knowledge of pending orders to profit from market moves. | Placing rapid, large volume orders to create confusion and slow down market data processing. |

| Purpose | Gain unfair advantage by exploiting non-public order information. | Disrupt competitors' trading algorithms and market efficiency. |

| Execution | Trades executed before known large orders to capitalize on expected price changes. | Flooding the order book with fake quotes that are quickly canceled. |

| Impact | Market manipulation, reduced market fairness, potential regulatory violations. | Market congestion, delayed data feeds, impaired price discovery. |

| Legality | Illegal in most jurisdictions under insider trading and market manipulation laws. | Often illegal, considered manipulative and harmful to market integrity. |

| Detection | Identified by suspicious timing between large orders and subsequent trades. | Detected by analyzing abnormal order flow and rapid cancellation patterns. |

Which is better?

Front running exploits non-public information to execute trades ahead of large orders, offering significant but illegal advantages and risking severe regulatory penalties. Quote stuffing involves rapidly placing and canceling large volumes of orders to create market confusion, aiming to manipulate prices and gain trading benefits, but it also faces strict scrutiny and legal consequences. Both practices undermine market integrity, but front running typically poses a higher regulatory risk and harsher penalties compared to quote stuffing.

Connection

Front running and quote stuffing are connected through manipulative trading practices aimed at exploiting market inefficiencies. Front running involves traders executing orders based on prior knowledge of pending large trades, while quote stuffing floods the market with excessive orders to create misleading price signals, enabling front runners to anticipate genuine market moves. Both techniques disrupt fair market conditions and undermine market integrity by creating artificial price patterns for strategic advantage.

Key Terms

High-Frequency Trading (HFT)

Quote stuffing involves rapidly placing and canceling large volumes of orders to overwhelm the market and create false price signals, disrupting the trading environment. Front running in High-Frequency Trading (HFT) refers to exploiting advance knowledge of upcoming large orders to trade ahead for profit, impacting market fairness and liquidity. Explore more about how these tactics influence market dynamics and regulatory responses.

Order Book

Quote stuffing floods the order book with rapid, excessive orders to create market noise and confuse competitors, often obscuring true supply and demand. Front running exploits knowledge of upcoming large orders by placing prioritized orders ahead in the book to benefit from anticipated price movements. Explore the intricate mechanics of order book manipulation to understand their distinct impacts further.

Latency

Quote stuffing leverages ultra-low latency to flood markets with rapid, repetitive order quotes, overwhelming trading systems and creating artificial traffic noise. Front running exploits minimal latency advantages by detecting large incoming orders and quickly executing trades ahead of them to capitalize on price movements. Explore the distinct latency mechanisms driving quote stuffing and front running strategies to deepen your understanding of high-frequency trading tactics.

Source and External Links

Quote Stuffing - Overview, How It Works, Example - Quote stuffing is a market manipulation technique where traders place a large number of buy or sell orders that are immediately canceled to create false demand and manipulate stock prices for profit.

How Larger Players Use Quote Stuffing to Gain an Edge in Trading - Quote stuffing is executed by flooding the market with excessive orders and quickly canceling them to cause confusion, disrupt trading, mislead other participants, and gain a price advantage using advanced algorithms and high-frequency trading.

Quote Stuffing - What Is It, Vs Spoofing Vs Layering - WallStreetMojo - Quote stuffing involves placing and rapidly canceling many buy and sell orders to generate false market signals and gain an advantage, often by high-frequency traders, differing from spoofing mainly by timing of order cancellations.

dowidth.com

dowidth.com