Volume profile reading reveals price levels with significant trading activity, highlighting areas of support and resistance by analyzing volume distribution over time. Auction Market Theory interprets price movement as a continuous auction process where buyers and sellers discover the market value through bids and offers, emphasizing market equilibrium and imbalance. Explore deeper insights to master market dynamics and enhance trading strategies.

Why it is important

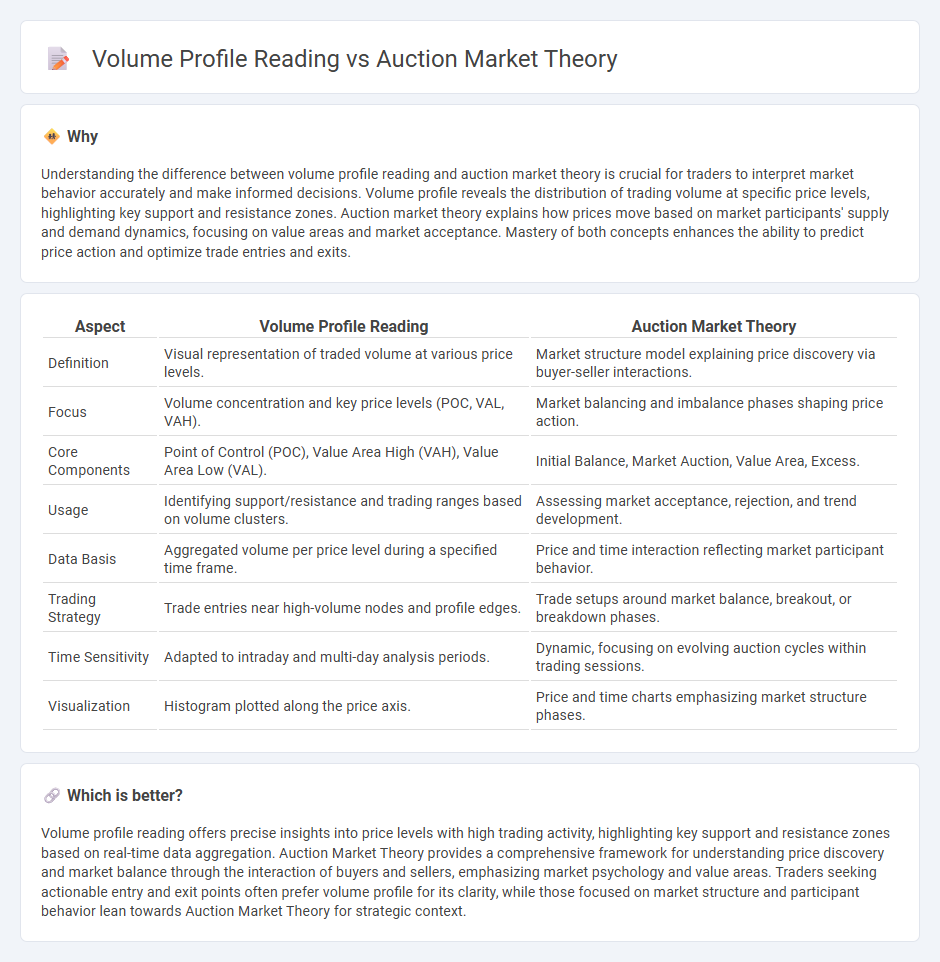

Understanding the difference between volume profile reading and auction market theory is crucial for traders to interpret market behavior accurately and make informed decisions. Volume profile reveals the distribution of trading volume at specific price levels, highlighting key support and resistance zones. Auction market theory explains how prices move based on market participants' supply and demand dynamics, focusing on value areas and market acceptance. Mastery of both concepts enhances the ability to predict price action and optimize trade entries and exits.

Comparison Table

| Aspect | Volume Profile Reading | Auction Market Theory |

|---|---|---|

| Definition | Visual representation of traded volume at various price levels. | Market structure model explaining price discovery via buyer-seller interactions. |

| Focus | Volume concentration and key price levels (POC, VAL, VAH). | Market balancing and imbalance phases shaping price action. |

| Core Components | Point of Control (POC), Value Area High (VAH), Value Area Low (VAL). | Initial Balance, Market Auction, Value Area, Excess. |

| Usage | Identifying support/resistance and trading ranges based on volume clusters. | Assessing market acceptance, rejection, and trend development. |

| Data Basis | Aggregated volume per price level during a specified time frame. | Price and time interaction reflecting market participant behavior. |

| Trading Strategy | Trade entries near high-volume nodes and profile edges. | Trade setups around market balance, breakout, or breakdown phases. |

| Time Sensitivity | Adapted to intraday and multi-day analysis periods. | Dynamic, focusing on evolving auction cycles within trading sessions. |

| Visualization | Histogram plotted along the price axis. | Price and time charts emphasizing market structure phases. |

Which is better?

Volume profile reading offers precise insights into price levels with high trading activity, highlighting key support and resistance zones based on real-time data aggregation. Auction Market Theory provides a comprehensive framework for understanding price discovery and market balance through the interaction of buyers and sellers, emphasizing market psychology and value areas. Traders seeking actionable entry and exit points often prefer volume profile for its clarity, while those focused on market structure and participant behavior lean towards Auction Market Theory for strategic context.

Connection

Volume profile reading provides a visual representation of traded volume at specific price levels, highlighting areas of high activity known as value areas. Auction Market Theory explains price discovery through the process of buyers and sellers negotiating value, creating market balance or imbalance within these value areas. Together, they offer traders insight into market behavior by identifying key levels where auction dynamics influence price movement and potential support or resistance.

Key Terms

**Auction Market Theory:**

Auction Market Theory emphasizes price discovery through the continuous interaction of buyers and sellers, focusing on the Value Area where the majority of trading volume occurs, which reflects market consensus. It integrates time, price, and volume to identify market structure, trends, and potential reversal points, offering traders a framework to interpret price movements and market sentiment. Explore Auction Market Theory in depth to enhance your trading strategies and market analysis.

Value Area

Auction Market Theory identifies the Value Area as the price range where approximately 70% of trading volume occurs, reflecting market consensus on value. Volume Profile Reading precisely charts this area by displaying traded volume at each price level, helping traders understand market acceptance and rejection zones. Explore deeper insights into Value Area analysis to enhance your trading strategies.

Price Discovery

Auction Market Theory emphasizes the dynamic interaction between buyers and sellers to establish market equilibrium and fair value, utilizing concepts like the Market Profile to identify price acceptance and rejection zones. Volume Profile Reading focuses on the distribution of traded volume across price levels, highlighting significant support and resistance areas based on heavy trading activity, which signals strong price discovery points. Explore deeper insights into how these methodologies decode market behavior and enhance trading strategies.

Source and External Links

Auction Market Theory - What Moves the Markets? - Auction Market Theory explains market price movements as a result of imbalances of buyer and seller aggression driving prices to a new fair value through a discovery phase.

Market Profile, Volume Profile and Auction Market Theory - Auction Market Theory describes the market as a dual auction process where price discovery happens through supply and demand dynamics and aggressiveness of buyers and sellers, establishing value areas.

Full Guide to Auction Market Theory & How to trade ... - Auction Market Theory is based on market price moving due to imbalances between buyers and sellers, with strong traders causing price to escape balance areas and creating support/resistance levels for directional moves.

dowidth.com

dowidth.com