Algorithmic arbitrage exploits price discrepancies across multiple markets to generate profit by executing rapid, automated trades. Liquidity provision involves continuously placing buy and sell orders to facilitate market efficiency and earn spread-based revenues. Explore the distinct strategies and benefits of algorithmic arbitrage and liquidity provision in trading.

Why it is important

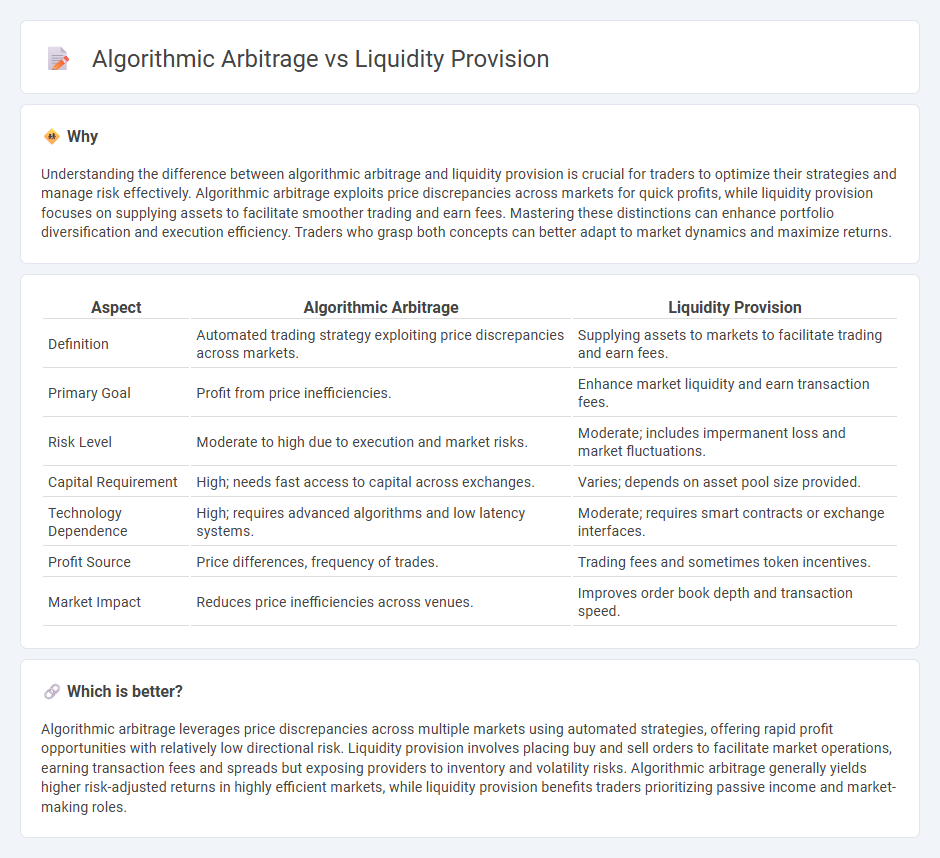

Understanding the difference between algorithmic arbitrage and liquidity provision is crucial for traders to optimize their strategies and manage risk effectively. Algorithmic arbitrage exploits price discrepancies across markets for quick profits, while liquidity provision focuses on supplying assets to facilitate smoother trading and earn fees. Mastering these distinctions can enhance portfolio diversification and execution efficiency. Traders who grasp both concepts can better adapt to market dynamics and maximize returns.

Comparison Table

| Aspect | Algorithmic Arbitrage | Liquidity Provision |

|---|---|---|

| Definition | Automated trading strategy exploiting price discrepancies across markets. | Supplying assets to markets to facilitate trading and earn fees. |

| Primary Goal | Profit from price inefficiencies. | Enhance market liquidity and earn transaction fees. |

| Risk Level | Moderate to high due to execution and market risks. | Moderate; includes impermanent loss and market fluctuations. |

| Capital Requirement | High; needs fast access to capital across exchanges. | Varies; depends on asset pool size provided. |

| Technology Dependence | High; requires advanced algorithms and low latency systems. | Moderate; requires smart contracts or exchange interfaces. |

| Profit Source | Price differences, frequency of trades. | Trading fees and sometimes token incentives. |

| Market Impact | Reduces price inefficiencies across venues. | Improves order book depth and transaction speed. |

Which is better?

Algorithmic arbitrage leverages price discrepancies across multiple markets using automated strategies, offering rapid profit opportunities with relatively low directional risk. Liquidity provision involves placing buy and sell orders to facilitate market operations, earning transaction fees and spreads but exposing providers to inventory and volatility risks. Algorithmic arbitrage generally yields higher risk-adjusted returns in highly efficient markets, while liquidity provision benefits traders prioritizing passive income and market-making roles.

Connection

Algorithmic arbitrage exploits price discrepancies across multiple markets by executing rapid trades that capitalize on inefficiencies, directly enhancing liquidity provision. Market makers use algorithmic strategies to continuously supply buy and sell orders, narrowing bid-ask spreads and stabilizing prices. The synergy between algorithmic arbitrage and liquidity provision improves market efficiency and reduces transaction costs for all participants.

Key Terms

**Liquidity Provision:**

Liquidity provision involves supplying assets to decentralized exchanges or automated market makers to facilitate smooth trading and minimize price slippage. This process enhances market efficiency by ensuring constant buy and sell orders, often earning providers fees or rewards based on trading volume. Discover how liquidity provision drives decentralized finance ecosystems and benefits market participants.

Bid-Ask Spread

Liquidity provision narrows the bid-ask spread by supplying continuous buy and sell orders, enhancing market depth and reducing price volatility. Algorithmic arbitrage exploits temporary inefficiencies within the bid-ask spread to generate profits by swiftly executing trades across multiple platforms. Explore how these strategies impact market dynamics and trading efficiency in greater detail.

Order Book Depth

Liquidity provision enhances order book depth by adding limit orders that increase market stability and reduce spread volatility. Algorithmic arbitrage exploits price discrepancies across markets, often consuming liquidity quickly and causing rapid order book fluctuations. Explore detailed strategies to optimize trading performance by balancing liquidity provision and algorithmic arbitrage effects on order book dynamics.

Source and External Links

Liquidity Provision - Commercial Bank Financial Services - A Liquidity Provider is a financial institution acting as an intermediary in the securities market to enhance liquidity by increasing market depth and trading volumes for specific stocks, crucial for investors and issuers.

DeFi Basics: Liquidity Provision - EMURGO - In decentralized finance (DeFi), liquidity provision means depositing cryptocurrency into a protocol to enable token swaps, where providers earn rewards from fees collected, usually by supplying a balanced token pair to a liquidity pool managed by smart contracts.

Liquidity Provision by the Federal Reserve - Central banks provide liquidity to mitigate financial crises, balancing between supplying cash or equivalents and assessing institutions' solvency to maintain market stability through tools like open market operations and lending facilities.

dowidth.com

dowidth.com