Paper trading competitions simulate stock market scenarios allowing participants to practice strategies without financial risk, ideal for sharpening trading skills and testing decision-making. Robo-advisor competitions focus on algorithmic portfolio management, evaluating automated systems based on performance, risk management, and adaptability to market fluctuations. Explore the unique advantages and insights each competition format offers to enhance your trading approach.

Why it is important

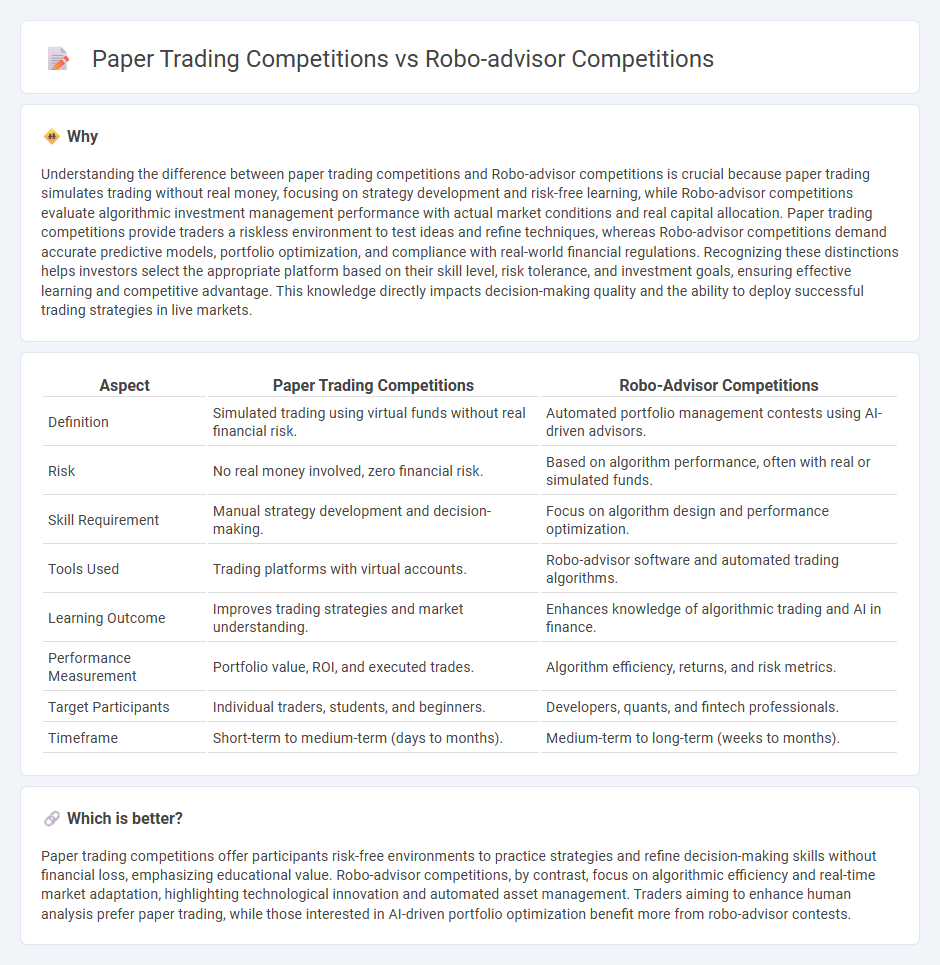

Understanding the difference between paper trading competitions and Robo-advisor competitions is crucial because paper trading simulates trading without real money, focusing on strategy development and risk-free learning, while Robo-advisor competitions evaluate algorithmic investment management performance with actual market conditions and real capital allocation. Paper trading competitions provide traders a riskless environment to test ideas and refine techniques, whereas Robo-advisor competitions demand accurate predictive models, portfolio optimization, and compliance with real-world financial regulations. Recognizing these distinctions helps investors select the appropriate platform based on their skill level, risk tolerance, and investment goals, ensuring effective learning and competitive advantage. This knowledge directly impacts decision-making quality and the ability to deploy successful trading strategies in live markets.

Comparison Table

| Aspect | Paper Trading Competitions | Robo-Advisor Competitions |

|---|---|---|

| Definition | Simulated trading using virtual funds without real financial risk. | Automated portfolio management contests using AI-driven advisors. |

| Risk | No real money involved, zero financial risk. | Based on algorithm performance, often with real or simulated funds. |

| Skill Requirement | Manual strategy development and decision-making. | Focus on algorithm design and performance optimization. |

| Tools Used | Trading platforms with virtual accounts. | Robo-advisor software and automated trading algorithms. |

| Learning Outcome | Improves trading strategies and market understanding. | Enhances knowledge of algorithmic trading and AI in finance. |

| Performance Measurement | Portfolio value, ROI, and executed trades. | Algorithm efficiency, returns, and risk metrics. |

| Target Participants | Individual traders, students, and beginners. | Developers, quants, and fintech professionals. |

| Timeframe | Short-term to medium-term (days to months). | Medium-term to long-term (weeks to months). |

Which is better?

Paper trading competitions offer participants risk-free environments to practice strategies and refine decision-making skills without financial loss, emphasizing educational value. Robo-advisor competitions, by contrast, focus on algorithmic efficiency and real-time market adaptation, highlighting technological innovation and automated asset management. Traders aiming to enhance human analysis prefer paper trading, while those interested in AI-driven portfolio optimization benefit more from robo-advisor contests.

Connection

Paper trading competitions and Robo-advisor competitions both leverage virtual environments to test and enhance trading strategies without real financial risk. Participants in paper trading competitions gain practical experience in market dynamics and risk management, while Robo-advisor competitions focus on algorithmic optimization and automated portfolio management. The data insights and strategic developments from these competitions contribute to the advancement of AI-driven trading technologies.

Key Terms

Algorithmic Strategy

Robo-advisor competitions emphasize real-time portfolio management using automated algorithmic strategies to optimize asset allocation and risk-adjusted returns, leveraging live market data for adaptive decision-making. Paper trading competitions simulate these strategies without financial risk, allowing participants to test algorithmic performance and refine models against historical or real-time data in a controlled environment. Explore how algorithmic innovations drive competitive advantage and strategic growth in robo-advisor platforms.

Backtesting

Robo-advisor competitions emphasize real-time algorithm performance and user experience, while paper trading competitions prioritize backtesting accuracy and historical data analysis to validate strategies. Backtesting in paper trading competitions enables participants to refine models by simulating trades over extensive datasets without financial risk. Explore the nuances of backtesting methods to enhance your competitive edge in both arenas.

Performance Metrics

Robo-advisor competitions prioritize real-time adaptive algorithms, emphasizing metrics like risk-adjusted returns, Sharpe ratio, and portfolio turnover, whereas paper trading competitions mainly focus on theoretical returns and benchmarking accuracy without live market pressures. Performance evaluation in robo-advisor contests includes latency, transaction costs, and user customization effectiveness, contrasting with the simplified environment of paper trading where slippage and liquidity impact are minimized. Explore the detailed differences and strategic implications of these performance metrics to optimize your investment approach.

Source and External Links

Robo-Advisor Statistics (2025) - Webflow HTML Website Template - Robo-advisor competitions include traditional financial advisor firms offering hybrid human-plus-AI models, personalized AI-driven portfolios, global market expansion especially in emerging markets, and niche-market robo-advisors focused on sustainable and demographic-specific investing.

The Best Robo-Advisors of 2025 - Morningstar - Top robo-advisors compete on factors like minimum investment, fees, portfolio customization, and availability of human advisor access, with leading firms including Vanguard Digital Advisor, Fidelity Go, and Schwab Intelligent Portfolios.

Growing competition in robo-advisory market to lead to further ... - The robo-advisory market is highly competitive, driving consolidation, innovation, and enhanced automation with sophisticated algorithms and machine learning to improve efficiency and financial inclusion globally.

dowidth.com

dowidth.com