Order flow analysis offers real-time insights into market dynamics by examining the flow of buy and sell orders to predict price movements. Gann analysis employs geometric angles and historical price patterns to forecast market trends based on time and price correlations. Explore the distinctive advantages of order flow and Gann analysis to enhance your trading strategy.

Why it is important

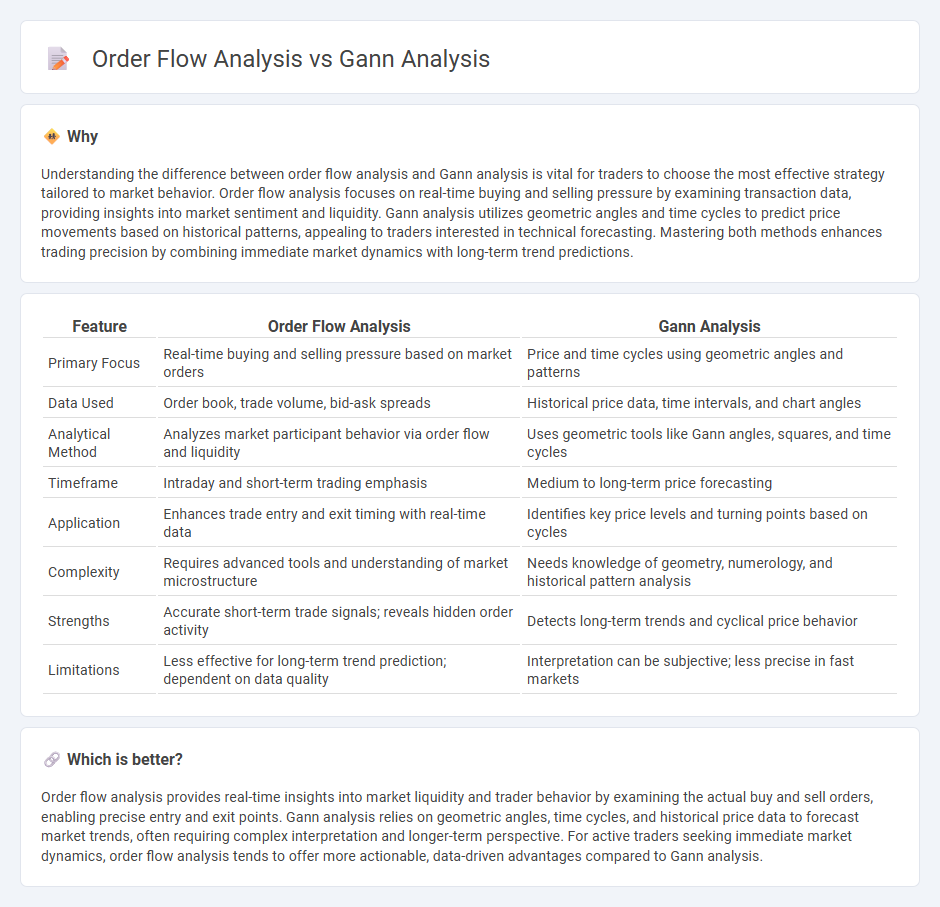

Understanding the difference between order flow analysis and Gann analysis is vital for traders to choose the most effective strategy tailored to market behavior. Order flow analysis focuses on real-time buying and selling pressure by examining transaction data, providing insights into market sentiment and liquidity. Gann analysis utilizes geometric angles and time cycles to predict price movements based on historical patterns, appealing to traders interested in technical forecasting. Mastering both methods enhances trading precision by combining immediate market dynamics with long-term trend predictions.

Comparison Table

| Feature | Order Flow Analysis | Gann Analysis |

|---|---|---|

| Primary Focus | Real-time buying and selling pressure based on market orders | Price and time cycles using geometric angles and patterns |

| Data Used | Order book, trade volume, bid-ask spreads | Historical price data, time intervals, and chart angles |

| Analytical Method | Analyzes market participant behavior via order flow and liquidity | Uses geometric tools like Gann angles, squares, and time cycles |

| Timeframe | Intraday and short-term trading emphasis | Medium to long-term price forecasting |

| Application | Enhances trade entry and exit timing with real-time data | Identifies key price levels and turning points based on cycles |

| Complexity | Requires advanced tools and understanding of market microstructure | Needs knowledge of geometry, numerology, and historical pattern analysis |

| Strengths | Accurate short-term trade signals; reveals hidden order activity | Detects long-term trends and cyclical price behavior |

| Limitations | Less effective for long-term trend prediction; dependent on data quality | Interpretation can be subjective; less precise in fast markets |

Which is better?

Order flow analysis provides real-time insights into market liquidity and trader behavior by examining the actual buy and sell orders, enabling precise entry and exit points. Gann analysis relies on geometric angles, time cycles, and historical price data to forecast market trends, often requiring complex interpretation and longer-term perspective. For active traders seeking immediate market dynamics, order flow analysis tends to offer more actionable, data-driven advantages compared to Gann analysis.

Connection

Order flow analysis provides real-time insights into market liquidity and trader behavior by examining transactions and volume data, which helps identify supply and demand imbalances. Gann analysis, based on geometric angles and time-price relationships, offers predictive frameworks for market turning points and trends. Combining order flow with Gann analysis enhances trading strategies by aligning precise entry and exit points from volume dynamics with time and price predictions.

Key Terms

Gann analysis:

Gann analysis utilizes geometric angles, time cycles, and price patterns to predict market movements, emphasizing historical price data and mathematical relationships. It contrasts with order flow analysis, which examines real-time buying and selling activity to gauge market sentiment and supply-demand dynamics. Explore the fundamentals of Gann analysis to deepen your understanding of its strategic market applications.

Time cycles

Gann analysis leverages time cycles to predict market turning points by identifying natural rhythms in price movements, relying heavily on geometric angles and historical time intervals. Order flow analysis, however, scrutinizes real-time transaction data to gauge supply and demand dynamics, offering precise insights into market momentum without explicit emphasis on time cycles. Explore deeper contrasts and applications of these methods for enhanced trading strategies.

Gann angles

Gann angles, a key element of Gann analysis, measure price movement in relation to time to identify support and resistance levels, providing traders with precise entry and exit points based on geometric and cyclical patterns. In contrast, order flow analysis examines real-time buy and sell orders to gauge market sentiment and liquidity, offering a micro-level view of market dynamics rather than time-price relationships. Explore the distinct advantages and applications of Gann angles in trading strategies by learning more about this technical analysis method.

Source and External Links

Gann Indicator Explained - Gann Indicators use geometric patterns, mathematical relationships, and timing cycles to forecast market movements by combining price, time, and shapes, with tools like Gann Angles (such as the 1x1 angle) and Gann Fans aiding traders in identifying support, resistance, and potential trend reversals.

What is Gann Theory? - Gann theory, developed by William D. Gann, claims that market prices move in predictable geometric angles and patterns, with the 1x1 angle (45 degrees) serving as a key support or resistance level, and suggests that breaking this angle signals a major market trend reversal.

Gann Fan Trading Strategy - The Gann fan strategy uses multiple angled lines drawn from significant price highs or lows to identify dynamic support and resistance levels, with the 1x1 line (45 degrees) indicating a strong trend and its breach suggesting a potential trend change.

dowidth.com

dowidth.com