Statistical arbitrage leverages mathematical models to exploit pricing inefficiencies between correlated financial instruments, often relying on mean reversion strategies within large portfolios. Dispersion trading focuses on the volatility differences between an index and its individual components, capitalizing on the spread between implied and realized volatility. Explore further to understand which approach aligns best with your trading objectives.

Why it is important

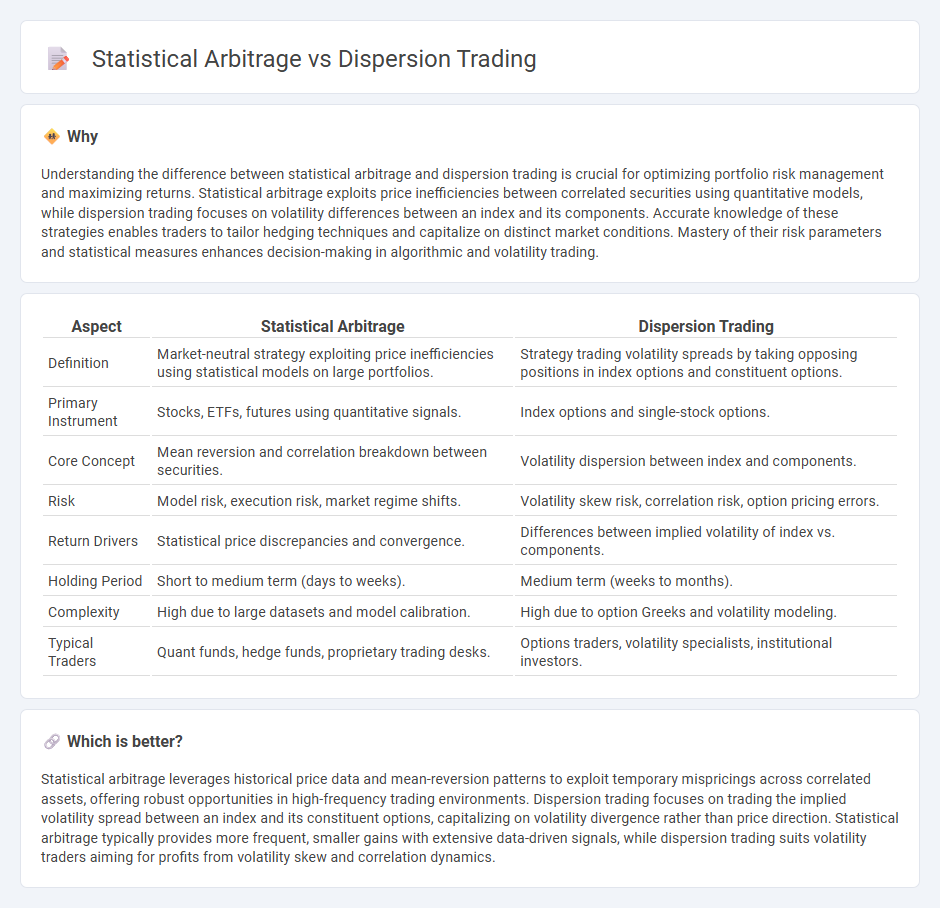

Understanding the difference between statistical arbitrage and dispersion trading is crucial for optimizing portfolio risk management and maximizing returns. Statistical arbitrage exploits price inefficiencies between correlated securities using quantitative models, while dispersion trading focuses on volatility differences between an index and its components. Accurate knowledge of these strategies enables traders to tailor hedging techniques and capitalize on distinct market conditions. Mastery of their risk parameters and statistical measures enhances decision-making in algorithmic and volatility trading.

Comparison Table

| Aspect | Statistical Arbitrage | Dispersion Trading |

|---|---|---|

| Definition | Market-neutral strategy exploiting price inefficiencies using statistical models on large portfolios. | Strategy trading volatility spreads by taking opposing positions in index options and constituent options. |

| Primary Instrument | Stocks, ETFs, futures using quantitative signals. | Index options and single-stock options. |

| Core Concept | Mean reversion and correlation breakdown between securities. | Volatility dispersion between index and components. |

| Risk | Model risk, execution risk, market regime shifts. | Volatility skew risk, correlation risk, option pricing errors. |

| Return Drivers | Statistical price discrepancies and convergence. | Differences between implied volatility of index vs. components. |

| Holding Period | Short to medium term (days to weeks). | Medium term (weeks to months). |

| Complexity | High due to large datasets and model calibration. | High due to option Greeks and volatility modeling. |

| Typical Traders | Quant funds, hedge funds, proprietary trading desks. | Options traders, volatility specialists, institutional investors. |

Which is better?

Statistical arbitrage leverages historical price data and mean-reversion patterns to exploit temporary mispricings across correlated assets, offering robust opportunities in high-frequency trading environments. Dispersion trading focuses on trading the implied volatility spread between an index and its constituent options, capitalizing on volatility divergence rather than price direction. Statistical arbitrage typically provides more frequent, smaller gains with extensive data-driven signals, while dispersion trading suits volatility traders aiming for profits from volatility skew and correlation dynamics.

Connection

Statistical arbitrage and dispersion trading both rely on identifying mispricings derived from statistical relationships among securities, where statistical arbitrage exploits mean reversion in price differences across correlated assets. Dispersion trading involves capitalizing on the variance spread between an index option and its constituent stock options, effectively applying statistical arbitrage principles to options markets by trading the implied correlation. Both strategies utilize quantitative models and historical data analysis to manage risk and enhance returns through exploiting correlation and volatility discrepancies.

Key Terms

**Dispersion Trading:**

Dispersion trading involves capitalizing on the volatility differences between an index and its component stocks by buying options on individual stocks while selling options on the index or vice versa, aiming to profit from the spread in implied correlations. This strategy requires precise correlation estimates and risk management, as it thrives in markets where stock correlations deviate from implied levels embedded in option prices. Explore further to understand how dispersion trading strategies exploit market inefficiencies and optimize hedging techniques.

Implied Correlation

Dispersion trading capitalizes on the divergence between index option implied volatility and the weighted average of individual stock volatilities, indirectly reflecting implied correlation. Statistical arbitrage leverages historical price patterns and mean-reverting relationships to exploit pricing inefficiencies across securities, often independent of correlation implied by options. Explore how implied correlation metrics uniquely impact risk management and strategy efficacy in dispersion trading.

Options Spread

Dispersion trading focuses on exploiting the difference between the implied correlation of an index option and the realized correlation of its constituent stocks, using options spreads to hedge and capture correlation risk. Statistical arbitrage relies on quantitative models to identify mispricings in options spreads based on historical price patterns and volatility, aiming for mean reversion profits. Explore detailed strategies and comparative performance metrics to deepen your understanding of options spread trading techniques.

Source and External Links

Dispersion Trading - Quantra by QuantInsti - Dispersion trading is an index arbitrage strategy involving selling options on an index and buying options on its component stocks, profiting when individual stocks are less correlated and exhibit dispersed returns compared to the index.

How To Trade Stock Dispersion With Options - Cboe Global Markets - Dispersion trading involves buying straddles on individual stocks in an index while selling straddles on the index itself, aiming to profit from how dispersed individual stock returns are relative to the index return over time.

Backtesting Dispersion Trading Chapter I - BSIC - Dispersion trading profits arise from the correlation risk premium embedded in index options and involve selling index straddles while buying straddles on components to exploit differences between implied correlation (in index options) and realized correlation among stocks.

dowidth.com

dowidth.com