On-chain analytics examines blockchain data such as transaction volumes, wallet activity, and network health to provide real-time insights into market trends and asset movements. Fundamental analysis evaluates the intrinsic value of an asset by studying financial statements, industry conditions, and macroeconomic factors to predict long-term performance. Explore the strengths and applications of both methods to enhance your trading strategy.

Why it is important

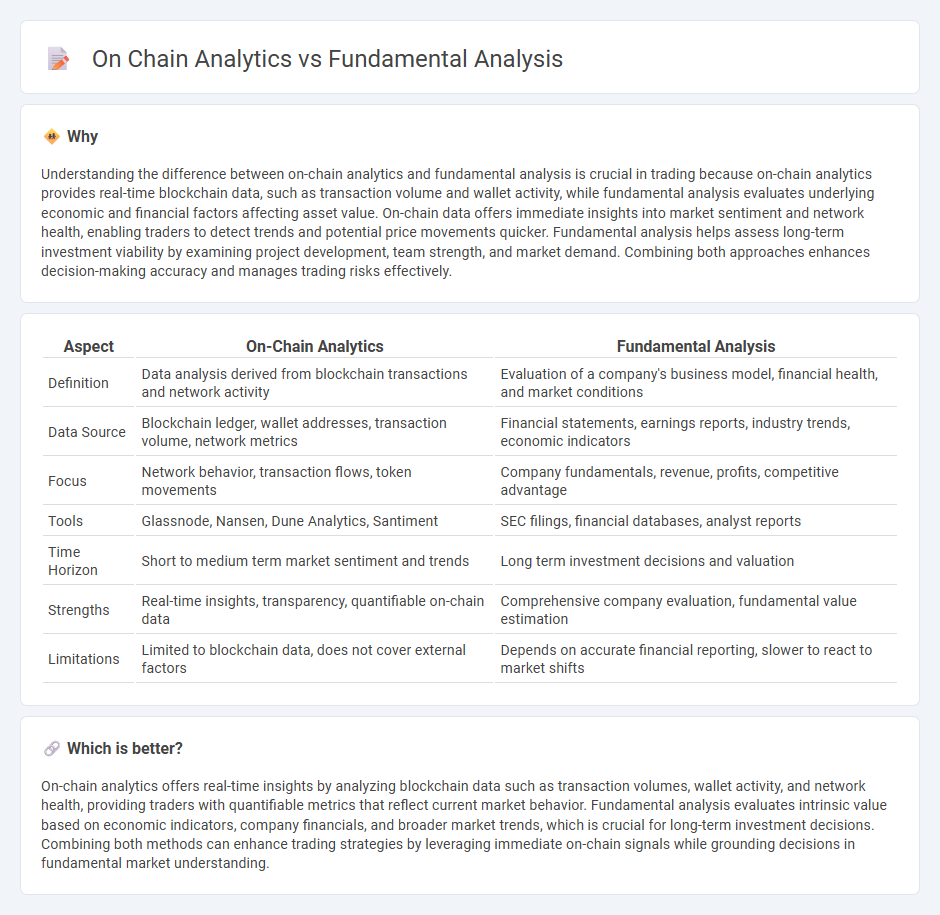

Understanding the difference between on-chain analytics and fundamental analysis is crucial in trading because on-chain analytics provides real-time blockchain data, such as transaction volume and wallet activity, while fundamental analysis evaluates underlying economic and financial factors affecting asset value. On-chain data offers immediate insights into market sentiment and network health, enabling traders to detect trends and potential price movements quicker. Fundamental analysis helps assess long-term investment viability by examining project development, team strength, and market demand. Combining both approaches enhances decision-making accuracy and manages trading risks effectively.

Comparison Table

| Aspect | On-Chain Analytics | Fundamental Analysis |

|---|---|---|

| Definition | Data analysis derived from blockchain transactions and network activity | Evaluation of a company's business model, financial health, and market conditions |

| Data Source | Blockchain ledger, wallet addresses, transaction volume, network metrics | Financial statements, earnings reports, industry trends, economic indicators |

| Focus | Network behavior, transaction flows, token movements | Company fundamentals, revenue, profits, competitive advantage |

| Tools | Glassnode, Nansen, Dune Analytics, Santiment | SEC filings, financial databases, analyst reports |

| Time Horizon | Short to medium term market sentiment and trends | Long term investment decisions and valuation |

| Strengths | Real-time insights, transparency, quantifiable on-chain data | Comprehensive company evaluation, fundamental value estimation |

| Limitations | Limited to blockchain data, does not cover external factors | Depends on accurate financial reporting, slower to react to market shifts |

Which is better?

On-chain analytics offers real-time insights by analyzing blockchain data such as transaction volumes, wallet activity, and network health, providing traders with quantifiable metrics that reflect current market behavior. Fundamental analysis evaluates intrinsic value based on economic indicators, company financials, and broader market trends, which is crucial for long-term investment decisions. Combining both methods can enhance trading strategies by leveraging immediate on-chain signals while grounding decisions in fundamental market understanding.

Connection

On-chain analytics provides real-time blockchain data such as transaction volumes, wallet activity, and token flows, offering objective insights into a cryptocurrency's market behavior. Fundamental analysis evaluates a project's intrinsic value by examining technology, team, adoption, and market potential. Combining on-chain analytics with fundamental analysis enables traders to identify strong investment opportunities and assess market sentiment more accurately.

Key Terms

**Fundamental Analysis:**

Fundamental analysis evaluates a cryptocurrency's intrinsic value by examining factors such as project technology, team expertise, market demand, tokenomics, and regulatory environment. This approach contrasts with on-chain analytics, which focuses on blockchain data like transaction volume, wallet activity, and network health to gauge real-time asset performance. Explore deeper insights on how fundamental analysis drives long-term investment decisions in the crypto space.

Earnings Reports

Earnings reports provide critical financial insights such as revenue, net income, and earnings per share, essential for fundamental analysis to evaluate a company's profitability and growth potential. On-chain analytics, however, offer real-time blockchain data like transaction volumes and wallet activity, delivering a unique perspective on decentralized finance and investor behavior. Explore deeper to understand how integrating both approaches can enhance investment decisions.

Price-to-Earnings Ratio (P/E)

Fundamental analysis evaluates a company's intrinsic value using metrics like the Price-to-Earnings Ratio (P/E) to assess profitability relative to its stock price. On-chain analytics examines blockchain transaction data to gain insights into asset behavior, liquidity, and investor sentiment, complementing traditional valuation methods. Explore how integrating on-chain data with fundamental analysis can enhance investment strategies.

Source and External Links

Fundamental Analysis - Corporate Finance Institute - Fundamental analysis is a method to assess the intrinsic value of a security by analyzing macroeconomic and microeconomic factors, comparing this intrinsic value to market price to make investment decisions, using a top-down or bottom-up approach focusing on economic health, industry, and company specifics.

Fundamental analysis - Wikipedia - Fundamental analysis involves evaluating economic, industry, and company data to determine a security's intrinsic value, guiding buy, hold, or sell decisions based on whether the intrinsic value is above, equal to, or below the market price.

Beginners Guide to Fundamental Analysis | Learn to Trade - Oanda - Fundamental analysis assesses an asset's strength by analyzing factors from macroeconomic impacts (top-down) to instrument-specific details (bottom-up), focusing on how events drive supply, demand, and price movements, especially in currencies and commodities.

dowidth.com

dowidth.com