High-frequency scalp bots execute numerous rapid trades to capitalize on minute price fluctuations, maximizing profits through speed and precision. Trend-following bots analyze market momentum and hold positions longer to capture significant price movements aligned with prevailing market trends. Explore the strategies and advantages of each bot to enhance your trading performance.

Why it is important

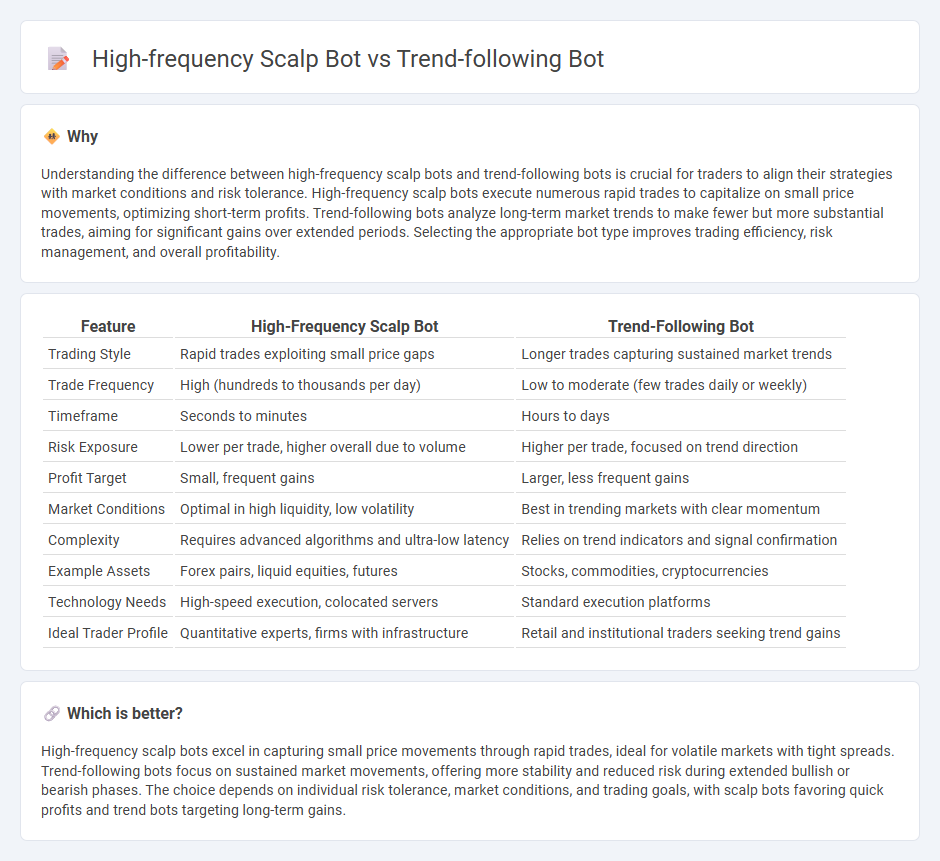

Understanding the difference between high-frequency scalp bots and trend-following bots is crucial for traders to align their strategies with market conditions and risk tolerance. High-frequency scalp bots execute numerous rapid trades to capitalize on small price movements, optimizing short-term profits. Trend-following bots analyze long-term market trends to make fewer but more substantial trades, aiming for significant gains over extended periods. Selecting the appropriate bot type improves trading efficiency, risk management, and overall profitability.

Comparison Table

| Feature | High-Frequency Scalp Bot | Trend-Following Bot |

|---|---|---|

| Trading Style | Rapid trades exploiting small price gaps | Longer trades capturing sustained market trends |

| Trade Frequency | High (hundreds to thousands per day) | Low to moderate (few trades daily or weekly) |

| Timeframe | Seconds to minutes | Hours to days |

| Risk Exposure | Lower per trade, higher overall due to volume | Higher per trade, focused on trend direction |

| Profit Target | Small, frequent gains | Larger, less frequent gains |

| Market Conditions | Optimal in high liquidity, low volatility | Best in trending markets with clear momentum |

| Complexity | Requires advanced algorithms and ultra-low latency | Relies on trend indicators and signal confirmation |

| Example Assets | Forex pairs, liquid equities, futures | Stocks, commodities, cryptocurrencies |

| Technology Needs | High-speed execution, colocated servers | Standard execution platforms |

| Ideal Trader Profile | Quantitative experts, firms with infrastructure | Retail and institutional traders seeking trend gains |

Which is better?

High-frequency scalp bots excel in capturing small price movements through rapid trades, ideal for volatile markets with tight spreads. Trend-following bots focus on sustained market movements, offering more stability and reduced risk during extended bullish or bearish phases. The choice depends on individual risk tolerance, market conditions, and trading goals, with scalp bots favoring quick profits and trend bots targeting long-term gains.

Connection

High-frequency scalp bots and trend-following bots both utilize algorithmic trading strategies to exploit market movements, but they differ in time horizons and tactics. High-frequency scalp bots execute numerous rapid trades to capture small price discrepancies, while trend-following bots analyze longer-term market trends to capitalize on sustained price movements. Their connection lies in leveraging advanced data analytics and real-time market signals to optimize trade execution and risk management.

Key Terms

**Trend-following bot:**

Trend-following bots analyze market momentum by tracking moving averages and price trends to make systematic trades that capitalize on sustained directional movements. These bots typically operate on longer timeframes, reducing noise and emphasizing market persistence, which helps in minimizing frequent trades and transaction costs. Explore how trend-following algorithms can enhance your trading strategy by adapting to evolving market conditions.

Moving Average

Trend-following bots leverage Moving Averages (MA) to identify sustained market directions by analyzing long-term price trends, enabling them to enter trades aligned with dominant market momentum. High-frequency scalp bots utilize shorter time-frame Moving Averages to execute rapid trades, capitalizing on minor price fluctuations and tight spreads for quick profit accumulation. Explore the strategic differences in MA implementation between these bots to optimize your automated trading approach.

Breakout

Trend-following bots leverage breakout strategies by identifying significant price movements beyond established support or resistance levels, aiming to capture sustained market trends. High-frequency scalp bots execute rapid trades around breakouts, exploiting minute price fluctuations for quick profits through high trade volumes and low latency execution. Explore detailed performance comparisons and strategy optimizations to understand which breakout approach suits your trading goals.

Source and External Links

Discover Trend-Following Bots: Boost Your Trading Efficiency - Trend-following bots are automated trading systems that analyze real-time and historical market data to detect trends and execute trades based on algorithmic strategies, providing emotion-free, consistent, and customizable trading with risk management tools like stop-loss orders.

Trend Following Bot Development That Turns Trends Into Profit - In crypto markets, trend-following bots automatically identify upward or downward price trends using technical indicators such as moving averages and momentum indicators, enabling efficient 24/7 trading and reducing emotional decision-making by executing trades aligned with market movements.

Trend Following Trading Bot | Ride Market Trends with 3Commas - These bots monitor technical signals to detect new trends and enter trades using various indicators, featuring trailing stop loss and take profit options, supporting strategies that range from days to months, suitable for beginner to intermediate traders, and integrate with tools like TradingView for automated strategy execution.

dowidth.com

dowidth.com