Prop firm challenges provide traders with funded accounts and real market conditions, demanding strict risk management and profit targets within set timeframes. Demo trading offers a risk-free environment to practice strategies but lacks the emotional intensity and real capital pressure of live trading. Explore how prop firm challenges sharpen trader skills and offer career opportunities beyond demo platforms.

Why it is important

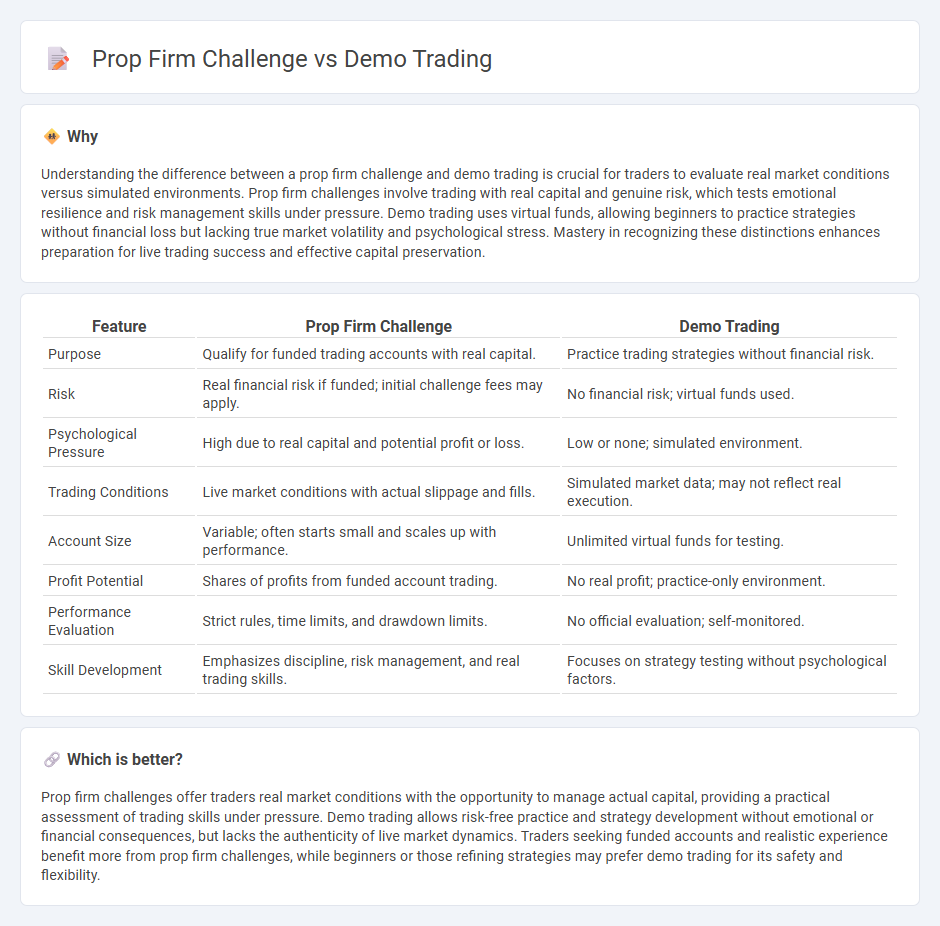

Understanding the difference between a prop firm challenge and demo trading is crucial for traders to evaluate real market conditions versus simulated environments. Prop firm challenges involve trading with real capital and genuine risk, which tests emotional resilience and risk management skills under pressure. Demo trading uses virtual funds, allowing beginners to practice strategies without financial loss but lacking true market volatility and psychological stress. Mastery in recognizing these distinctions enhances preparation for live trading success and effective capital preservation.

Comparison Table

| Feature | Prop Firm Challenge | Demo Trading |

|---|---|---|

| Purpose | Qualify for funded trading accounts with real capital. | Practice trading strategies without financial risk. |

| Risk | Real financial risk if funded; initial challenge fees may apply. | No financial risk; virtual funds used. |

| Psychological Pressure | High due to real capital and potential profit or loss. | Low or none; simulated environment. |

| Trading Conditions | Live market conditions with actual slippage and fills. | Simulated market data; may not reflect real execution. |

| Account Size | Variable; often starts small and scales up with performance. | Unlimited virtual funds for testing. |

| Profit Potential | Shares of profits from funded account trading. | No real profit; practice-only environment. |

| Performance Evaluation | Strict rules, time limits, and drawdown limits. | No official evaluation; self-monitored. |

| Skill Development | Emphasizes discipline, risk management, and real trading skills. | Focuses on strategy testing without psychological factors. |

Which is better?

Prop firm challenges offer traders real market conditions with the opportunity to manage actual capital, providing a practical assessment of trading skills under pressure. Demo trading allows risk-free practice and strategy development without emotional or financial consequences, but lacks the authenticity of live market dynamics. Traders seeking funded accounts and realistic experience benefit more from prop firm challenges, while beginners or those refining strategies may prefer demo trading for its safety and flexibility.

Connection

Prop firm challenges simulate real-market conditions through demo trading platforms, allowing traders to showcase their skills without risking actual capital. Performance in these demo accounts is evaluated based on profit targets, risk management, and consistency to qualify for funding. This connection provides a risk-free environment to demonstrate trading strategies before managing live funds.

Key Terms

Virtual Funds

Demo trading offers beginners virtual funds to practice strategies without risking real money, providing a risk-free learning environment. Prop firm challenges also use virtual funds but add the pressure of performance targets and potential career opportunities upon success. Explore our detailed guide to understand how virtual funds impact your trading journey with demo accounts and prop firm challenges.

Evaluation Metrics

Demo trading evaluates performance without financial risk, tracking metrics like profit consistency, drawdown, and trade accuracy to simulate real market conditions. Prop firm challenges emphasize stringent evaluation criteria, including achieving specific profit targets, adhering to risk management rules, and maintaining a disciplined trading approach under live account constraints. Explore detailed comparisons to understand how evaluation metrics impact your trading career prospects.

Drawdown Limits

Drawdown limits in demo trading are often more lenient, allowing traders to experiment without the consequence of real financial loss. Prop firm challenges enforce stricter drawdown thresholds to simulate live market conditions and protect the firm's capital. Explore the detailed differences and strategies to manage drawdown effectively in both scenarios.

Source and External Links

Demo Trading Account | Binary Options Demo | No Minimum Deposit - Offers a free demo trading account with $10,000 in virtual funds to practice binary options, knock-outs, and call spreads on a regulated exchange, accessible via desktop and mobile platforms and designed for testing trading strategies and managing risk effectively.

Practice on a Demo Trading Account - Exness - Provides a risk-free demo account to sharpen trading skills and strategies across global markets by using platforms like MetaTrader 4 and 5, with identical conditions as live accounts and available on desktop and mobile.

Demo Trading Account: Try IG's Paper Trading Simulator - A simulated trading environment offering access to over 17,000 markets including stocks, forex, and CFDs, enabling users to practice trading, use alerts, analyze charts, and trade via MT4 without financial risk.

dowidth.com

dowidth.com