Dark pool prints provide insights into large, anonymous trades executed off public exchanges, revealing hidden liquidity and price movements. Institutional order flow represents the aggregated buying and selling activity from major financial players that can influence market trends and volatility. Discover how understanding these elements can enhance your trading strategy.

Why it is important

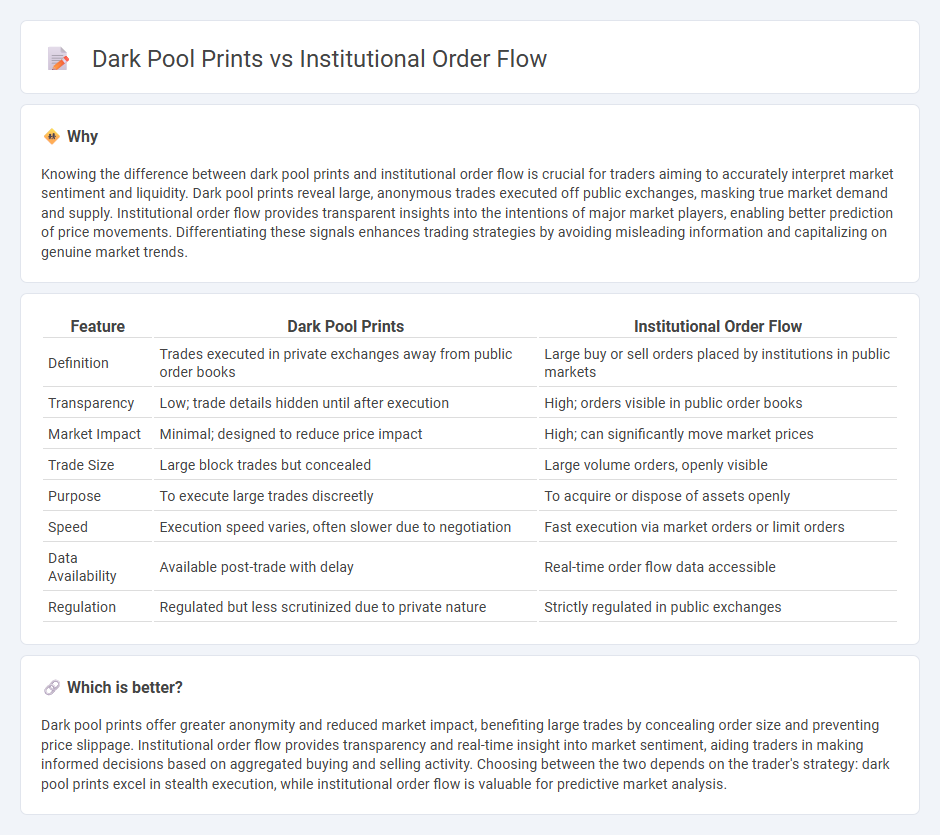

Knowing the difference between dark pool prints and institutional order flow is crucial for traders aiming to accurately interpret market sentiment and liquidity. Dark pool prints reveal large, anonymous trades executed off public exchanges, masking true market demand and supply. Institutional order flow provides transparent insights into the intentions of major market players, enabling better prediction of price movements. Differentiating these signals enhances trading strategies by avoiding misleading information and capitalizing on genuine market trends.

Comparison Table

| Feature | Dark Pool Prints | Institutional Order Flow |

|---|---|---|

| Definition | Trades executed in private exchanges away from public order books | Large buy or sell orders placed by institutions in public markets |

| Transparency | Low; trade details hidden until after execution | High; orders visible in public order books |

| Market Impact | Minimal; designed to reduce price impact | High; can significantly move market prices |

| Trade Size | Large block trades but concealed | Large volume orders, openly visible |

| Purpose | To execute large trades discreetly | To acquire or dispose of assets openly |

| Speed | Execution speed varies, often slower due to negotiation | Fast execution via market orders or limit orders |

| Data Availability | Available post-trade with delay | Real-time order flow data accessible |

| Regulation | Regulated but less scrutinized due to private nature | Strictly regulated in public exchanges |

Which is better?

Dark pool prints offer greater anonymity and reduced market impact, benefiting large trades by concealing order size and preventing price slippage. Institutional order flow provides transparency and real-time insight into market sentiment, aiding traders in making informed decisions based on aggregated buying and selling activity. Choosing between the two depends on the trader's strategy: dark pool prints excel in stealth execution, while institutional order flow is valuable for predictive market analysis.

Connection

Dark pool prints represent large block trades executed off public exchanges, providing institutional investors with anonymity to minimize market impact. Institutional order flow drives these dark pool transactions by aggregating significant buy or sell orders from hedge funds, mutual funds, and pension funds. Monitoring dark pool prints helps traders infer institutional sentiment and anticipate price movements before they appear on lit markets.

Key Terms

Liquidity

Institutional order flow represents large blocks of trades executed directly in public exchanges, providing transparent liquidity signals crucial for market participants. Dark pool prints, however, occur in private trading venues where large orders are matched anonymously, offering reduced market impact but limited visible liquidity data. Explore the nuances of liquidity dynamics between these trading methods to enhance your market strategy.

Block Trades

Institutional order flow represents large buy or sell orders executed by financial institutions, providing transparent market signals, whereas dark pool prints involve block trades executed in private exchanges to minimize market impact and preserve anonymity. Block trades refer to substantial share transactions often taking place in dark pools, significantly affecting market liquidity and price discovery when revealed. Explore the nuances of block trades in institutional order flow and dark pool prints to better understand market dynamics.

Transparency

Institutional order flow provides transparent insights into large trades executed on public exchanges, reflecting market sentiment with clear visibility into trade sizes and prices. Dark pool prints, however, involve off-exchange transactions designed to minimize market impact and maintain anonymity, often leading to less transparency and potential information asymmetry. Explore how transparency in these trading methods affects market efficiency and decision-making processes.

Source and External Links

Unlock the Power of Institutional Order Flow - Opofinance Blog - Institutional order flow refers to the large-scale buying and selling activity by financial institutions in the forex market, which significantly impacts price movements, liquidity, trend creation, market sentiment, and volatility through their sizable orders and market influence.

Bullish and Bearish Order Flow - SMC & ICT trading - Writo-Finance - Institutional order flow reflects the gradual accumulation and distribution of large positions by smart money, visible through order blocks on charts which mark key areas of institutional interest where price momentum shifts occur.

Institutional Order Flow Trading | PDF - Scribd - Order flow trading uses concepts like bullish and bearish order blocks to identify price manipulation by institutions, revealing directional bias and potential trading setups based on how price reacts around these blocks.

dowidth.com

dowidth.com