Zero Knowledge Proof (ZKP) trading enhances privacy by allowing transaction verification without revealing sensitive data, ensuring secure and confidential asset exchanges. Decentralized Exchange (DEX) trading operates on blockchain networks, removing intermediaries and enabling peer-to-peer transactions with enhanced transparency and control. Explore how these innovative trading methods redefine security and user empowerment in modern finance.

Why it is important

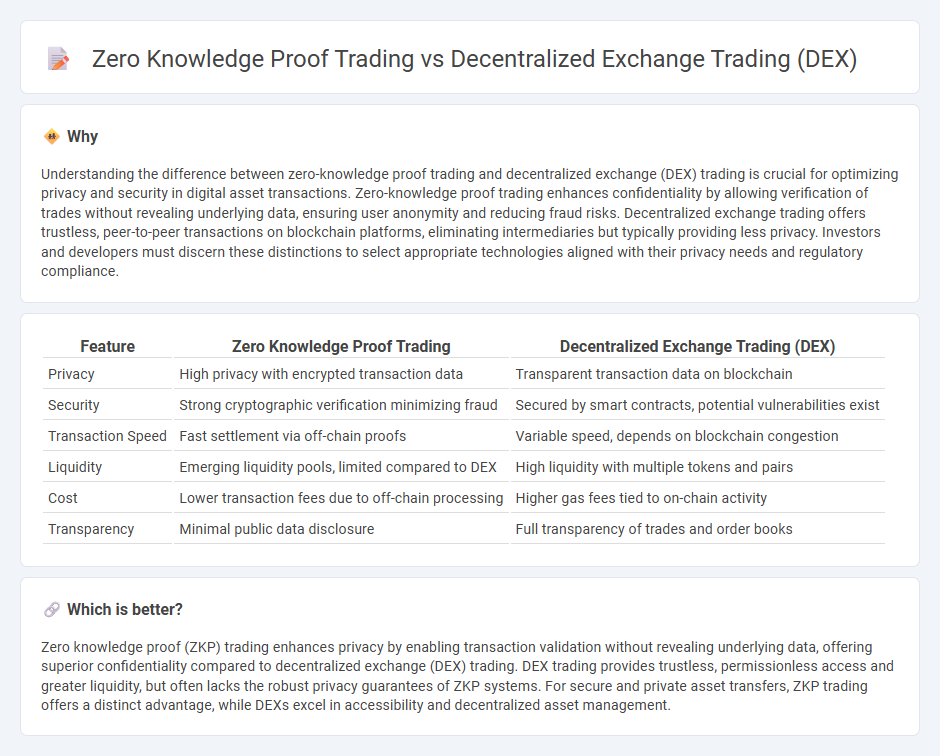

Understanding the difference between zero-knowledge proof trading and decentralized exchange (DEX) trading is crucial for optimizing privacy and security in digital asset transactions. Zero-knowledge proof trading enhances confidentiality by allowing verification of trades without revealing underlying data, ensuring user anonymity and reducing fraud risks. Decentralized exchange trading offers trustless, peer-to-peer transactions on blockchain platforms, eliminating intermediaries but typically providing less privacy. Investors and developers must discern these distinctions to select appropriate technologies aligned with their privacy needs and regulatory compliance.

Comparison Table

| Feature | Zero Knowledge Proof Trading | Decentralized Exchange Trading (DEX) |

|---|---|---|

| Privacy | High privacy with encrypted transaction data | Transparent transaction data on blockchain |

| Security | Strong cryptographic verification minimizing fraud | Secured by smart contracts, potential vulnerabilities exist |

| Transaction Speed | Fast settlement via off-chain proofs | Variable speed, depends on blockchain congestion |

| Liquidity | Emerging liquidity pools, limited compared to DEX | High liquidity with multiple tokens and pairs |

| Cost | Lower transaction fees due to off-chain processing | Higher gas fees tied to on-chain activity |

| Transparency | Minimal public data disclosure | Full transparency of trades and order books |

Which is better?

Zero knowledge proof (ZKP) trading enhances privacy by enabling transaction validation without revealing underlying data, offering superior confidentiality compared to decentralized exchange (DEX) trading. DEX trading provides trustless, permissionless access and greater liquidity, but often lacks the robust privacy guarantees of ZKP systems. For secure and private asset transfers, ZKP trading offers a distinct advantage, while DEXs excel in accessibility and decentralized asset management.

Connection

Zero-knowledge proof trading enhances decentralized exchange (DEX) trading by enabling secure and private transaction verification without revealing sensitive trade details. This cryptographic technology ensures trustless interactions on DEX platforms by proving the validity of trades while maintaining user confidentiality. Integrating zero-knowledge proofs within DEX frameworks significantly boosts transaction privacy and scalability, addressing common challenges faced by decentralized trading ecosystems.

Key Terms

Liquidity Pools

Liquidity pools in decentralized exchanges (DEX) facilitate seamless token swaps by locking assets in smart contracts, enhancing trading efficiency and reducing reliance on order books. Zero-knowledge proof (ZKP) trading leverages cryptographic methods to validate transactions within liquidity pools without revealing sensitive information, boosting privacy and security. Discover how these innovative mechanisms transform liquidity pools and empower decentralized finance protocols.

Privacy/Anonymity

Decentralized exchange (DEX) trading ensures privacy by enabling users to trade assets directly from their wallets without intermediaries, reducing exposure of personal data. Zero-knowledge proof trading enhances anonymity by cryptographically verifying transactions without revealing sensitive information, providing robust privacy guarantees beyond typical DEX capabilities. Discover how zero-knowledge proofs can transform the future of private trading by exploring their integration with decentralized finance platforms.

Smart Contracts

Decentralized exchange trading (DEX) leverages smart contracts to facilitate peer-to-peer asset swaps without intermediaries, ensuring transparency and security through blockchain execution. Zero-knowledge proof (ZKP) trading enhances privacy by enabling transaction validation on smart contracts without revealing sensitive information, thus combining confidentiality with trustless verification. Explore how smart contracts innovate the intersection of DEX and ZKP to revolutionize secure, private trading.

Source and External Links

What Is a DEX (Decentralized Exchange)? - Chainlink - A decentralized exchange (DEX) is a peer-to-peer marketplace where users trade cryptocurrencies in a non-custodial manner through blockchain-based smart contracts, eliminating intermediaries and offering complete transparency, reduced counterparty risk, and decentralization benefits.

The Ins and Outs of Decentralized Exchanges (DEXs) - Hedera - DEXs use smart contracts to enable direct crypto trading from users' wallets without intermediaries, providing privacy and control over private keys, with types including automated market makers, order books, and aggregators.

What is a DEX? - Coinbase - Decentralized exchanges operate via smart contracts and liquidity pools on blockchain directly, enabling crypto-to-crypto trades without centralized order books, making transactions transparent and modifiable through open-source code.

dowidth.com

dowidth.com