Trade journaling software offers traders a comprehensive platform to record, analyze, and optimize their trading performance using detailed metrics and personalized insights. Trading signal services provide real-time market alerts and actionable trade recommendations generated by algorithms or expert analysts to guide decision-making. Explore the advantages and features of both tools to enhance your trading strategy effectively.

Why it is important

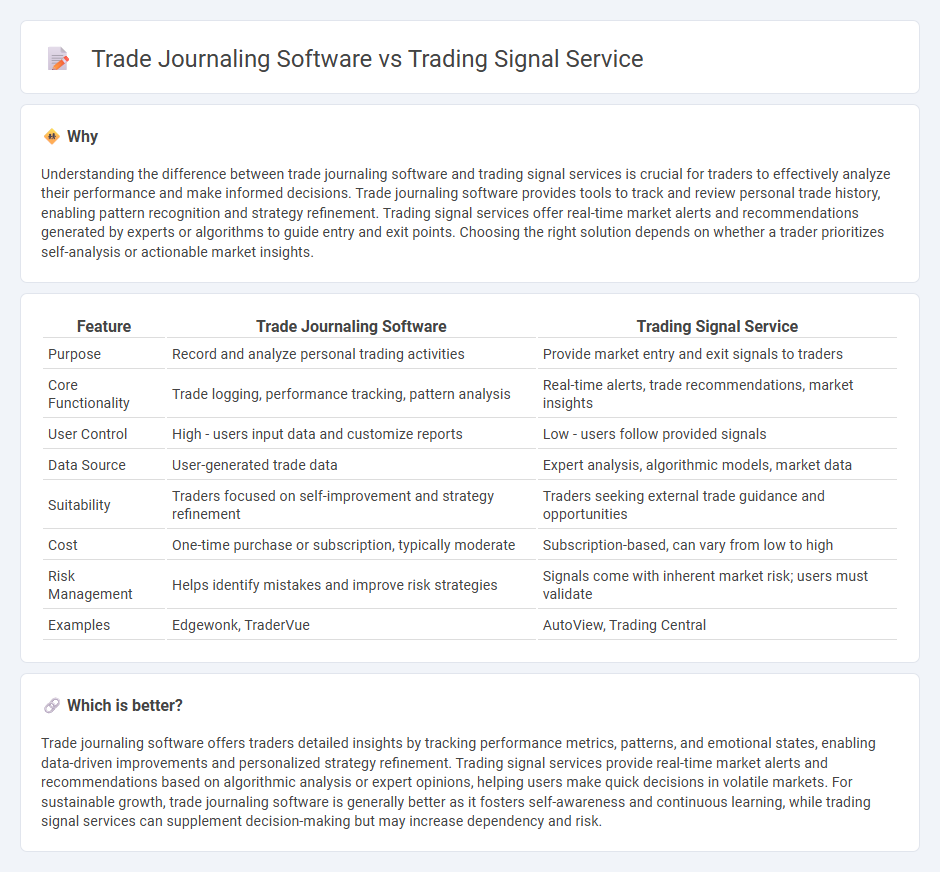

Understanding the difference between trade journaling software and trading signal services is crucial for traders to effectively analyze their performance and make informed decisions. Trade journaling software provides tools to track and review personal trade history, enabling pattern recognition and strategy refinement. Trading signal services offer real-time market alerts and recommendations generated by experts or algorithms to guide entry and exit points. Choosing the right solution depends on whether a trader prioritizes self-analysis or actionable market insights.

Comparison Table

| Feature | Trade Journaling Software | Trading Signal Service |

|---|---|---|

| Purpose | Record and analyze personal trading activities | Provide market entry and exit signals to traders |

| Core Functionality | Trade logging, performance tracking, pattern analysis | Real-time alerts, trade recommendations, market insights |

| User Control | High - users input data and customize reports | Low - users follow provided signals |

| Data Source | User-generated trade data | Expert analysis, algorithmic models, market data |

| Suitability | Traders focused on self-improvement and strategy refinement | Traders seeking external trade guidance and opportunities |

| Cost | One-time purchase or subscription, typically moderate | Subscription-based, can vary from low to high |

| Risk Management | Helps identify mistakes and improve risk strategies | Signals come with inherent market risk; users must validate |

| Examples | Edgewonk, TraderVue | AutoView, Trading Central |

Which is better?

Trade journaling software offers traders detailed insights by tracking performance metrics, patterns, and emotional states, enabling data-driven improvements and personalized strategy refinement. Trading signal services provide real-time market alerts and recommendations based on algorithmic analysis or expert opinions, helping users make quick decisions in volatile markets. For sustainable growth, trade journaling software is generally better as it fosters self-awareness and continuous learning, while trading signal services can supplement decision-making but may increase dependency and risk.

Connection

Trade journaling software and trading signal services are interconnected through their shared goal of enhancing trading performance by providing actionable insights and tracking market signals. Trade journaling software records detailed transaction data, enabling traders to analyze outcomes and refine strategies based on signals received from trading signal services. Integrating these tools allows for systematic evaluation of signal effectiveness, improving decision-making and risk management in trading activities.

Key Terms

**Trading Signal Service:**

Trading signal services provide real-time market alerts based on algorithmic analysis and expert insights, enabling traders to execute timely decisions without extensive market research. These services often include actionable buy or sell signals for various assets like stocks, forex, and cryptocurrencies, enhancing trade precision and minimizing emotional bias. Explore how trading signal services can optimize your strategy and boost profitability.

Signal Provider

A trading signal service delivers real-time market alerts generated by professional analysts or algorithms, enabling traders to execute informed buy or sell decisions promptly. Trade journaling software primarily focuses on capturing and analyzing a trader's own transactions to identify patterns and improve strategy over time. Explore how signal providers enhance trading accuracy and timing to boost your market performance.

Entry/Exit Alerts

Trading signal services provide real-time entry and exit alerts generated by algorithms or expert analysts to help traders make timely decisions and maximize profit opportunities. Trade journaling software, on the other hand, records past trades and performance metrics but does not actively deliver alerts, serving primarily as a tool for analysis and improvement. Discover how leveraging entry/exit alerts can enhance your trading strategy effectiveness by exploring the key differences in these tools.

Source and External Links

Best Forex Signal Providers 2025 - Myfxbook.com - Offers various Forex signal services including Signals365, 1000pipBuilder, and Market Expert Group that provide real-time trade alerts with entry, stop loss, and take profit levels, plus educational support and multiple delivery platforms.

Choose Your Forex Signal Service | Free 8-day trial - Provides Forex trade signals featuring precise entry points, stop loss, and take profit levels with real-time updates via SMS, email, and a cloud-based platform accessible on any device.

Best Forex Trading Signals for 2025 - FXLeaders - Delivers live, highly accurate Forex signals generated by over 10 expert analysts combining technical indicators, AI algorithms, and fundamental analysis, with real-time alerts and easy-to-follow trade instructions for all trader levels.

dowidth.com

dowidth.com