Airdrop farming involves collecting free tokens distributed by blockchain projects to promote adoption, whereas yield farming focuses on earning interest or rewards by staking or lending crypto assets within decentralized finance (DeFi) protocols. Both strategies provide passive income opportunities but differ in risk, effort, and potential returns. Explore these methods further to optimize your trading portfolio effectively.

Why it is important

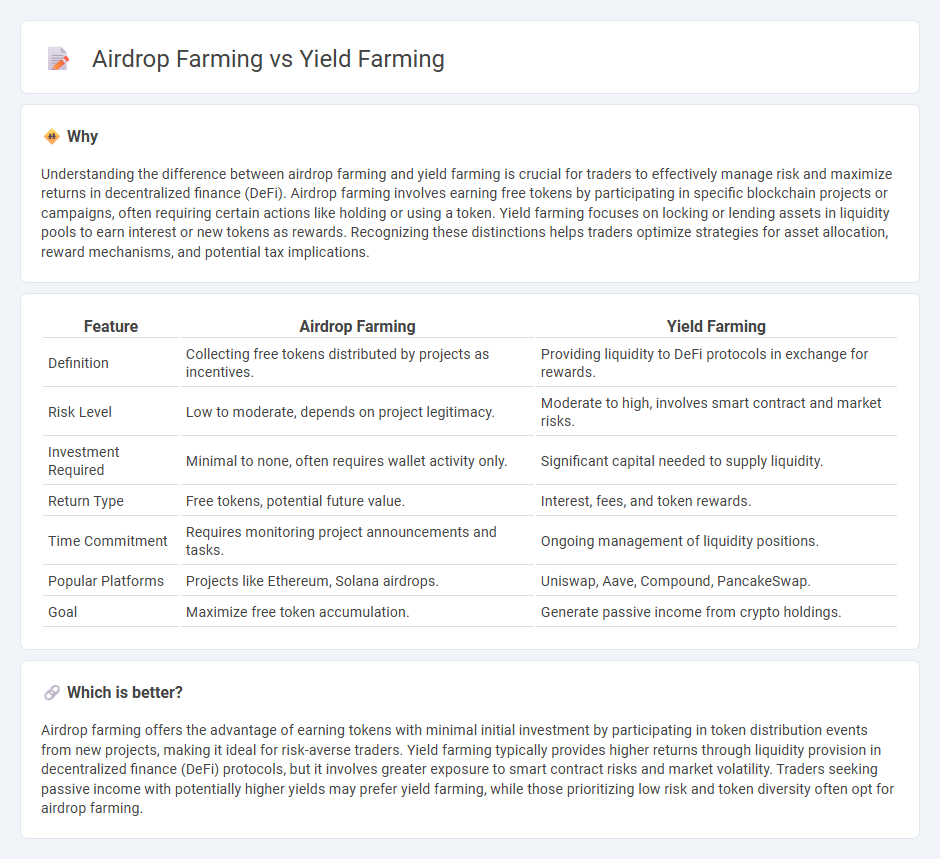

Understanding the difference between airdrop farming and yield farming is crucial for traders to effectively manage risk and maximize returns in decentralized finance (DeFi). Airdrop farming involves earning free tokens by participating in specific blockchain projects or campaigns, often requiring certain actions like holding or using a token. Yield farming focuses on locking or lending assets in liquidity pools to earn interest or new tokens as rewards. Recognizing these distinctions helps traders optimize strategies for asset allocation, reward mechanisms, and potential tax implications.

Comparison Table

| Feature | Airdrop Farming | Yield Farming |

|---|---|---|

| Definition | Collecting free tokens distributed by projects as incentives. | Providing liquidity to DeFi protocols in exchange for rewards. |

| Risk Level | Low to moderate, depends on project legitimacy. | Moderate to high, involves smart contract and market risks. |

| Investment Required | Minimal to none, often requires wallet activity only. | Significant capital needed to supply liquidity. |

| Return Type | Free tokens, potential future value. | Interest, fees, and token rewards. |

| Time Commitment | Requires monitoring project announcements and tasks. | Ongoing management of liquidity positions. |

| Popular Platforms | Projects like Ethereum, Solana airdrops. | Uniswap, Aave, Compound, PancakeSwap. |

| Goal | Maximize free token accumulation. | Generate passive income from crypto holdings. |

Which is better?

Airdrop farming offers the advantage of earning tokens with minimal initial investment by participating in token distribution events from new projects, making it ideal for risk-averse traders. Yield farming typically provides higher returns through liquidity provision in decentralized finance (DeFi) protocols, but it involves greater exposure to smart contract risks and market volatility. Traders seeking passive income with potentially higher yields may prefer yield farming, while those prioritizing low risk and token diversity often opt for airdrop farming.

Connection

Airdrop farming and yield farming intersect through decentralized finance (DeFi) protocols that reward users with tokens for participating in liquidity provision and governance activities. Both strategies leverage blockchain incentives, where airdrops distribute tokens to active users while yield farming maximizes returns via staking or lending assets in DeFi pools. Engaging in yield farming often qualifies participants for potential airdrops, linking user activity across DeFi ecosystems.

Key Terms

Liquidity Provision (Yield Farming)

Yield farming involves providing liquidity to decentralized finance (DeFi) protocols, allowing users to earn rewards through transaction fees and incentive tokens by staking their assets in liquidity pools. This method emphasizes unlocking capital efficiency by supplying token pairs to automated market makers (AMMs) such as Uniswap or SushiSwap, enhancing market liquidity. Explore more about how yield farming strategies can maximize returns in DeFi ecosystems.

Token Distribution (Airdrop Farming)

Token distribution in airdrop farming involves allocating free tokens to users based on specific criteria such as holding certain cryptocurrencies or participating in platform activities, promoting wider adoption and network effects. Unlike yield farming, which primarily focuses on earning returns through staking or liquidity provision, airdrop farming rewards users without requiring capital investment, emphasizing community growth and token decentralization. Explore deeper strategies and benefits of airdrop farming to optimize your token acquisition and participation in emerging blockchain projects.

Reward Mechanism

Yield farming involves providing liquidity to decentralized finance (DeFi) protocols in exchange for interest or token rewards, often reflecting a share of the platform's fees or new token emissions. Airdrop farming entails holding or interacting with specific blockchain assets or protocols to qualify for free token distributions, typically as a promotional or governance incentive. Explore the nuances of each reward mechanism and their impact on maximizing crypto asset gains.

Source and External Links

What is yield farming and how does it work? - Coinbase - Yield farming, or liquidity mining, is a DeFi practice where users provide crypto liquidity to protocols and earn rewards, typically in the protocol's token, by locking assets in smart contracts.

What Is Yield Farming? Meaning and Definition - Chainlink - Yield farming rewards users for provisioning liquidity or value-adding services in DeFi, aiming to bootstrap liquidity and distribute governance tokens fairly among protocol users.

Yield Farming in DeFi Explained: Possibilities, Risks & Strategies - Yield farming is evolving toward sustainable models emphasizing real yield from platform revenue, AI-driven strategies, regulatory oversight, and crosschain interoperability to optimize and expand DeFi yields.

dowidth.com

dowidth.com