Flash loans enable traders to borrow large amounts of capital instantly without collateral, exploiting arbitrage opportunities within a single transaction on decentralized finance platforms. Options trading involves contracts granting the right, but not the obligation, to buy or sell an asset at a predetermined price before expiration, offering strategic risk management and profit potential. Discover how these advanced financial instruments can enhance your trading strategies and portfolio performance.

Why it is important

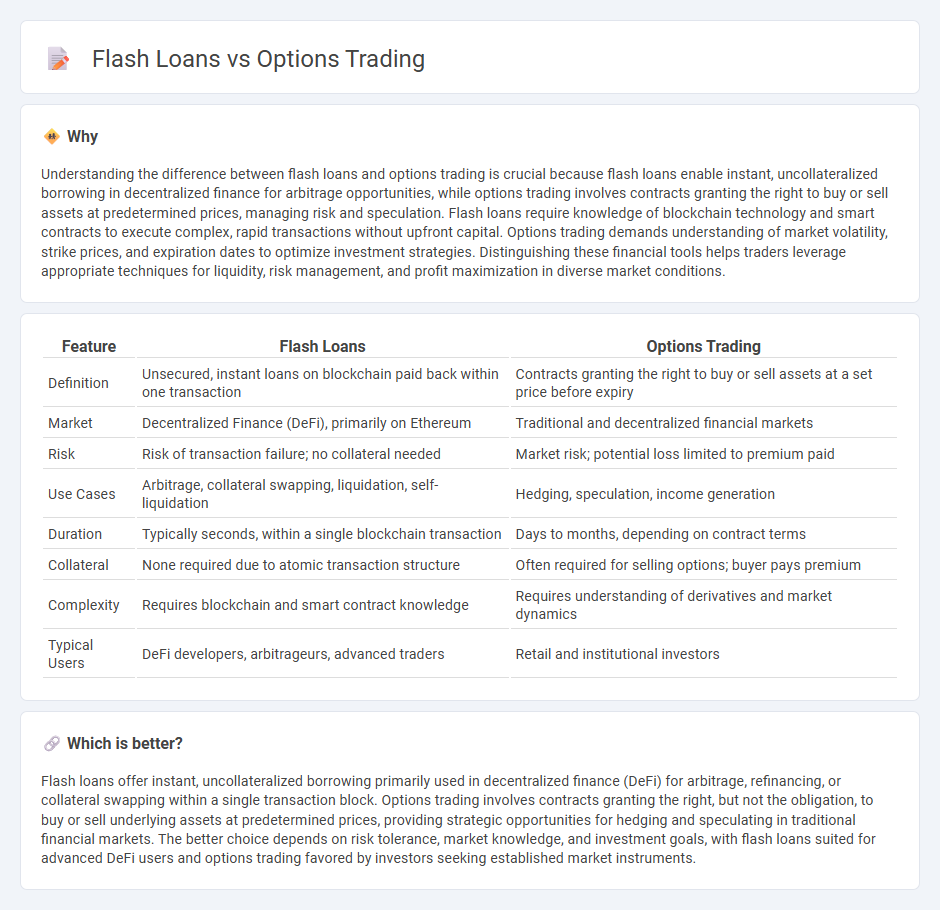

Understanding the difference between flash loans and options trading is crucial because flash loans enable instant, uncollateralized borrowing in decentralized finance for arbitrage opportunities, while options trading involves contracts granting the right to buy or sell assets at predetermined prices, managing risk and speculation. Flash loans require knowledge of blockchain technology and smart contracts to execute complex, rapid transactions without upfront capital. Options trading demands understanding of market volatility, strike prices, and expiration dates to optimize investment strategies. Distinguishing these financial tools helps traders leverage appropriate techniques for liquidity, risk management, and profit maximization in diverse market conditions.

Comparison Table

| Feature | Flash Loans | Options Trading |

|---|---|---|

| Definition | Unsecured, instant loans on blockchain paid back within one transaction | Contracts granting the right to buy or sell assets at a set price before expiry |

| Market | Decentralized Finance (DeFi), primarily on Ethereum | Traditional and decentralized financial markets |

| Risk | Risk of transaction failure; no collateral needed | Market risk; potential loss limited to premium paid |

| Use Cases | Arbitrage, collateral swapping, liquidation, self-liquidation | Hedging, speculation, income generation |

| Duration | Typically seconds, within a single blockchain transaction | Days to months, depending on contract terms |

| Collateral | None required due to atomic transaction structure | Often required for selling options; buyer pays premium |

| Complexity | Requires blockchain and smart contract knowledge | Requires understanding of derivatives and market dynamics |

| Typical Users | DeFi developers, arbitrageurs, advanced traders | Retail and institutional investors |

Which is better?

Flash loans offer instant, uncollateralized borrowing primarily used in decentralized finance (DeFi) for arbitrage, refinancing, or collateral swapping within a single transaction block. Options trading involves contracts granting the right, but not the obligation, to buy or sell underlying assets at predetermined prices, providing strategic opportunities for hedging and speculating in traditional financial markets. The better choice depends on risk tolerance, market knowledge, and investment goals, with flash loans suited for advanced DeFi users and options trading favored by investors seeking established market instruments.

Connection

Flash loans enable traders to access uncollateralized capital instantly, facilitating complex options trading strategies such as arbitrage, hedging, and synthetic asset creation. By leveraging flash loans, traders can execute large, temporary positions within a single transaction, maximizing profits while minimizing upfront risk in volatile options markets. This integration of DeFi technology with options trading enhances liquidity and opens new avenues for decentralized financial innovation.

Key Terms

Derivatives

Options trading involves contracts granting the right to buy or sell an asset at a set price before expiration, functioning as derivatives based on underlying assets such as stocks or commodities. Flash loans, predominantly used in decentralized finance (DeFi), are uncollateralized loans executed and repaid within a single blockchain transaction, enabling arbitrage or collateral swaps without upfront capital but do not constitute traditional derivatives. Explore the distinct mechanisms and risk profiles of options trading and flash loans to understand their roles in modern financial strategies.

Arbitrage

Options trading involves leveraging contract rights to buy or sell assets at predetermined prices, creating opportunities for arbitrage by exploiting price discrepancies between markets. Flash loans enable instant, uncollateralized borrowing within blockchain ecosystems, making them powerful tools for rapid arbitrage in decentralized finance (DeFi) by capitalizing on momentary price inefficiencies. Explore the nuances and strategies behind options trading and flash loan arbitrage to enhance your financial acumen.

Leverage

Options trading allows investors to leverage their capital by controlling a large number of shares with a relatively small upfront premium, amplifying potential gains and losses. Flash loans provide instant, uncollateralized leverage in decentralized finance (DeFi), enabling borrowers to execute complex arbitrage or refinancing strategies within a single blockchain transaction. Explore how leverage mechanisms differ in traditional finance and DeFi to optimize your trading strategies.

Source and External Links

Options | FINRA.org - Options are contracts allowing investors to profit from changes in an underlying security's value without owning the stock, involving buying or selling calls and puts, with profits realized through selling the contracts or exercising rights under them.

Options Trading: Step-by-Step Guide for Beginners - Options trading means buying or selling contracts that give the right to buy or sell stock at a set price by a certain date, offering potential profits based on stock price movements, but requiring advanced knowledge and opening a specific trading account.

Option (finance) - An option contract allows the holder to buy or sell an asset at a specified strike price before expiration, with the key strategies including buying calls or puts to speculate on price moves with limited risk to the premium paid.

dowidth.com

dowidth.com