High frequency trading (HFT) involves executing thousands of trades per second using complex algorithms and high-speed data networks to exploit minute price discrepancies. Trend following strategies focus on identifying and capitalizing on sustained market movements by analyzing historical price patterns and momentum over longer time frames. Explore the key differences and advantages of each approach to enhance your trading strategy.

Why it is important

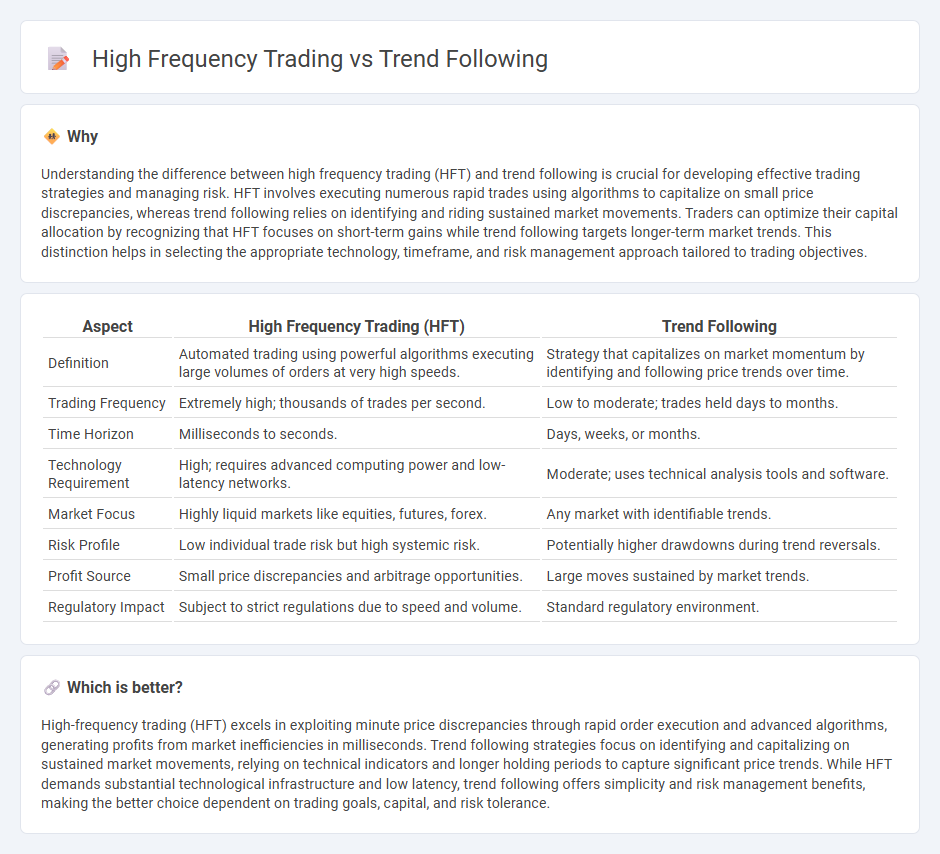

Understanding the difference between high frequency trading (HFT) and trend following is crucial for developing effective trading strategies and managing risk. HFT involves executing numerous rapid trades using algorithms to capitalize on small price discrepancies, whereas trend following relies on identifying and riding sustained market movements. Traders can optimize their capital allocation by recognizing that HFT focuses on short-term gains while trend following targets longer-term market trends. This distinction helps in selecting the appropriate technology, timeframe, and risk management approach tailored to trading objectives.

Comparison Table

| Aspect | High Frequency Trading (HFT) | Trend Following |

|---|---|---|

| Definition | Automated trading using powerful algorithms executing large volumes of orders at very high speeds. | Strategy that capitalizes on market momentum by identifying and following price trends over time. |

| Trading Frequency | Extremely high; thousands of trades per second. | Low to moderate; trades held days to months. |

| Time Horizon | Milliseconds to seconds. | Days, weeks, or months. |

| Technology Requirement | High; requires advanced computing power and low-latency networks. | Moderate; uses technical analysis tools and software. |

| Market Focus | Highly liquid markets like equities, futures, forex. | Any market with identifiable trends. |

| Risk Profile | Low individual trade risk but high systemic risk. | Potentially higher drawdowns during trend reversals. |

| Profit Source | Small price discrepancies and arbitrage opportunities. | Large moves sustained by market trends. |

| Regulatory Impact | Subject to strict regulations due to speed and volume. | Standard regulatory environment. |

Which is better?

High-frequency trading (HFT) excels in exploiting minute price discrepancies through rapid order execution and advanced algorithms, generating profits from market inefficiencies in milliseconds. Trend following strategies focus on identifying and capitalizing on sustained market movements, relying on technical indicators and longer holding periods to capture significant price trends. While HFT demands substantial technological infrastructure and low latency, trend following offers simplicity and risk management benefits, making the better choice dependent on trading goals, capital, and risk tolerance.

Connection

High frequency trading (HFT) and trend following both rely on analyzing market data to identify and exploit trading opportunities, with HFT using ultra-fast algorithms to capture short-term price movements while trend following focuses on recognizing sustained market trends. HFT strategies often incorporate elements of trend detection to enhance execution speed and improve profitability by quickly reacting to emerging patterns. Both approaches utilize advanced quantitative techniques and real-time data processing to maximize returns in volatile trading environments.

Key Terms

Trend Following:

Trend following is a systematic trading strategy that capitalizes on the persistence of market trends by buying assets in uptrends and selling during downtrends, primarily using technical indicators like moving averages and momentum oscillators. This approach is favored for its simplicity, robustness across various markets, and ability to mitigate emotional trading biases, making it popular among hedge funds and individual traders alike. Explore comprehensive insights into trend following strategies and how they compare to high frequency trading techniques.

Moving Average

Trend following strategies leverage moving averages to identify and capitalize on sustained price trends by analyzing long-term market momentum, whereas high-frequency trading employs rapid, algorithmic execution to exploit short-term market inefficiencies often without direct reliance on moving averages. Moving averages in trend following smooth price data to signal entry and exit points, enhancing trade decisions over days to months, while high-frequency traders prioritize speed and order execution over trend signals. Explore detailed methods and performance comparisons to understand the strategic roles of moving averages in these distinct trading approaches.

Breakout

Trend following and high-frequency trading (HFT) both capitalize on market momentum but differ in execution speed and strategy complexity, with breakout patterns being a key signal in trend following strategies to identify entry points. Trend following relies on longer-term breakout confirmations from moving averages or price channels, while HFT exploits micro-breakouts within milliseconds using algorithms to capture small price inefficiencies. Explore the nuanced advantages of breakout strategies in trend following and high-frequency trading for improved trading performance.

Source and External Links

Trend following - Wikipedia - Trend following is a trading strategy where traders buy assets when their price trends upward and sell when the trend goes downward, relying on various technical tools like moving averages and channel breakouts to identify trends, without attempting to forecast exact price levels.

Trend Following Trading Strategies and Systems (Backtest) - Quantified Strategies - Trend following strategies use technical analysis to enter trades in the direction of prevailing market trends and exit at reversal signals, employing tools such as ATR channels, Bollinger Bands, and moving averages, and emphasizing risk management and systematic rules across diverse asset classes.

Trend-Following Primer - Graham Capital - Trend-following is a major alternative investment strategy involving systematic, algorithmic models to capture price trends by taking long or short positions across diverse markets, offering portfolio diversification and potential performance in both rising and falling markets.

dowidth.com

dowidth.com