Liquidity mining allows traders to earn rewards by providing assets to decentralized pools, incentivizing participation in blockchain ecosystems. Automated market makers (AMMs) facilitate seamless trading by using algorithms to set prices and maintain liquidity without traditional order books. Discover more about how these innovations shape decentralized finance and optimize trading strategies.

Why it is important

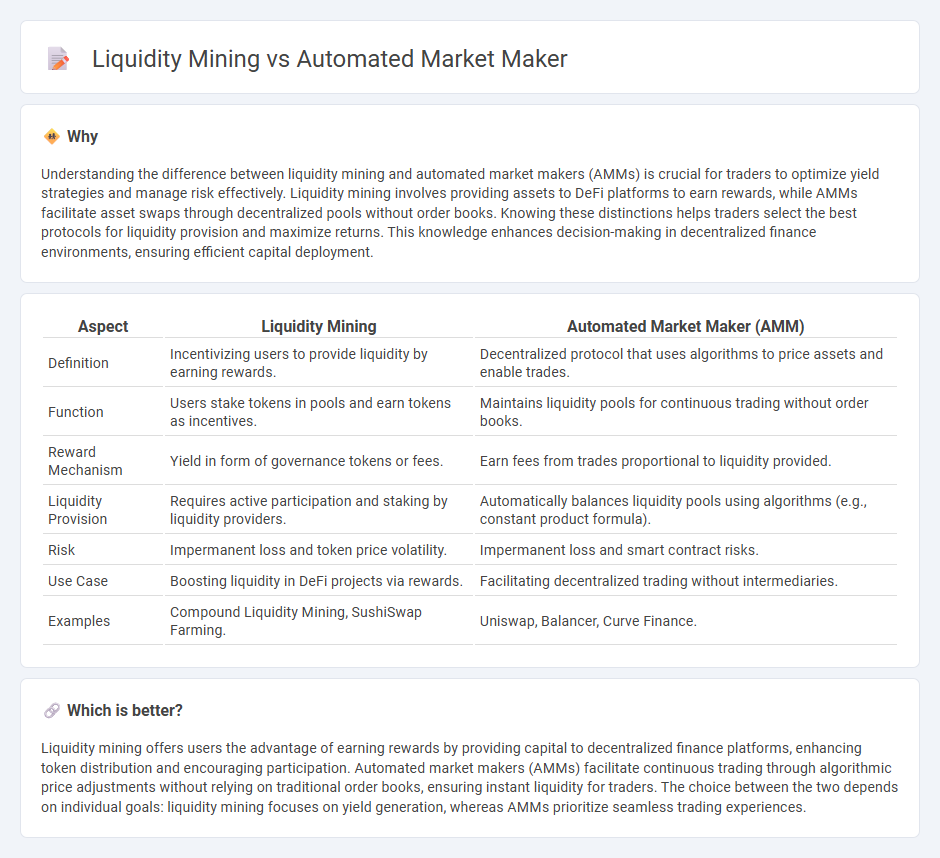

Understanding the difference between liquidity mining and automated market makers (AMMs) is crucial for traders to optimize yield strategies and manage risk effectively. Liquidity mining involves providing assets to DeFi platforms to earn rewards, while AMMs facilitate asset swaps through decentralized pools without order books. Knowing these distinctions helps traders select the best protocols for liquidity provision and maximize returns. This knowledge enhances decision-making in decentralized finance environments, ensuring efficient capital deployment.

Comparison Table

| Aspect | Liquidity Mining | Automated Market Maker (AMM) |

|---|---|---|

| Definition | Incentivizing users to provide liquidity by earning rewards. | Decentralized protocol that uses algorithms to price assets and enable trades. |

| Function | Users stake tokens in pools and earn tokens as incentives. | Maintains liquidity pools for continuous trading without order books. |

| Reward Mechanism | Yield in form of governance tokens or fees. | Earn fees from trades proportional to liquidity provided. |

| Liquidity Provision | Requires active participation and staking by liquidity providers. | Automatically balances liquidity pools using algorithms (e.g., constant product formula). |

| Risk | Impermanent loss and token price volatility. | Impermanent loss and smart contract risks. |

| Use Case | Boosting liquidity in DeFi projects via rewards. | Facilitating decentralized trading without intermediaries. |

| Examples | Compound Liquidity Mining, SushiSwap Farming. | Uniswap, Balancer, Curve Finance. |

Which is better?

Liquidity mining offers users the advantage of earning rewards by providing capital to decentralized finance platforms, enhancing token distribution and encouraging participation. Automated market makers (AMMs) facilitate continuous trading through algorithmic price adjustments without relying on traditional order books, ensuring instant liquidity for traders. The choice between the two depends on individual goals: liquidity mining focuses on yield generation, whereas AMMs prioritize seamless trading experiences.

Connection

Liquidity mining incentivizes users to provide assets to automated market makers (AMMs), enhancing the pools' liquidity and trading efficiency. Automated market makers rely on these liquidity pools to enable seamless asset swaps without traditional order books, reducing slippage and improving price stability. This symbiotic relationship drives decentralized finance growth by increasing market depth and user participation.

Key Terms

Algorithmic Pricing (Automated Market Maker)

Automated Market Makers (AMMs) utilize algorithmic pricing models such as constant product formulas to dynamically adjust asset prices based on liquidity pool ratios, ensuring continuous market liquidity without order books. Liquidity mining incentivizes users to provide capital to these pools by rewarding them with tokens, enhancing pool depth and market efficiency. Explore our detailed analysis to understand how algorithmic pricing revolutionizes decentralized trading.

Liquidity Pool (Both)

Automated Market Makers (AMMs) use liquidity pools composed of user-contributed tokens to enable decentralized, continuous trading without order books. Liquidity mining incentivizes users to add assets to these pools by rewarding them with tokens, increasing pool depth and enhancing market stability. Explore how liquidity pools drive DeFi innovation and yield opportunities.

Yield Farming (Liquidity Mining)

Automated Market Makers (AMMs) are decentralized exchanges that use algorithms to set asset prices and facilitate trades without order books, enabling continuous liquidity. Liquidity mining, a form of yield farming, incentivizes users to provide assets to AMM pools in exchange for rewards, often in the form of governance tokens, boosting liquidity and enabling passive income. Explore how liquidity mining strategies optimize yield farming opportunities within AMM protocols.

Source and External Links

What is an Automated Market Maker? - Uniswap Blog - An automated market maker (AMM) is a decentralized exchange type that runs on smart contracts instead of order books, automatically pricing trades via formulas to enable fast, 24/7 onchain markets without intermediaries, allowing anyone to trade or provide liquidity and earn fees.

What Is an Automated Market Maker (AMM)? - Gemini - AMMs are DeFi protocols using liquidity pools and algorithms to price and trade crypto assets automatically without traditional buyers and sellers, enabling permissionless, continuous trading via math-based token price formulas.

The Ecology of Automated Market Makers - Bank of Canada - AMMs are popular decentralized exchange models for pricing and trading crypto assets through smart contract pools funded by liquidity providers, featuring diverse designs and governance that shape their market roles and regulatory considerations.

dowidth.com

dowidth.com