Perpetual swaps offer traders continuous exposure to an asset without an expiration date, enabling flexible positions with leveraged trading. Options provide the right, but not the obligation, to buy or sell an asset at a predetermined price within a specific time frame, allowing strategic hedging and speculative opportunities. Explore the key differences and advantages of perpetual swaps versus options to enhance your trading strategy.

Why it is important

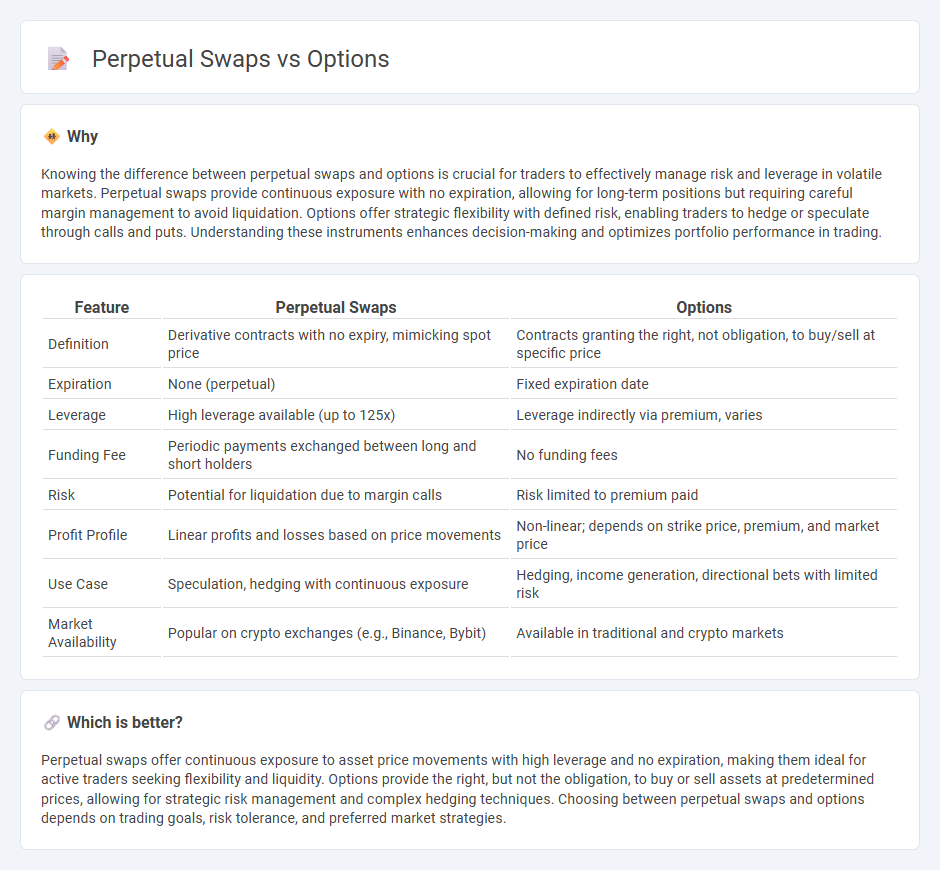

Knowing the difference between perpetual swaps and options is crucial for traders to effectively manage risk and leverage in volatile markets. Perpetual swaps provide continuous exposure with no expiration, allowing for long-term positions but requiring careful margin management to avoid liquidation. Options offer strategic flexibility with defined risk, enabling traders to hedge or speculate through calls and puts. Understanding these instruments enhances decision-making and optimizes portfolio performance in trading.

Comparison Table

| Feature | Perpetual Swaps | Options |

|---|---|---|

| Definition | Derivative contracts with no expiry, mimicking spot price | Contracts granting the right, not obligation, to buy/sell at specific price |

| Expiration | None (perpetual) | Fixed expiration date |

| Leverage | High leverage available (up to 125x) | Leverage indirectly via premium, varies |

| Funding Fee | Periodic payments exchanged between long and short holders | No funding fees |

| Risk | Potential for liquidation due to margin calls | Risk limited to premium paid |

| Profit Profile | Linear profits and losses based on price movements | Non-linear; depends on strike price, premium, and market price |

| Use Case | Speculation, hedging with continuous exposure | Hedging, income generation, directional bets with limited risk |

| Market Availability | Popular on crypto exchanges (e.g., Binance, Bybit) | Available in traditional and crypto markets |

Which is better?

Perpetual swaps offer continuous exposure to asset price movements with high leverage and no expiration, making them ideal for active traders seeking flexibility and liquidity. Options provide the right, but not the obligation, to buy or sell assets at predetermined prices, allowing for strategic risk management and complex hedging techniques. Choosing between perpetual swaps and options depends on trading goals, risk tolerance, and preferred market strategies.

Connection

Perpetual swaps and options are interconnected derivatives that allow traders to hedge or speculate on asset price movements without owning the underlying asset. Perpetual swaps offer continuous exposure with no expiry, while options provide the right, but not the obligation, to buy or sell an asset at a predetermined price within a specific timeframe. Combining these instruments enables sophisticated strategies for risk management and leverage in volatile markets.

Key Terms

Expiry Date

Options have a fixed expiry date, after which the contract becomes void and the holder must exercise or forfeit the right to buy or sell the underlying asset. Perpetual swaps lack an expiry date, allowing positions to remain open indefinitely, with funding rates exchanged between long and short traders to anchor the swap price to the spot market. Explore the advantages and strategic implications of expiry dates in derivatives trading to optimize your investment approach.

Leverage

Options provide leveraged exposure by controlling an asset with a fraction of its price, allowing traders to amplify potential returns without owning the underlying. Perpetual swaps offer continuous leverage with no expiry, enabling larger position sizes relative to margin but require careful risk management due to funding rate fluctuations. Explore deeper insights on leverage mechanics in options and perpetual swaps to optimize your trading strategy.

Funding Rate

Options and perpetual swaps differ significantly in how funding rates influence their pricing mechanisms. Perpetual swaps feature an ongoing funding rate that incentivizes price alignment between the swap and the underlying asset, resulting in a dynamic cost for holding positions. To explore the impact of funding rates on trading strategies and risk management, dive deeper into funding rate mechanisms in derivative markets.

Source and External Links

Options | FINRA.org - Options are contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a set price (the strike price) within a specific time period, available as either call (buy) or put (sell) options, and can be used to hedge risk or generate income from investments.

Option (finance) - An option is a financial contract that grants its owner the right (without obligation) to buy or sell a specific quantity of an underlying asset at a predetermined price before the contract expires, with two main forms: standardized exchange-traded options (like stock and index options) and customized over-the-counter (OTC) options.

Introduction to Options - An option is a derivative contract representing the right (not obligation) to buy or sell a financial product at an agreed price for a set period, offering strategies for hedging, income generation, and speculation, but requiring specific brokerage approval and carrying inherent risks.

dowidth.com

dowidth.com