Synthetic positions replicate the payoff of a bull spread by combining options with different strike prices but similar expiration dates, offering versatile strategies for traders aiming to capitalize on moderate price increases. Bull spreads involve buying a call option at a lower strike price while selling another at a higher strike price, limiting both risk and profit potential. Explore detailed comparisons to optimize your trading strategy with synthetic positions and bull spreads.

Why it is important

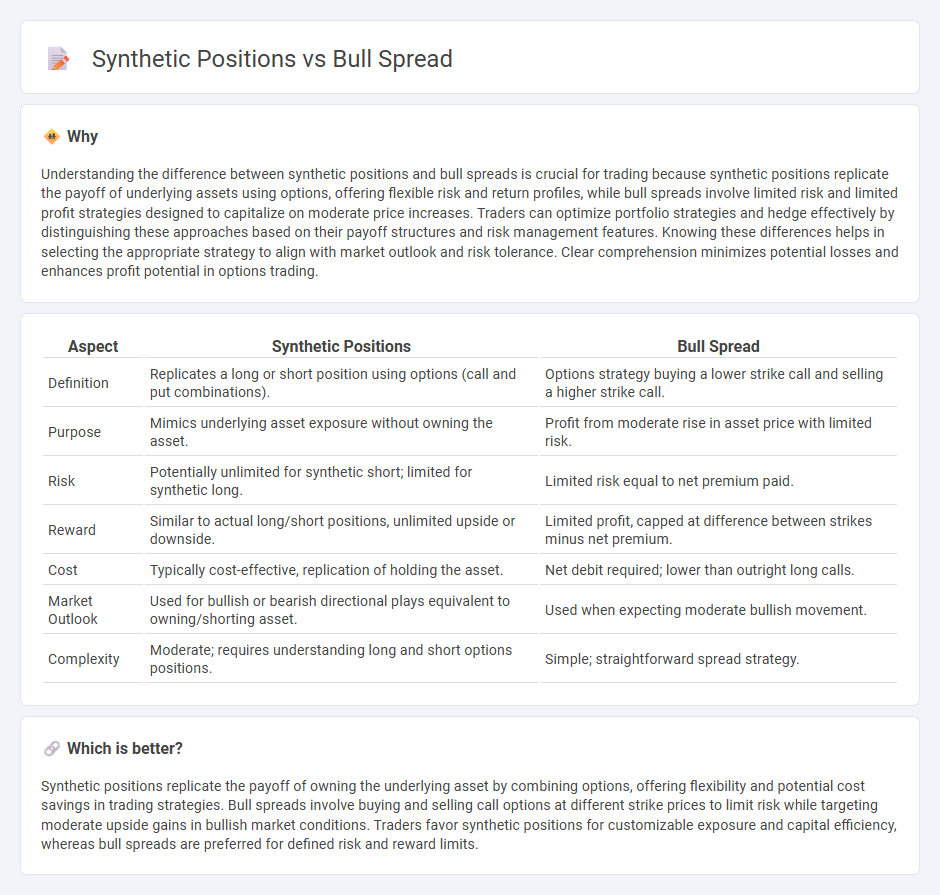

Understanding the difference between synthetic positions and bull spreads is crucial for trading because synthetic positions replicate the payoff of underlying assets using options, offering flexible risk and return profiles, while bull spreads involve limited risk and limited profit strategies designed to capitalize on moderate price increases. Traders can optimize portfolio strategies and hedge effectively by distinguishing these approaches based on their payoff structures and risk management features. Knowing these differences helps in selecting the appropriate strategy to align with market outlook and risk tolerance. Clear comprehension minimizes potential losses and enhances profit potential in options trading.

Comparison Table

| Aspect | Synthetic Positions | Bull Spread |

|---|---|---|

| Definition | Replicates a long or short position using options (call and put combinations). | Options strategy buying a lower strike call and selling a higher strike call. |

| Purpose | Mimics underlying asset exposure without owning the asset. | Profit from moderate rise in asset price with limited risk. |

| Risk | Potentially unlimited for synthetic short; limited for synthetic long. | Limited risk equal to net premium paid. |

| Reward | Similar to actual long/short positions, unlimited upside or downside. | Limited profit, capped at difference between strikes minus net premium. |

| Cost | Typically cost-effective, replication of holding the asset. | Net debit required; lower than outright long calls. |

| Market Outlook | Used for bullish or bearish directional plays equivalent to owning/shorting asset. | Used when expecting moderate bullish movement. |

| Complexity | Moderate; requires understanding long and short options positions. | Simple; straightforward spread strategy. |

Which is better?

Synthetic positions replicate the payoff of owning the underlying asset by combining options, offering flexibility and potential cost savings in trading strategies. Bull spreads involve buying and selling call options at different strike prices to limit risk while targeting moderate upside gains in bullish market conditions. Traders favor synthetic positions for customizable exposure and capital efficiency, whereas bull spreads are preferred for defined risk and reward limits.

Connection

Synthetic positions replicate the payoff of an underlying asset by combining options, often involving a call and put with the same strike price and expiration. Bull spreads, typically constructed using call options at different strike prices, benefit from limited risk and capped profit within a rising market. Both strategies use option combinations to manage risk and leverage directional market views effectively.

Key Terms

Option Spread

Bull spread strategies involve buying and selling call or put options at different strike prices to capitalize on moderate price increases while limiting risk. Synthetic positions replicate stock ownership through options, such as creating a synthetic long stock by combining a long call and short put with the same strike price and expiration. Explore detailed comparisons and applications of these synthetic and bull spread option strategies to optimize your trading approach.

Payoff Structure

Bull spreads and synthetic positions both aim to profit from moderate price increases but differ significantly in payoff structure and risk profiles. A bull spread involves buying a lower strike call option and selling a higher strike call option, limiting both profit and loss within a defined range, while synthetic positions replicate stock ownership using options, often combining long calls and short puts, resulting in unlimited upside potential but greater risk. Explore detailed comparisons of payoff diagrams and risk management strategies for these option techniques to refine your trading approach.

Arbitrage

Bull spreads use options strategies to limit risk and profit from moderate price increases, while synthetic positions replicate the payoff of an underlying asset through a combination of options and underlying securities to exploit mispricing. Arbitrage opportunities arise when discrepancies between bull spreads and synthetic equivalents allow traders to lock in risk-free profits by simultaneously buying undervalued positions and selling overvalued ones. Explore the mechanics and arbitrage potentials of these strategies to enhance your trading edge.

Source and External Links

Bull spread - Wikipedia - A bull spread is a bullish options strategy that profits from a moderate rise in the underlying security's price, constructed using either calls (bull call spread) or puts (bull put spread), involving options with different strike prices but the same expiration date.

Bull Put Spread (Credit Put Spread) - The Options Industry Council - A bull put spread consists of selling a put option at a higher strike while buying another put at a lower strike, generating a net credit with limited risk and reward, aiming to profit if the stock price stays the same or rises.

What Is A Bull Call Spread? - Fidelity Investments - A bull call spread involves buying a call option with a lower strike and selling another with a higher strike, both with the same expiration, to limit risk and profit if the stock rises moderately.

dowidth.com

dowidth.com