Altcoin sniping involves quickly purchasing newly listed or low-cap cryptocurrencies to capitalize on early price spikes, requiring real-time market analysis and fast execution. Copy trading allows investors to replicate the trades of experienced traders on platforms, providing a more hands-off approach to altcoin investing with reduced risk. Explore the detailed pros and cons of altcoin sniping versus copy trading to enhance your trading strategy.

Why it is important

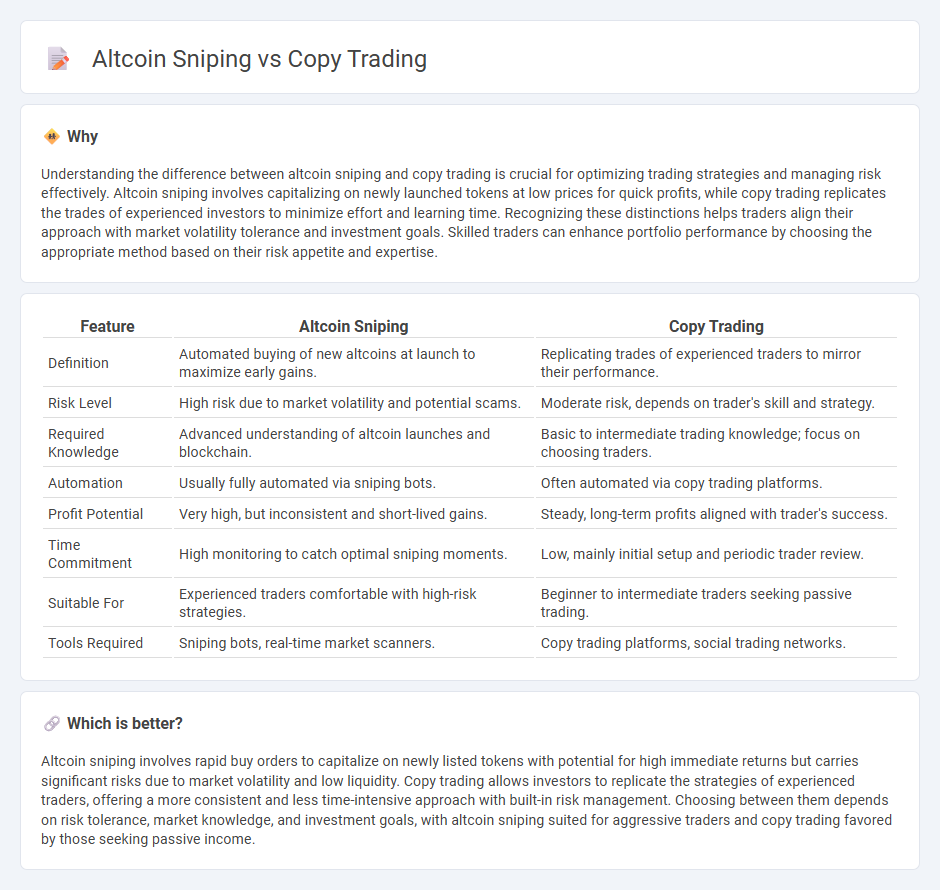

Understanding the difference between altcoin sniping and copy trading is crucial for optimizing trading strategies and managing risk effectively. Altcoin sniping involves capitalizing on newly launched tokens at low prices for quick profits, while copy trading replicates the trades of experienced investors to minimize effort and learning time. Recognizing these distinctions helps traders align their approach with market volatility tolerance and investment goals. Skilled traders can enhance portfolio performance by choosing the appropriate method based on their risk appetite and expertise.

Comparison Table

| Feature | Altcoin Sniping | Copy Trading |

|---|---|---|

| Definition | Automated buying of new altcoins at launch to maximize early gains. | Replicating trades of experienced traders to mirror their performance. |

| Risk Level | High risk due to market volatility and potential scams. | Moderate risk, depends on trader's skill and strategy. |

| Required Knowledge | Advanced understanding of altcoin launches and blockchain. | Basic to intermediate trading knowledge; focus on choosing traders. |

| Automation | Usually fully automated via sniping bots. | Often automated via copy trading platforms. |

| Profit Potential | Very high, but inconsistent and short-lived gains. | Steady, long-term profits aligned with trader's success. |

| Time Commitment | High monitoring to catch optimal sniping moments. | Low, mainly initial setup and periodic trader review. |

| Suitable For | Experienced traders comfortable with high-risk strategies. | Beginner to intermediate traders seeking passive trading. |

| Tools Required | Sniping bots, real-time market scanners. | Copy trading platforms, social trading networks. |

Which is better?

Altcoin sniping involves rapid buy orders to capitalize on newly listed tokens with potential for high immediate returns but carries significant risks due to market volatility and low liquidity. Copy trading allows investors to replicate the strategies of experienced traders, offering a more consistent and less time-intensive approach with built-in risk management. Choosing between them depends on risk tolerance, market knowledge, and investment goals, with altcoin sniping suited for aggressive traders and copy trading favored by those seeking passive income.

Connection

Altcoin sniping and copy trading are connected through their focus on capitalizing on rapid market movements in cryptocurrency trading. Altcoin sniping involves executing quick buy orders immediately after a new token launch or price dip, while copy trading allows investors to replicate the trades of experienced traders who often use sniping strategies. Both techniques rely on real-time data analysis and automated trading tools to maximize profits in volatile altcoin markets.

Key Terms

**Copy Trading:**

Copy trading enables investors to automatically replicate the trades of experienced traders, leveraging their market insights to optimize portfolio performance. This strategy reduces the learning curve and mitigates risks associated with direct coin selection while diversifying exposure across various altcoins and trading styles. Discover how copy trading can enhance your investment approach and streamline market participation.

Signal Provider

Signal providers play a crucial role in both copy trading and altcoin sniping by delivering timely and accurate trading signals to followers. In copy trading, signal providers execute trades on behalf of subscribers, aiming for steady profit through long-term strategies, while altcoin sniping signal providers specialize in spotting newly launched, high-potential altcoins for quick gains. Explore expert signal providers to enhance your trading success in both approaches.

Automated Execution

Copy trading leverages automated execution by replicating the trades of expert investors in real-time, optimizing decision-making without manual intervention. Altcoin sniping employs automated bots designed to execute rapid trades at precise moments during token launches or price dips, capitalizing on market volatility. Discover how automated execution techniques can enhance your investment strategy in volatile markets.

Source and External Links

Copy trading - Wikipedia - Copy trading allows individuals to automatically copy the trades of selected investors, linking a portion of funds so trading actions by the leader are duplicated in the follower's account; it differs from mirror trading and supports a new kind of "people-based" portfolio management.

Copy Trading | Copy the Best Traders in 2025 | AvaTrade - Copy trading lets a less experienced trader automatically replicate the trades of more experienced traders, offering a hands-off way to trade by following individual traders based on their performance and style, distinct from social and mirror trading.

What is Copy Trading, How Does it Work and How to ... - PrimeXBT - Copy trading enables automatic copying of trades from successful traders, enabling novices to gain profits without market analysis and allowing customization of risk levels, with many brokers providing platforms for easy trader selection.

dowidth.com

dowidth.com