Dark pool activity involves private, non-public trading venues where large institutional investors execute sizable orders anonymously to minimize market impact, while iceberg orders break large transactions into smaller visible portions to conceal the full order size on public exchanges. These mechanisms help traders manage liquidity and reduce price distortion during large trades, enhancing execution efficiency. Explore how dark pool activity and iceberg orders influence market dynamics and trading strategies in depth.

Why it is important

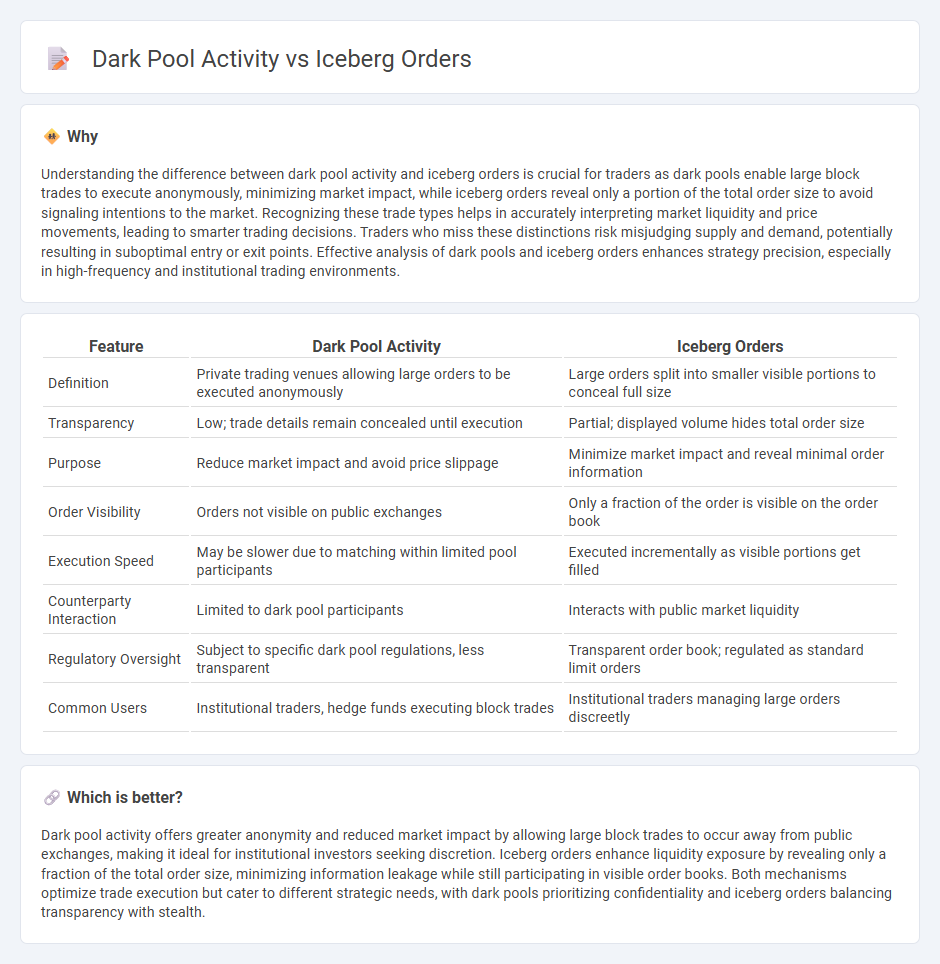

Understanding the difference between dark pool activity and iceberg orders is crucial for traders as dark pools enable large block trades to execute anonymously, minimizing market impact, while iceberg orders reveal only a portion of the total order size to avoid signaling intentions to the market. Recognizing these trade types helps in accurately interpreting market liquidity and price movements, leading to smarter trading decisions. Traders who miss these distinctions risk misjudging supply and demand, potentially resulting in suboptimal entry or exit points. Effective analysis of dark pools and iceberg orders enhances strategy precision, especially in high-frequency and institutional trading environments.

Comparison Table

| Feature | Dark Pool Activity | Iceberg Orders |

|---|---|---|

| Definition | Private trading venues allowing large orders to be executed anonymously | Large orders split into smaller visible portions to conceal full size |

| Transparency | Low; trade details remain concealed until execution | Partial; displayed volume hides total order size |

| Purpose | Reduce market impact and avoid price slippage | Minimize market impact and reveal minimal order information |

| Order Visibility | Orders not visible on public exchanges | Only a fraction of the order is visible on the order book |

| Execution Speed | May be slower due to matching within limited pool participants | Executed incrementally as visible portions get filled |

| Counterparty Interaction | Limited to dark pool participants | Interacts with public market liquidity |

| Regulatory Oversight | Subject to specific dark pool regulations, less transparent | Transparent order book; regulated as standard limit orders |

| Common Users | Institutional traders, hedge funds executing block trades | Institutional traders managing large orders discreetly |

Which is better?

Dark pool activity offers greater anonymity and reduced market impact by allowing large block trades to occur away from public exchanges, making it ideal for institutional investors seeking discretion. Iceberg orders enhance liquidity exposure by revealing only a fraction of the total order size, minimizing information leakage while still participating in visible order books. Both mechanisms optimize trade execution but cater to different strategic needs, with dark pools prioritizing confidentiality and iceberg orders balancing transparency with stealth.

Connection

Dark pool activity and iceberg orders both contribute to minimizing market impact by concealing large trades from public order books, thereby reducing price slippage. Iceberg orders hide the true order size by revealing only a small portion, while dark pools provide private trading venues where large blocks of shares are executed anonymously. Together, these mechanisms support institutional traders in maintaining confidentiality and achieving better execution prices.

Key Terms

Order Book

Iceberg orders strategically split large trades into smaller visible portions to minimize market impact within the order book, while the hidden volumes remain concealed. Dark pool activity involves private trading venues where large transactions occur off the public order book, offering anonymity and reduced slippage risk. Explore detailed analyses on how iceberg orders and dark pools influence market liquidity and price discovery.

Hidden Liquidity

Iceberg orders strategically reveal only a small portion of the total order size to the market, concealing the full volume and thereby minimizing price impact while signaling hidden liquidity. Dark pool activity involves private trading venues where large blocks of shares are executed away from public exchanges, further masking true market intentions and preserving hidden liquidity. Explore the mechanisms behind iceberg orders and dark pools to better understand how hidden liquidity shapes market dynamics.

Execution Transparency

Iceberg orders reveal only a fraction of the total order size, masking true market demand and reducing execution transparency. Dark pool activity further obscures trade details by executing large blocks away from public exchanges, complicating price discovery and market fairness. Explore deeper insights on how these hidden liquidity mechanisms impact market execution and transparency.

Source and External Links

Iceberg Order - Overview, How It Works, and Example - An iceberg order breaks a large order into multiple smaller orders, showing only a fraction ("tip of the iceberg") at a time to hide the full size and reduce market impact, commonly used by institutional traders to buy or sell large quantities discreetly.

Iceberg Orders - Iceberg orders, also called hidden orders, display only a portion of the order size on the order book while the rest remains concealed and is revealed incrementally as the visible part is filled, helping execute large trades without affecting market prices.

What are Iceberg Orders? | What is an ... - Iceberg orders hide large buy or sell orders by slicing them into smaller limit orders to avoid disturbing the market price or causing rumors, thus enabling the execution of big trades without sharp price swings.

dowidth.com

dowidth.com