Paper trading platforms simulate real market environments allowing users to practice strategies without risking actual capital, ideal for beginners to build confidence and refine skills. Copy trading platforms enable investors to replicate the trades of experienced traders in real time, providing an opportunity to benefit from expert insights and market experience. Explore the advantages and features of both platforms to determine which suits your trading goals and risk tolerance.

Why it is important

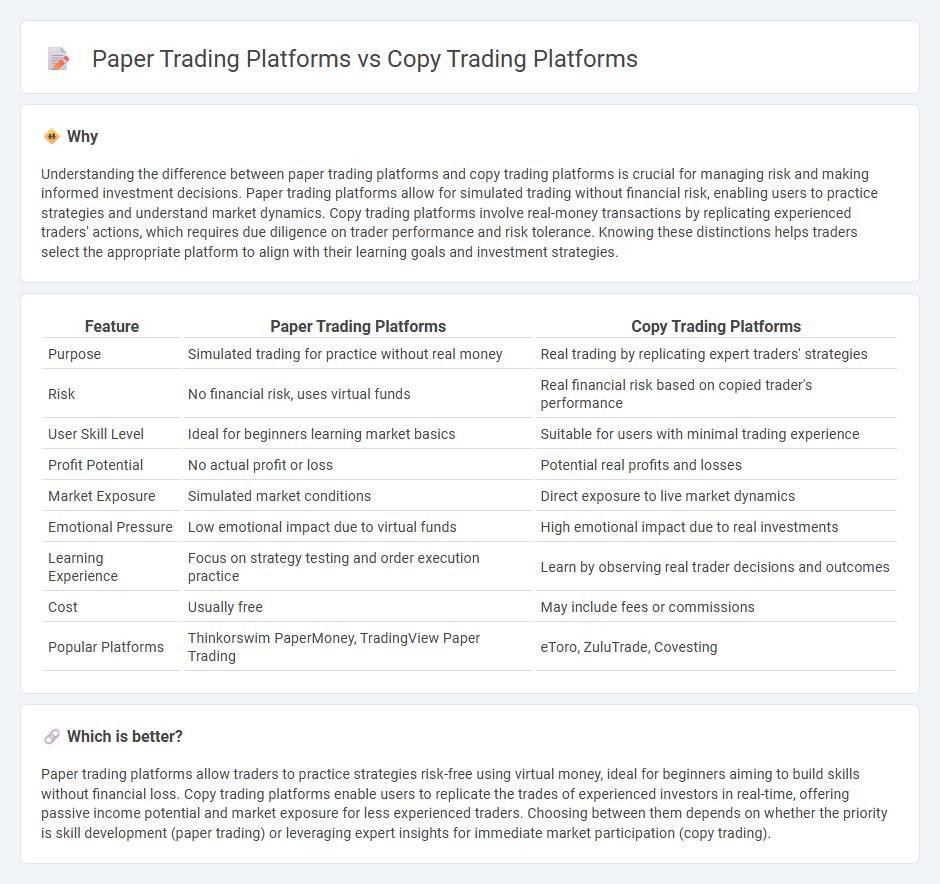

Understanding the difference between paper trading platforms and copy trading platforms is crucial for managing risk and making informed investment decisions. Paper trading platforms allow for simulated trading without financial risk, enabling users to practice strategies and understand market dynamics. Copy trading platforms involve real-money transactions by replicating experienced traders' actions, which requires due diligence on trader performance and risk tolerance. Knowing these distinctions helps traders select the appropriate platform to align with their learning goals and investment strategies.

Comparison Table

| Feature | Paper Trading Platforms | Copy Trading Platforms |

|---|---|---|

| Purpose | Simulated trading for practice without real money | Real trading by replicating expert traders' strategies |

| Risk | No financial risk, uses virtual funds | Real financial risk based on copied trader's performance |

| User Skill Level | Ideal for beginners learning market basics | Suitable for users with minimal trading experience |

| Profit Potential | No actual profit or loss | Potential real profits and losses |

| Market Exposure | Simulated market conditions | Direct exposure to live market dynamics |

| Emotional Pressure | Low emotional impact due to virtual funds | High emotional impact due to real investments |

| Learning Experience | Focus on strategy testing and order execution practice | Learn by observing real trader decisions and outcomes |

| Cost | Usually free | May include fees or commissions |

| Popular Platforms | Thinkorswim PaperMoney, TradingView Paper Trading | eToro, ZuluTrade, Covesting |

Which is better?

Paper trading platforms allow traders to practice strategies risk-free using virtual money, ideal for beginners aiming to build skills without financial loss. Copy trading platforms enable users to replicate the trades of experienced investors in real-time, offering passive income potential and market exposure for less experienced traders. Choosing between them depends on whether the priority is skill development (paper trading) or leveraging expert insights for immediate market participation (copy trading).

Connection

Paper trading platforms simulate real market conditions allowing users to practice trading strategies without financial risk, serving as a foundational tool for developing skills. Copy trading platforms enable investors to automatically replicate trades of experienced traders in real-time, leveraging performance insights often honed through paper trading simulations. Both platforms are interconnected by their focus on strategy testing and risk management, enhancing trader confidence and decision-making accuracy in live market environments.

Key Terms

Copy Trading Platforms:

Copy trading platforms enable investors to automatically replicate the trades of experienced traders, offering real-time market exposure and potential profit without extensive personal analysis. These platforms provide social trading features, performance metrics, and risk management tools designed to optimize investment decisions based on expert strategies. Explore popular copy trading platforms to understand how they can enhance your trading efficiency and portfolio diversification.

Signal Provider

Copy trading platforms enable investors to automatically replicate trades from professional Signal Providers, facilitating real-time portfolio diversification and potential profit from expert strategies. Paper trading platforms simulate market conditions without financial risk, designed primarily for practicing and testing Signal Provider tactics before live implementation. Explore how leading platforms integrate Signal Providers to enhance your trading experience effectively.

Auto-execution

Copy trading platforms enable auto-execution by replicating trades from expert traders in real-time, providing users with a hands-free investment approach that mirrors professional strategies. Paper trading platforms offer simulated trading environments without financial risk but lack auto-execution since all trades must be manually entered by the user, limiting automation benefits. Explore detailed comparisons of copy trading and paper trading platforms to choose the best fit for your trading goals.

Source and External Links

Best Copy Trading Platform USA for Beginners in 2025 - Highlights top copy trading platforms like eToro for social trading, AvaTrade for regulated assets, and others like Pepperstone and IC Markets catering to diverse trader needs in the USA.

Copy top-performing crypto traders with eToro's CopyTrader - eToro offers a no-management-fee copy trading service where users can replicate top traders' strategies instantly and join a community to learn and share insights.

WeCopyTrade: Unlocking Streams of Automated Earning - WeCopyTrade is a social trading platform enabling automatic replication of trades with risk control between master traders and copiers.

dowidth.com

dowidth.com