Algorithmic arbitrage exploits price inefficiencies across different markets using automated trading systems, capitalizing on rapid execution speeds to lock in risk-free profits. Pairs trading, a market-neutral strategy, involves simultaneously buying and selling two correlated assets to profit from deviations in their price relationship. Explore the nuances and advantages of each approach to enhance your trading strategies.

Why it is important

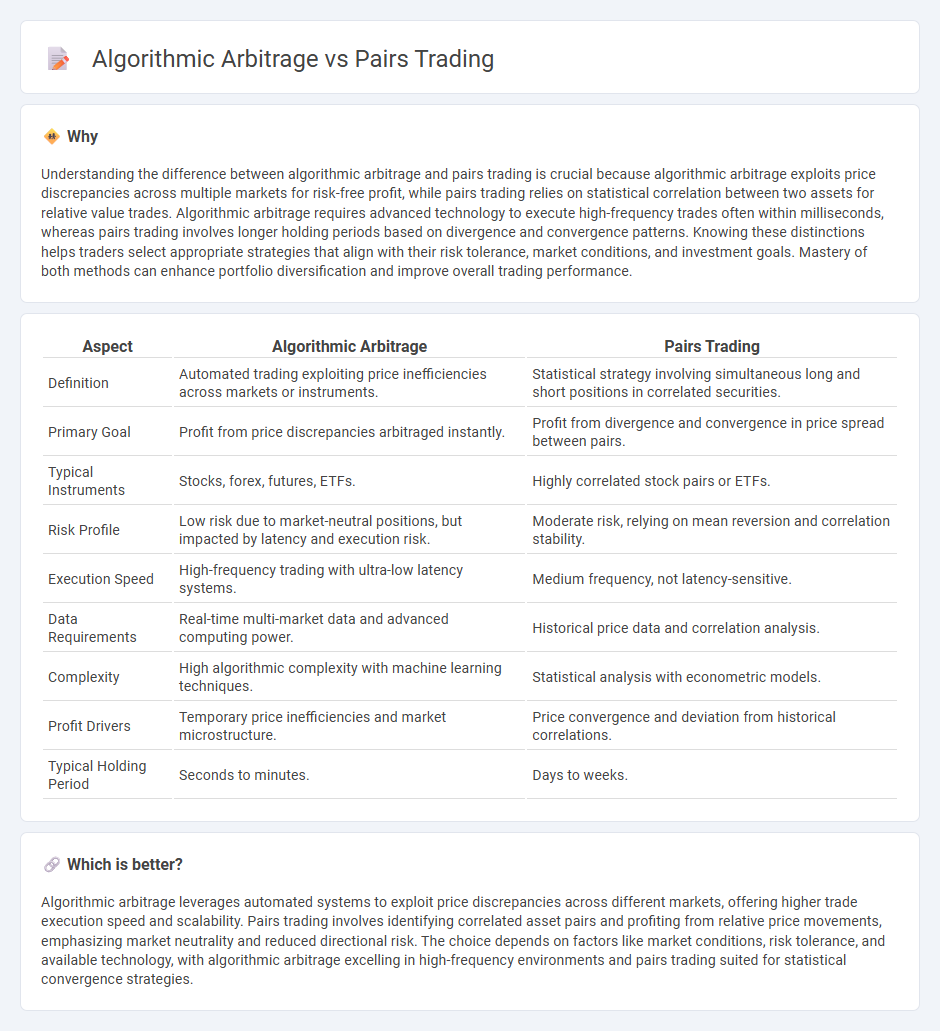

Understanding the difference between algorithmic arbitrage and pairs trading is crucial because algorithmic arbitrage exploits price discrepancies across multiple markets for risk-free profit, while pairs trading relies on statistical correlation between two assets for relative value trades. Algorithmic arbitrage requires advanced technology to execute high-frequency trades often within milliseconds, whereas pairs trading involves longer holding periods based on divergence and convergence patterns. Knowing these distinctions helps traders select appropriate strategies that align with their risk tolerance, market conditions, and investment goals. Mastery of both methods can enhance portfolio diversification and improve overall trading performance.

Comparison Table

| Aspect | Algorithmic Arbitrage | Pairs Trading |

|---|---|---|

| Definition | Automated trading exploiting price inefficiencies across markets or instruments. | Statistical strategy involving simultaneous long and short positions in correlated securities. |

| Primary Goal | Profit from price discrepancies arbitraged instantly. | Profit from divergence and convergence in price spread between pairs. |

| Typical Instruments | Stocks, forex, futures, ETFs. | Highly correlated stock pairs or ETFs. |

| Risk Profile | Low risk due to market-neutral positions, but impacted by latency and execution risk. | Moderate risk, relying on mean reversion and correlation stability. |

| Execution Speed | High-frequency trading with ultra-low latency systems. | Medium frequency, not latency-sensitive. |

| Data Requirements | Real-time multi-market data and advanced computing power. | Historical price data and correlation analysis. |

| Complexity | High algorithmic complexity with machine learning techniques. | Statistical analysis with econometric models. |

| Profit Drivers | Temporary price inefficiencies and market microstructure. | Price convergence and deviation from historical correlations. |

| Typical Holding Period | Seconds to minutes. | Days to weeks. |

Which is better?

Algorithmic arbitrage leverages automated systems to exploit price discrepancies across different markets, offering higher trade execution speed and scalability. Pairs trading involves identifying correlated asset pairs and profiting from relative price movements, emphasizing market neutrality and reduced directional risk. The choice depends on factors like market conditions, risk tolerance, and available technology, with algorithmic arbitrage excelling in high-frequency environments and pairs trading suited for statistical convergence strategies.

Connection

Algorithmic arbitrage and pairs trading both leverage automated systems to exploit market inefficiencies by identifying price discrepancies between correlated assets. Pairs trading uses statistical models to monitor and trade two historically correlated securities, while algorithmic arbitrage executes high-frequency trades across multiple markets or instruments to capitalize on temporary price divergences. The integration of advanced algorithms enables faster decision-making and execution, enhancing profitability in both strategies.

Key Terms

Pairs Trading:

Pairs trading leverages statistical correlations between two historically correlated assets, identifying divergence to capitalize on mean reversion. The strategy involves simultaneously taking long and short positions to hedge market risk and achieve market-neutral returns. Discover how advanced analytics and AI enhance pairs trading efficiency and profitability.

Cointegration

Pairs trading leverages cointegration to identify two assets whose price movements exhibit a stable, long-term equilibrium, enabling traders to exploit relative price deviations for profit. Algorithmic arbitrage, while also using statistical relationships, often incorporates cointegration analysis to automate trade execution across multiple markets, maximizing speed and efficiency. Explore deeper insights into cointegration's role in optimizing pairs trading and algorithmic arbitrage strategies.

Spread

Pairs trading exploits price divergences between two correlated assets by monitoring the spread, aiming to buy the undervalued and sell the overvalued security. Algorithmic arbitrage encompasses automated strategies that trade temporary price discrepancies across markets or instruments, often executing high-frequency trades to capture minimal spreads. Explore how advanced spread analysis enhances precision in pairs trading and algorithmic arbitrage models.

Source and External Links

Pairs trade - Wikipedia - Pairs trading is a market neutral strategy where traders monitor two historically correlated securities and trade by shorting the outperforming one and longing the underperforming one, betting their prices will converge again regardless of overall market direction.

What Is Pairs Trading? - Fidelity Investments - This is a non-directional, relative value strategy that uses statistical analysis to exploit temporary imbalances between two correlated financial instruments, aiming to profit when their prices normalize.

The Comprehensive Introduction to Pairs Trading - Hudson & Thames - Pairs trading exploits mispricings between co-moving assets by taking a long position in one and shorting the other, relying on the prices reverting to an equilibrium spread without needing to predict market direction.

dowidth.com

dowidth.com