Degen trading focuses on high-risk, short-term speculative trades aiming for rapid profits through volatile assets like cryptocurrencies and meme stocks. In contrast, value investing prioritizes long-term wealth growth by identifying undervalued stocks based on fundamental analysis and intrinsic value. Explore deeper insights to determine which strategy aligns best with your financial goals.

Why it is important

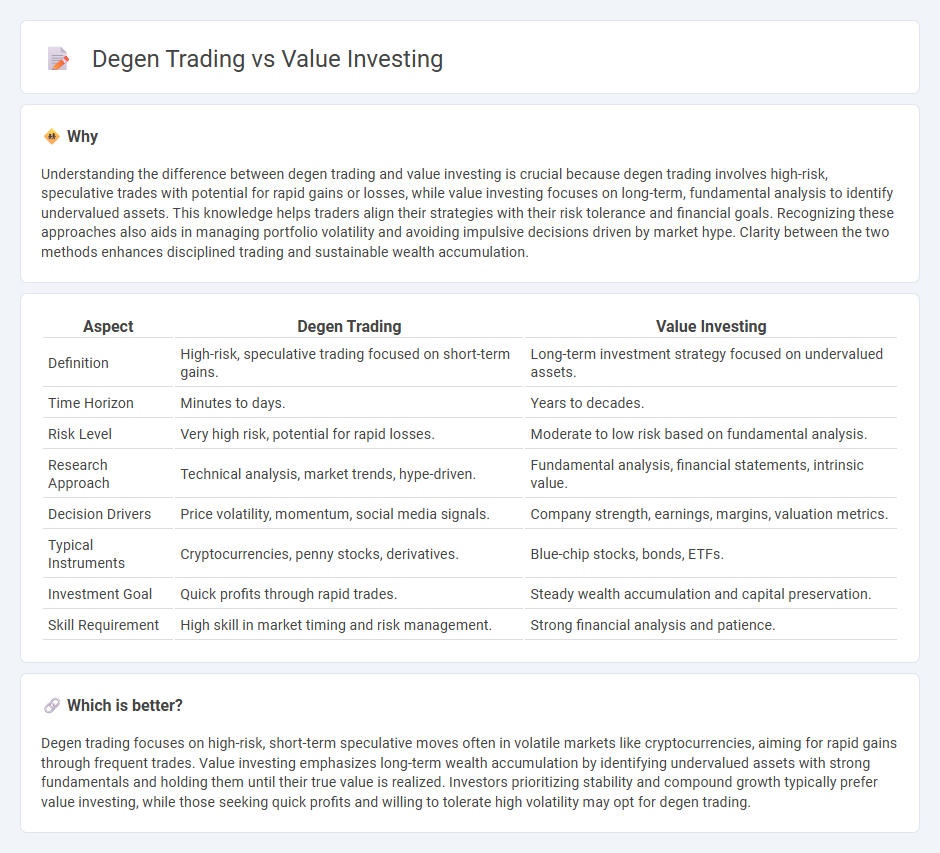

Understanding the difference between degen trading and value investing is crucial because degen trading involves high-risk, speculative trades with potential for rapid gains or losses, while value investing focuses on long-term, fundamental analysis to identify undervalued assets. This knowledge helps traders align their strategies with their risk tolerance and financial goals. Recognizing these approaches also aids in managing portfolio volatility and avoiding impulsive decisions driven by market hype. Clarity between the two methods enhances disciplined trading and sustainable wealth accumulation.

Comparison Table

| Aspect | Degen Trading | Value Investing |

|---|---|---|

| Definition | High-risk, speculative trading focused on short-term gains. | Long-term investment strategy focused on undervalued assets. |

| Time Horizon | Minutes to days. | Years to decades. |

| Risk Level | Very high risk, potential for rapid losses. | Moderate to low risk based on fundamental analysis. |

| Research Approach | Technical analysis, market trends, hype-driven. | Fundamental analysis, financial statements, intrinsic value. |

| Decision Drivers | Price volatility, momentum, social media signals. | Company strength, earnings, margins, valuation metrics. |

| Typical Instruments | Cryptocurrencies, penny stocks, derivatives. | Blue-chip stocks, bonds, ETFs. |

| Investment Goal | Quick profits through rapid trades. | Steady wealth accumulation and capital preservation. |

| Skill Requirement | High skill in market timing and risk management. | Strong financial analysis and patience. |

Which is better?

Degen trading focuses on high-risk, short-term speculative moves often in volatile markets like cryptocurrencies, aiming for rapid gains through frequent trades. Value investing emphasizes long-term wealth accumulation by identifying undervalued assets with strong fundamentals and holding them until their true value is realized. Investors prioritizing stability and compound growth typically prefer value investing, while those seeking quick profits and willing to tolerate high volatility may opt for degen trading.

Connection

Degen trading and value investing both revolve around capitalizing on market opportunities but differ fundamentally in risk tolerance and strategy. Degen traders engage in high-risk, short-term speculative trades often driven by market trends or social media hype, while value investors focus on identifying undervalued assets based on intrinsic worth for long-term gains. Understanding these approaches highlights the spectrum of investment strategies, from speculative ventures to disciplined analysis grounded in financial fundamentals.

Key Terms

**Value Investing:**

Value investing emphasizes long-term wealth accumulation by identifying undervalued stocks with strong fundamentals, such as low price-to-earnings ratios and solid dividend yields. Investors analyze financial statements, industry trends, and economic conditions to minimize risk and maximize returns through patient market exposure. Discover more strategies and insights to master value investing effectively.

Intrinsic Value

Value investing emphasizes analyzing a company's intrinsic value by examining fundamental factors such as earnings, cash flow, and assets to identify undervalued stocks with long-term growth potential. In contrast, degen trading relies heavily on high-risk, speculative strategies often driven by market sentiment and short-term price movements without thorough intrinsic valuation. Explore the critical differences in approach and risk management between value investing and degen trading to better understand how intrinsic value shapes investment decisions.

Margin of Safety

Value investing emphasizes the Margin of Safety by purchasing undervalued stocks with intrinsic value significantly higher than their market price, minimizing downside risk. In contrast, degen trading relies on high-risk, speculative trades often with little to no Margin of Safety, aiming for quick, substantial gains. Explore in-depth strategies to balance risk and reward in your investment approach.

Source and External Links

Value investing - An investment approach that involves buying securities undervalued by fundamental analysis, originated from Benjamin Graham and David Dodd, focusing on buying stocks at less than intrinsic value to achieve a margin of safety.

What is value investing? | iShares - BlackRock - A strategy targeting stocks cheap relative to their real worth using metrics like price-to-book and price-to-earnings, accessible now via low-cost ETFs like the iShares MSCI World ex Australia Value ETF.

The Value of Value Investing - Focuses on finding undervalued stocks with steady profits and the potential to regain fair value, emphasizing companies with strong fundamentals and stable earnings, beneficial during inflationary periods.

dowidth.com

dowidth.com